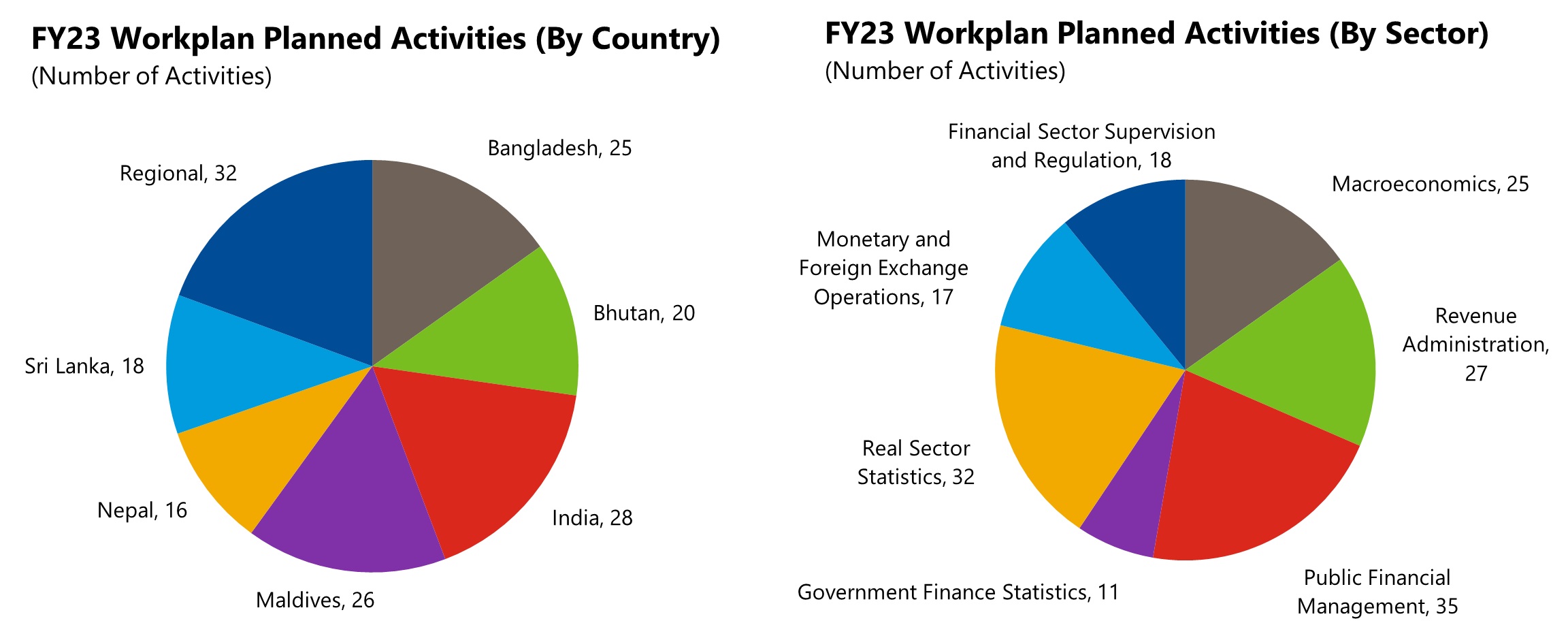

SARTTAC’s Sixth Annual Steering Committee (SC) Meeting took place in New Delhi in hybrid format on July 7, 2022. The meeting was joined by around 75 in-person and virtual participants. It focused on SARTTAC’s operations during FY22 (May 2021 – April 2022) and draft workplan and budget for FY23, which was laid out for the SC’s endorsement, including in a report for them circulated in advance of the meeting. The workplan for FY23, which comprises 165 activities, was prepared in consultation with member countries, IMF capacity development (CD) departments, and country teams in the Asia and Pacific Department. The SC meeting was preceded by a short meeting with member country agency training and human resources department on July 1 to brief them of the FY23 training schedule and get their feedback on delivery and plans.

During the SC meeting, highlights were provided on CD delivery by SARTTAC, recent CD developments at IMF, and current macro-vulnerabilities caused by inflation, supply chain disruptions, and growth prospects. Presentations were made on how IMF will continue to engage closely with countries on surveillance, lending operations, and CD to support their policy priorities and, from SARTTAC’s perspective, ensure all is well integrated such that training and TA resources can be used to assist member countries as they see fit in addressing contemporaneous challenges.

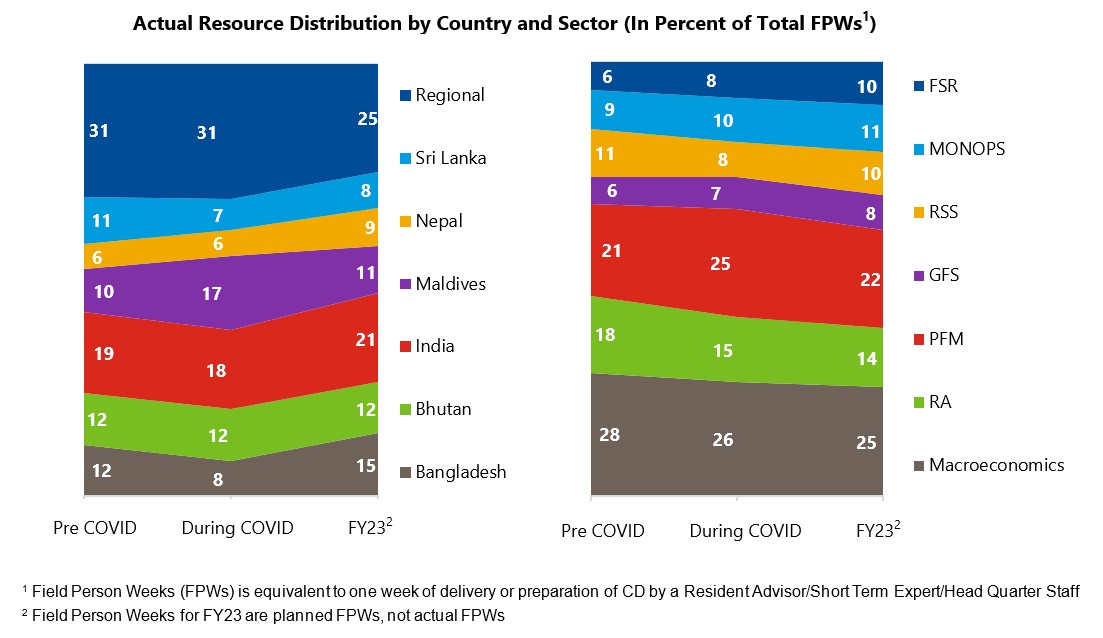

In FY23, the balance of activities is expected to be tilted slightly more to technical assistance (TA), given challenges faced in the past two years in virtual delivery and, as a result, some backlog in this area. This change is also reflected in more country versus regional activities in terms of envisaged resource usage. In non-macroeconomic training areas, planned CD in FY23 is expected to be more balanced across all CD programs, although fiscal-related areas (public financial management, revenue administration, and government finance statistics) account for approximately 40 percent of planned resources usage on CD. New courses are being offered around climate and digitalization issues, and more training in general is envisaged with national cohorts, notably in India and Bangladesh, to ensure SARTTAC’s support is well aligned with established learning and development programs.

The SC endorsed the FY23 workplan and appreciated the support provided by SARTTAC to its member countries. They also expressed appreciation for SARTTAC’s efforts in late FY22 to be amongst the first IMF regional capacity development centers to resume in-person training and TA and welcomed more in this direction in FY23. Among the views shared, Mr. Rajat Kumar Mishra, Additional Secretary in the India Ministry of Finance’s Department of Economic Affairs, assured India’s support for SARTTAC in the years ahead and urged follow through by SARTTAC on CD plans for Sri Lanka as part of the country’s stabilization efforts. Nepal Rastra Bank’s Deputy Governor, Mr. Bam Bahadur Mishra voiced the need for training on external sector vulnerabilities and cybersecurity. Mr. Rohana Wijesekar, Assistant Governor, Central Bank of Sri Lanka (CBSL), urged SARTTAC to continue with some virtual training, and proposed new opportunities be provided in big data analytics, machine learning and sensitivity analysis.

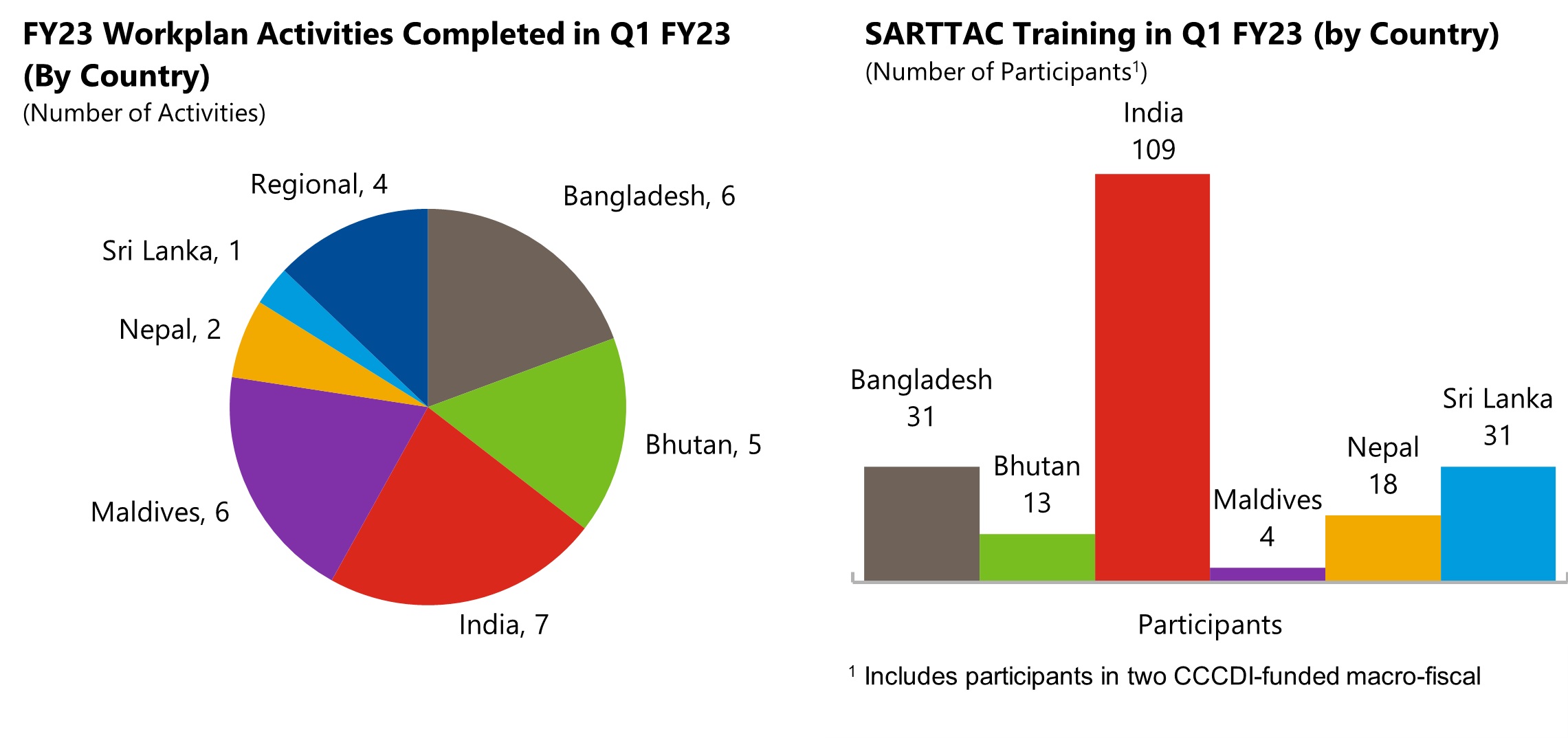

During the first quarter of FY23 SARTTAC completed or had commenced 31 activities which is nearly 20 per cent of the annual workplan, in line with expectations. Technical assistance missions, nearly all in-person, took place under most CD programs in SARTTAC and with each member country (including in the Indian state of Tamil Nadu) except Sri Lanka, as officials there dealt with the exigencies of the economic crisis, with their uptake in SARTTAC’s support expected from the second quarter. Eleven of the completed activities were training events—all but two in person. They included two new regional courses related to fiscal forecasting and frameworks, each aligned closely with ongoing and envisaged TA, including in selected Indian states, and funded under the IMF COVID-19 Crisis Capacity Development Initiative (CCCDI).

India remained the largest recipient of training in part because of three dedicated courses for its Central Board of Direct Taxes (compliance risk management, dispute resolution techniques, and the Tax Administration Diagnostic Assessment Tool), as part of a multi-year training plan. For Bangladesh, a highlight was the resumption of course for Ministry of Finance officials in July 2022 on strengthening the public financial management framework, in coordination with the Ministry’s Institute for Public Finance, following more than a two-year pandemic-induced hiatus. For Sri Lanka, a virtual course on monetary policy implementation was conducted for the CBSL in June 2022, providing hands-on exercises in supporting officials in meeting real-time challenges.

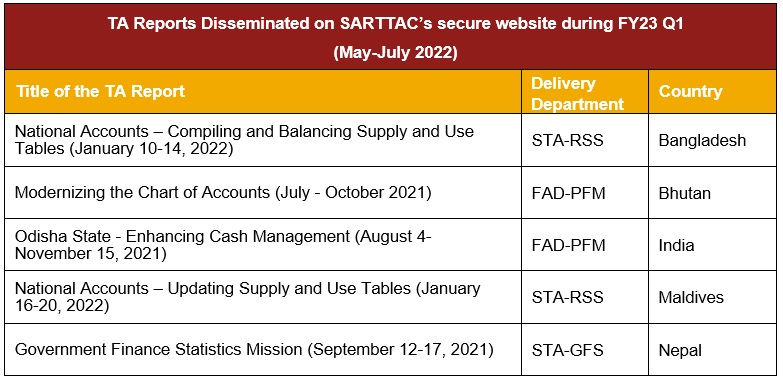

The rest of this quarter’s bulletin highlights the IMF’s updated framework on dissemination of CD information and SARTTAC’s efforts to share information on its activities at a higher frequency and to a broader audience using social media. For the first quarter of FY23, summaries of TA activities and reports disseminated, training events, and webinars are also provided.

IMF’s Updated Framework on the Dissemination of Capacity Development Information came into effect recently.

The framework covers CD-related information disseminated by the IMF from May 1, 2022. The key areas where changes have been made are to disseminating technical assistance reports and new high-level summaries and sharing of the Fund’s assessment of CD delivery (e.g. through external evaluations, results-based management, and other progress reports). The framework also covers the sharing of sensitive information from CD delivery with Fund staff for program or surveillance purposes and with World Bank and other international organizations.

More information on the framework can be accessed in a Staff Operation Guidance Note on dissemination of capacity development information, and in a factsheet available here.

Since January 2022, SARTTAC has raised awareness of its activities, IMF CD initiatives, and related member country activities through a Twitter account accessible to all. Updates on new course offerings and registration links, highlights of recently concluded training events, new published reports by SARTTAC, and ongoing CD engagement in South Asia offer followers a regular glimpse into the activities of SARTTAC and access to range of CD resources available to the public, including online learning opportunities provided by the IMF.

The most popular tweet so far has been around a video produced by India’s Lal Bahadur Shastri National Academy of Administration on SARTTAC’s contribution there to macroeconomic training of Indian Administrative Service officers in April 2022. Tweets on regional courses have also garnered considerable attention, with all upcoming training course now notified with a tweet (as well as through the standard e-mail notifications). Member country agencies and officials and other stakeholders are encouraged to follow @sarttac for the most up-to-date information on SARTTAC’s activities and plans and get a better glimpse of IMF CD in action.

New Staff Announcement

|

Apoorba Mitra joined IMF SARTTAC as Staff Assistant in July 2022. Previously, she worked with the Asia Unit of Médecins Sans Frontières (MSF) where she was supporting the Head of Mission in managing operations in the Asia region. She handled relations with different boards of directors of MSF entities across Southeast Asia and organized regional training workshops. Apoorba holds a bachelor's degree in Political Science (Hons) from Delhi University and a master's degree in Social Work from Jamia Millia Islamia.

|

Technical Assistance: May – July 2022

BANGLADESH

Revenue Administration: During a scoping mission (July 18-21), SARTTAC’s new Revenue Administration (RA) Advisor engaged with senior officials of the National Board of Revenue (NBR) to assess and identify the NBR’s capacity development needs in specific areas of RA.

Public Financial Management: A mission (June 1-12) reviewed progress in consolidating government cash resources under the Treasury Single Account (TSA) system and advised officials on options for further strengthening of the TSA. The mission also delivered a half-day workshop for the officials of the Finance Department, selected autonomous bodies, and other officials to disseminate international good practices in organizing a TSA.

Real Sector Statistics: Two mission were delivered to the Bangladesh Bureau of Statistics (BBS) during the quarter. The first mission (May 8-12) assisted BBS with finalizing an updated consumer price index (CPI) and preparing the data for dissemination. The second mission (July 13-21) assisted the BBS in developing experimental estimates of quarterly GDP (QGDP) by identifying high-frequency indicators’ source data, determining their suitability in compiling QGDP, and developing a compilation framework for QGDP.

Financial Sector Regulation and Supervision: A mission (May 29-June 8) followed up with Bangladesh Bank (BB) on progress made in implementing a pilot risk-based supervision (RBS) action plan for the banking system.

BHUTAN

Public Financial Management: SARTTAC continued to support modernization of Bhutan’s Unified Chart of Accounts (UCoA) by aligning it with the Government Finance Statistics Manual 2014 (GFSM 2014). A mission (May 2-12) reviewed the current capabilities of the government’s IT systems to implement the proposed multi-segment UCoA. The mission’s recommendations focused on how to capture data at the lowest level of spending and to support the enhanced reporting opportunities offered by the revised UCoA. A follow-up mission (July 26-August 1) focused on finalizing the structure of the multi-segment UCoA.

Real Sector Statistics: A mission (June 15-17) jointly funded by IMF’s Data for Decisions Fund and SARTTAC led a knowledge sharing event with officials from Bhutan’s Royal Monetary Authority (RMA), National Bureau of Statistics, and Ministry of Finance, which contributed to consolidating the knowledge gained by the RMA through earlier IMF technical assistance on developing an experimental Monthly Indicator of Economic Growth (MIEG) series. The topics covered at the event included improving sectoral estimates, data sources and indicators used for MIEG compilation, seasonal adjustments of estimates, and data sharing between different departments and agencies in hybrid format, with the IMF Statistics Department and SARTTAC experts joining from remote and officials gathered at a venue in Thimphu to foster greater interaction.

Financial Sector Regulation and Supervision: Two concurrent missions (July 4-15) assisted the RMA in strengthening financial supervision. The first followed up on the work done during a mission in April 2022 on assessing the risk-management framework and practices initiated before the pandemic and strengthening on-site and off-site supervision. The second mission also carried forward the work done during previous missions to support the implementation of a risk-based supervision framework for insurance.

INDIA

Public Financial Management: SARTTAC’s support to the PFM reforms of state of Tamil Nadu continued with two missions during the quarter (May 22-June 3 and July 18-22). They focused on (i) enabling the authorities to prepare a Medium-Term Fiscal Framework (MTFF); (ii) implementing a top-down structure for budgets; (iii) expanding the budget challenge function to implement strategic budgeting; and (iv) managing fiscal risks by preparing a fiscal risk register and a statement of fiscal risk.

MALDIVES

Revenue Administration: The first mission of the quarter (June 13-15) focused on building awareness on the Medium-Term Revenue Strategy (MTRS) approach to tax system reform and undertaking a gap analysis of current reform efforts. Discussions were held with the authorities on key government reform priorities, expenditure drivers, and institutional strategic plans over the medium term. An action plan was provided to the authorities in preparation of the MTRS formulation phase, which is planned for later in the year. In response to a request from the Maldives Ministry of Finance’s Tax Policy Unit (TPU) and the Maldives Inland Revenue Authority (MIRA), the second mission of the quarter (July 17-21) assisted the TPU and MIRA with the development of a framework to manage the negotiation process for tax treaties and provided training in this area.

Public Financial Management: A mission (June 12-23) supported the authorities’ efforts to better manage, monitor, and report against risks posed by state-owned enterprises (SOEs). The mission followed up on the earlier work done on SOE governance, consolidated reporting, and monitoring. It also reviewed progress in the development of consolidated SOE sector reports and identified additional improvements that can be implemented in the reporting processes.

Real Sector Statistics: SARTTAC continued its support to the Maldives Bureau of Statistics in preparing a producer price index (PPI) and updating the CPI through a TA mission (June 26-30). The mission reviewed and finalized data collected to produce the indices and addressed compilation issues raised by the authorities.

Financial Sector Regulation and Supervision: Two concurrent missions to the Maldives Monetary Authority (MMA) were delivered during the quarter (June 12-23). The first mission on banking supervision capacity assessed the work done to date by the MMA on implementing corporate governance regulations, risk management guidelines, and on-site supervision. The second mission assessed the implementation of the RBS framework for the insurance sector and reviewed the work done by the MMA insurance supervisors to date.

NEPAL

Government Finance Statistics: At the request of Nepal’s Office of the Financial Comptroller General, a mission (July 18-29) assisted the work being undertaken by the authorities in the compilation of GFS, increasing frequency of dissemination to quarterly for budget central government from this financial year and expanding coverage of GFS to include extra-budgetary units.

Real Sector Statistics: A scoping mission (May 18-19) was conducted by SARTTAC’s new real sector statistics (RSS) advisor to the Central Bureau of Statistics and the Nepal Rastra Bank. The mission assessed Nepal’s RSS technical assistance needs to develop an action plan and followed up with authorities on improvements in GDP compilation and expanding the PPI to include services.

IMF Departments: FAD (Fiscal Affairs), MCM (Monetary and Capital Markets), STA (Statistics)

SARTTAC Funding Programs: FSR (Financial Sector Supervision and Regulation). GFS (Government Finance Statistics), MONOPS (Monetary and Foreign Exchange Operations), PFM (Public Financial Management), RA (Revenue Administration), and RSS (Real Sector Statistics)

Access SARTTAC TA Reports on secure website (Requires Login Credentials)

Macroeconomics: A course on fiscal policy analysis (July 11-22) led by the IMF Institute for Capacity Development (ICD) provided participants an overview of the concepts and techniques used to analyze how fiscal policy can help ensure macroeconomic stability and sustainable long-term growth. The learning units included general empirical findings, case studies, and hand-on exercises, which enabled participants to assess a country's fiscal stance, fiscal multipliers, debt sustainability, and key elements of tax and expenditure policy.

Government Finance Statistics: A course on compiling public sector balance sheets (PSBS) (June 27-July 1) covered the compilation of public debt and and preparation of balance sheets for general government and its sub-sectors and the broader public sector, including key concepts of the PSBS as well as practical advice on how to compile them in line with the GFSM 2014 and Public Sector Debt Statistics Guide 2011. The training helped participants in identifying fiscal risks in their own countries, as PSBS provide a comprehensive picture of public wealth and account for what the state owns and owes at any point in time.

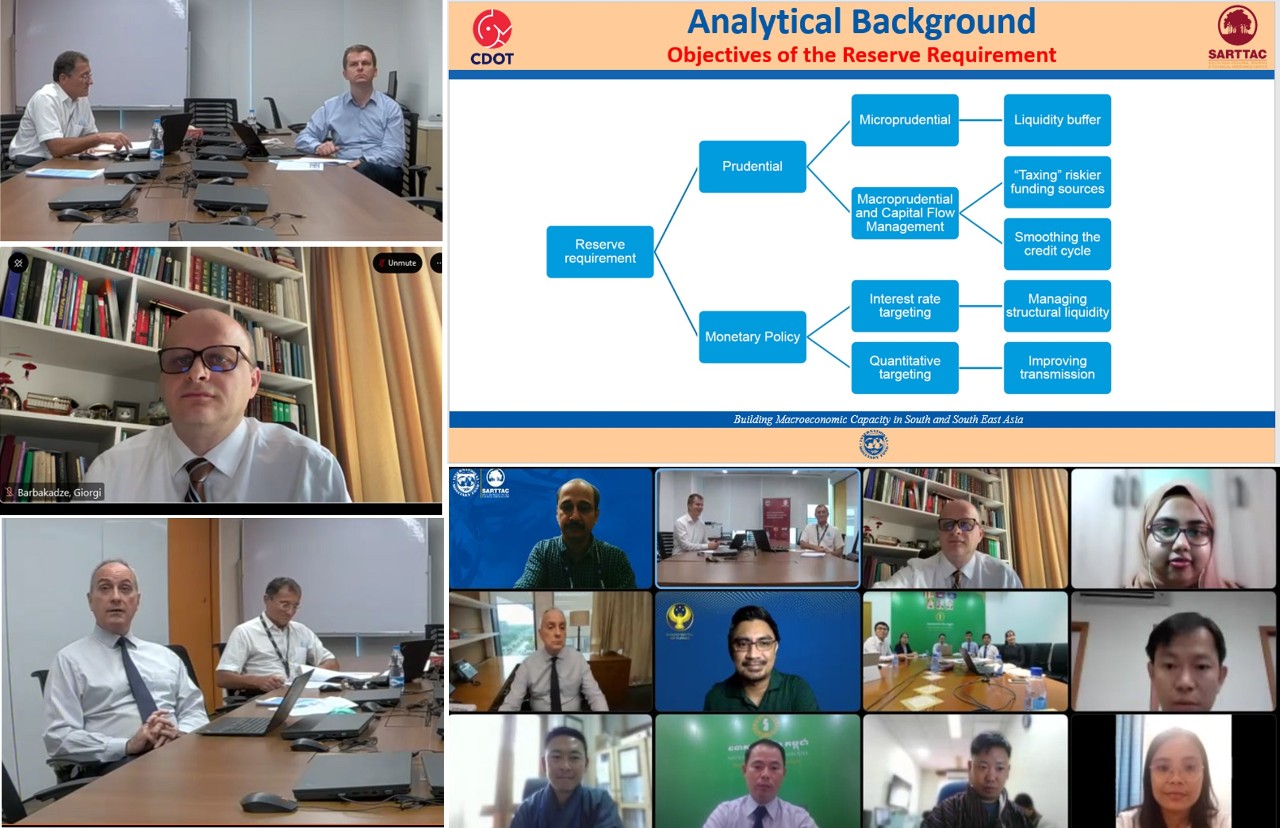

Monetary Policy and Foreign Exchange Market Operations: A course on reserve requirements was held, the fifth in a series on monetary policy implementation jointly organized training by SARTTAC and IMF Capacity Development Office in Thailand (CDOT) (July 11-14). It provided guidance on conceptual and operational considerations on the use and design of the reserve requirements in different monetary policy regimes. The course also benefitted from country presentations by senior central bank officials from Philippines, Morocco, and Maldives.

Macro-Fiscal: Two macro-fiscal courses were delivered during the quarter, both with support through the IMF COVID-19 Crisis Capacity Development Initiative. The first course on fiscal analysis and quantitative methods (June 13-17) helped participants strengthen their data manipulation and analysis skills and learn new techniques and methods using case-studies with topics common to macro-fiscal analysis. It was followed by a new course on developing a medium-term fiscal framework (MTFF) tool (July 25-29), which taught participants how to design and build an MTFF spreadsheet that incorporates country- or state-specific macroeconomic and public finance characteristics, and covered GDP and revenue forecasting, the importance of a fiscal anchor, and how to forecast baseline expenditures and financing. The course also covered the importance of the “process side” of an MTFF—i.e. discussing and agreeing assumptions and forecasts with various government stakeholders, including senior managers, to build wider understanding and buy-in.

Macroeconomics: SARTTAC delivered a module on macroeconomics to trainee Indian Administrative Services (IAS) officers at the Lal Bahadur Shastri National Academy of Administration (LBSNAA) in Mussoorie Uttarakhand (June 16-17). The module introduced key topics in macroeconomics such as aggregate demand and supply, fiscal and monetary policy, and tradeoffs between different policy choices. The course eschewed a mathematical representation of economic concepts to one relying on intuition, as most of the participants were not trained economists.

A short video prepared by LBSNAA on earlier training by SARTTAC can be accessed here.

Revenue Administration: Three training workshops were delivered to officials from India’s Central Board of Direct Taxes (CBDT). The first one (June 20-24) titled compliance risk management provided the participants with an understanding of both the theoretical concepts behind managing compliance risks and the practical application of those concepts. The second workshop (July 11-13) focused on dispute resolution and rulings, equipping participants with the skills necessary to apply sound dispute management and resolution principles and practices reflecting international good practice, including alternative dispute resolution and practical sessions designed to apply principles learned. The third workshop delivered during the quarter was on Tax Administration Diagnostic Assessment Tool, or TADAT (July 25-29), which introduced participants to the TADAT methodology of assessing tax administration. During discussions on each of nine TADAT performance areas, participants compared current CDBT administration with international good practices and how current practices could be improved.

Public Financial Management: SARTTAC resumed cohort training on strengthening public financial management framework for mid-level officers nominated by Bangladesh’s MOF and in association with a training program offered by its Institute for Public Finance after a pandemic-induced hiatus during FY21 and FY22. The first course (July 12-16) in a series of three was delivered in-person in New Delhi, with two others planned for separate cohorts in 2022. The training focused on topics like macroeconomic and fiscal frameworks, strategic budgeting, expenditure and revenue forecasts, public investment management, and PFM and digitalization.

Monetary Policy and Foreign Exchange Market Operations: At the request of the Central Bank of Sri Lanka (CBSL), SARTTAC delivered a monetary policy implementation course to the CBSL staff (June 6-15). The course provided a mix of theoretical and practice-oriented lectures on implementing an interest-rate focused monetary policy framework. The lectures were followed by hands-on exercises simulating the liquidity committee decision-making process.

REGIONAL WEBINARS

Real Sector Statistics: A regional webinar on valuing household unpaid work was delivered on June 23. It provided an overview of concepts and valuation methods used to compile the values of household unpaid service work within the framework of System of National Accounts 2008. The webinar included a presentation, followed by a question-and-answer session to address specific conceptual/methodological issues raised by the participants.

Non-SARTTAC Webinars: A webinar titled Unfolding the Impact of the War in Ukraine on Asia was hosted by SARTTAC and delivered by the IMF Asia and Pacific Department (APD) on May 4. Its focus was on the impact on South Asia’s near-term growth and inflation outlook, especially in an environment of high global food and fuel prices, with senior officials from central banks in Bhutan, Nepal, and Sri Lanka providing their own perspectives. The webinar also touched on longer-term challenges, including economic scars left by the pandemic, all in conjunction with the launch of APD’s latest Regional Economic Outlook.

A webinar on India’s digital payment system and beyond (June 2) kicked off a peer-learning webinar series on digital technologies and digital money in Asia and the Pacific organized by IMF – Singapore Regional Training Institute in collaboration with the IMF Monetary and Capital Markets Department, APD, and SARTTAC.

More articles from the same issue

- IMF’s Updated Framework on the Dissemination of Capacity Development Information

- SARTTAC’s Social Media Outreach

- New Staff Announcement

RECENT and UPCOMING ACTIVITIES

- Technical Assistance

- Training and Webinars

- Upcoming Training Courses

- Upcoming Webinars

- IMF Online Courses

Previous Issues <