The first quarter (Q1) of FY24 (May – July 2023) saw a range of new engagements, activities, and outcomes for the IMF South Asia Regional Training and Technical Assistance Center (SARTTAC). Headlining the quarter was SARTTAC’s seventh annual Steering Committee Meeting on June 20, 2023—a hybrid event held in New Delhi covering the Center’s operations in FY23 (May 2022 – April 2023), the workplan and budget for FY24, and an update on Phase II preparation, as discussed here. Several new staff joined SARTTAC in Q1, putting the Center at its full contingent for the first time in nearly a year. Mr. Saji Thomas, the new Deputy Director, joined in early June from the IMF Western Hemisphere Department, with his impressions of the first few months in SARTTAC shared here. His arrival was preceded by Mr. Nitin Jain, the new Financial Sector Supervision and Regulation Advisor, who joined in early May from the Reserve Bank of India (RBI), and followed by Ms. Charline Ramspacher, the new Macroeconomic Advisor, who joined in late July and had previously held a similar post in the IMF Africa Training Institute in Mauritius.

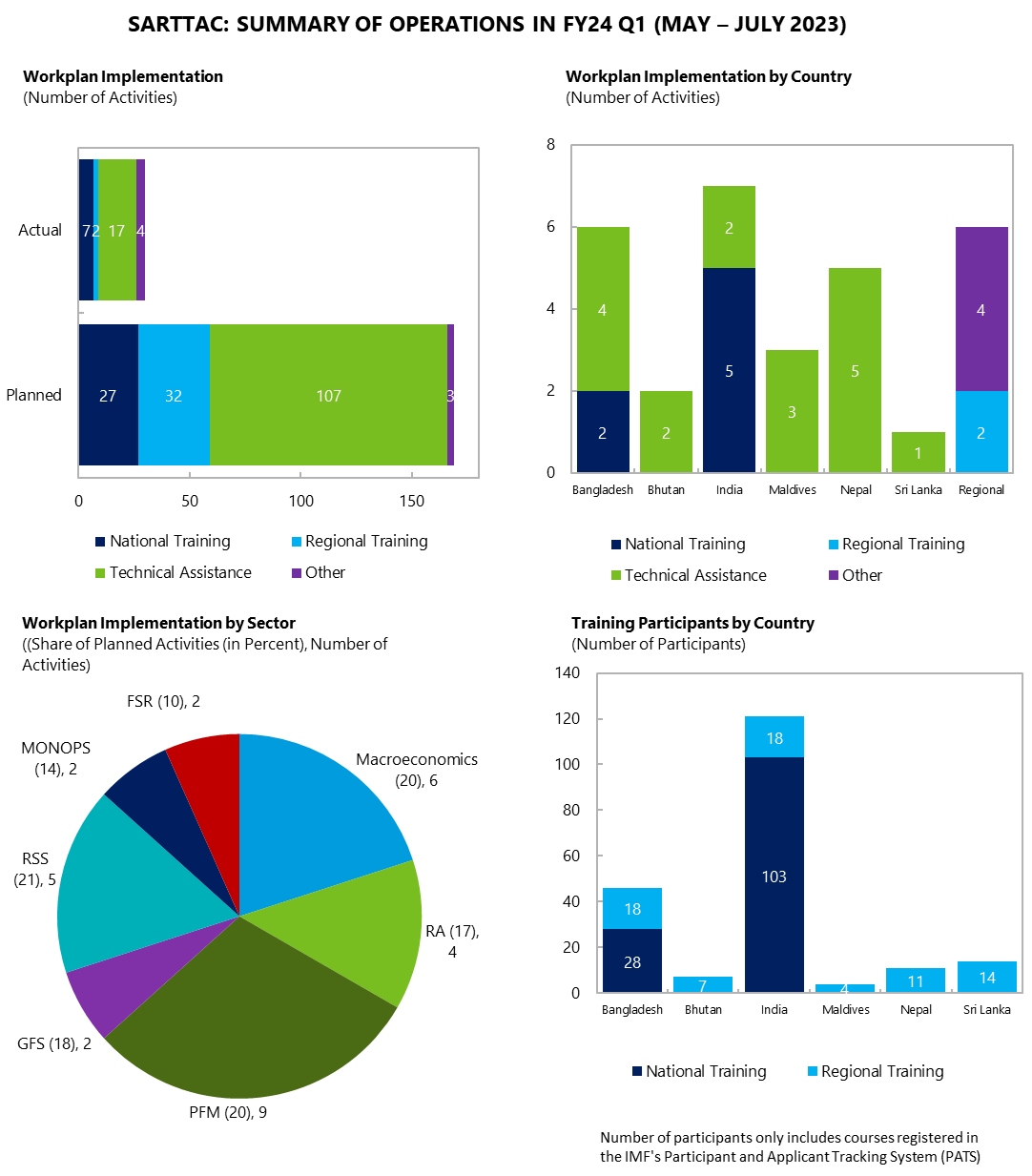

The fiscal year kicked off nine training events in the first quarter (see figure below), with a complete list found here. New ones for SARTTAC included regional courses on fintech market development and policy implications led by IMF Institute for Capacity Development (ICD) and on international trade in goods and services from the IMF Statistics Department (STA), with both attracting much interest. Several customized courses were held for India, including ones on revenue forecasting and analysis for the Central Board of Direct Taxes, under the lead of the IMF Fiscal Affairs Department; on government finance statistics for the Ministry of Finance’s (MOF) Comptroller General of Accounts and Department of Economic Affairs in support of progress by India on the G-20 Data Gaps Initiative; and on selected macroeconomic issues for approximately 30 mid-career officers in the Indian Economic Services. In addition, SARTTAC commenced capacity development (CD) work on public financial management (PFM) in the Indian state of Assam with a four-day workshop on reforms envisaged under a new two-year project. For Bangladesh, the quarter saw the first of three planned offerings in FY24 of a Strengthening the PFM Framework course for mid- to senior-level line ministry officials, in coordination with the Bangladesh MOF’s Institute of Public Finance. Nine Bangladesh Bank (BB) officials also participated in a three-day attachment on an interest rate targeting framework hosted by the RBI and arranged and funded by SARTTAC.

In addition, 17 technical assistance missions commenced in FY24 Q1 in line with SARTTAC’s annual workplan, with a complete list here. Highlights included the resumption of TA after some lag on monetary and foreign exchange operations, with mission for the Central Bank of Sri Lanka on improving liquidity monitoring and forecasting. A SARTTAC TA mission was also conducted for Nepal’s Ministry of Finance on improving cash flow forecasting. Follow up support was provided in Maldives to its MOF and Inland Revenue Authority on a medium-term revenue strategy. In Bangladesh, under ICD’s lead and with SARTTAC funding, progress continued to be made with BB on developing a forecasting and policy analysis system to improve monetary forecasting and policy setting under a project started in FY23. For Bhutan, work commenced on GDP rebasing and reviewing the compilation system, while in India, a PFM mission took place in the Indian state of Tamil Nadu (TN) on strategic budgeting, with TN’s Finance Department also co-organizing with SARTTAC a state-level workshop on budget documentation and transparency, which was joined by their own officials, as well as others from the states of Assam, Kerala, and Odisha, complementing TA already received by the last in this area, which helped enrich experience sharing.

Other activities funded by SARTTAC in FY24 Q1 were participation by a few long-term experts in India and regional events related to CD, as well as by Director and Deputy Director of SARTTAC in the IMF – Singapore Regional Training Institute’s training directors meeting. The meeting, which occurred triennially in the past (and for the first time since 2019 because of the pandemic) brought together central banks and MOFs from more than 20 countries, IMF regional capacity development heads in the Asia-Pacific region, and senior managers in ICD to discuss best-practices in training content, design, and delivery. Among the participants were training and human resource department officials from agencies in Bangladesh, Bhutan, Maldives, Nepal, and Sri Lanka. One suggestion of those attending were more “train-the-trainer” programs as a way of scaling up knowledge transfer in the region.

South Asia and SARTTAC officials at the IMF - Singapore Regional Training Institute Training Directors' Meeting, June 12 - 13, 2023.

Regional Workshop on Climate Action in South Asian Economies, July 20, 2023.

SARTTAC also supported the organization of a few events in FY24 Q1 looking at aspects of climate change. A hybrid regional workshop in July on Climate Action in South Asian Economies was organized by the Center with the IMF Asia and Pacific Department (APD), Research Department (RES), and ICD. At the workshop, senior officials from Bangladesh, Maldives, Nepal, and Sri Lanka each set out how macro-fiscal frameworks and financing plans were being factored into climate change adaption and mitigation strategies (joining also were officials from India, the World Bank, and Asian Development Bank). The workshop also featured hands-on sessions—one led by RES on the DIGNAD—A Toolkit for Macro Policy Assessments of Building Resilience to and Recovery from Natural Disasters in emerging market and developing economies, and one led by ICD on the ND_DDT—The Natural Disasters for the Debt. The Debt-Investment-Growth and Natural Disasters (DIGNAD) provides a toolkit that enables users to evaluate debt sustainability risks following natural disasters and analyze the effects of ex-ante policies, such as building adaptation infrastructure, increasing fiscal buffers, or improving public investment efficiency, compared to the need for ex-post reconstruction, through the lens of a rich general equilibrium structure. The Public Debt Dynamics Tool (DDT) can be used to project out the stock of public debt for the baseline (most likely) and alternative scenarios to estimate paths of fiscal adjustments consistent with a user-defined target level of debt. This workshop was immediately preceded by a high-level seminar in New Delhi organized by APD and India’s Centre for Social and Economic Progress, structured as a peer-learning dialogue on climate change considerations and the economy, with administrative and logistical support from SARTTAC.

SARTTAC’s Seventh Annual Steering Committee (SC) meeting (hybrid) took place in New Delhi on June 20, 2023. The meeting was joined by around 60 in-person and virtual participants including SC members, alternates, and observers, including from the World Bank, Asian Development Bank, and Japan Ministry of Finance. It focused on SARTTAC’s operations during FY23 (May 2022 – April 2023) and the draft workplan and budget for FY24, which were set out for the SC’s endorsement. The meeting was preceded by a welcome reception the evening before and selected bilateral meetings (both virtual and in-person) with member country (MC) agencies focused on the contents of the FY24 workplan and support for Phase II of SARTTAC’s operations. Ahead of the meeting, a draft report on SARTTAC’s activities in FY23 (including the FY24 workplan and budget) and an annotated draft program document (PD) outlining Phase II of SARTTAC operations were circulated to the SC.

During the SC meeting, SARTTAC highlighted achievements in capacity development (CD) during the past year. Despite some challenges, SARTTAC delivered 98 percent of the planned CD activities as per its revised FY23 annual workplan with most CD activities conducted in-person. India and Bangladesh remained the largest recipients of single-country CD accounting for an estimated 17 and 15 percent of the total CD spending, respectively. Bhutan, Maldives, Nepal, and Sri Lanka received roughly equal share of support. Engagement rose in absolute and relative terms in Bangladesh, Nepal and Sri Lanka compared with FY22, given greater urgency in addressing macroeconomic imbalances and external vulnerabilities, in each case in parallel with IMF lending arrangements.

IMF SARTTAC’s Seventh Annual Steering Committee Meeting (Hybrid), June 20, 2023.

The SC was apprised of the growing importance of cohort training by SARTTAC for India and Bangladesh and first-time courses in transformational areas such as climate issues, digital money, and digitalization of public financial management (PFM). New and concentrated technical assistance (TA) activities were highlighted including support to Indian states (Odisha and Tamil Nadu) in areas such as fiscal risk management, strategic budgeting, and medium-term fiscal frameworks (MTFFs), new engagement with the Indian state of Assam, and cross-state workshops aimed at raising awareness of common challenges. The Tax Administration and Diagnostic Tool (TADAT) TA missions to Bhutan, Nepal, and Sri Lanka in FY23, which guided formulation of the FY24 workplan in revenue administration and beyond, were also discussed.

The FY24 workplan is divided between two phases of SARTTAC’s operations—Phase I ending in December 2023 and Phase II beginning in January 2024. In total, the workplan in FY24 programs more than a 40 percent increase in planned activities compared to execution in FY23. Technical assistance is expected to be the largest component of delivery (about two-thirds of planned activities in FY24). Selective attachments have also been reintroduced. SARTTAC’s CD support will help MCs in addressing vulnerabilities accentuated due to the slowdown in growth globally and after-effects of the pandemic. In addition, SARTTAC will deepen its CD support in transformational areas related to climate, digitalization, big data, and gender issues, mostly in training, but also incorporating in selected TA. Outside the workplan, the SC was briefed on plans by the IMF Monetary and Capital Markets Department to base a public debt management (PDM) advisor in SARTTAC in FY24. The position will be funded by CD resources provided to the Fund by Japan, focused on Maldives and Sri Lanka (and the Lao People’s Democratic Republic) as the main beneficiaries of this support. Work on PDM is complementary to that already supported by SARTTAC in macroeconomic training, PFM, and monetary operations.

The SC meeting provided an opportunity to update on preparations for Phase II in SARTTAC, which will be anchored by a US$50 million contribution by the Government of India. This next phase of operations, which is tentatively slated for January 2024 – April 2029, will build on results achieved in Phase I through a likely continuation of most existing CD programs in SARTTAC, adapted to include new projects. Both MCs and development partners were encouraged to pledge their support for the next phase, complementing India’s contribution and earlier one made by Australia. SARTTAC envisages that its training program in Phase II will include more cohort and subnational training, while TA will continue to be aligned with the IMF surveillance dialogue and lending operations in MCs. Both training and TA are expected to encapsulate work in transformational areas to ensure that SARTTAC is doing its part to work with MCs in meeting contemporaneous challenges posed by climate change, gender gaps, and technological change.

Saji Thomas joined SARTTAC as Deputy Director in June 2023, replacing Bhaswar Mukhopadhyay, who returned to IMF headquarters in February 2023 and retired from the Fund in April 2023. Since joining the IMF in 2002, Saji has worked on surveillance, lending programs, and technical assistance for a range of countries in Africa, Asia, and Latin America. His current research interests include fiscal policy and its coordination with monetary policy, sovereign debt, and fiscal rules. Saji has spent a considerable part of his career in the IMF Fiscal Affairs and Western Hemisphere Departments, with a focus on emerging market and developing economies. Prior to joining the IMF, he worked as an economist at the World Bank Research Department. He holds a Ph.D. in Economics from the University of Minnesota.

Below, Saji shares his motivations for joining SARTTAC and initial impressions of the Center and India, after studying and working outside his native country for almost 30 years.

What motivated you to join SARTTAC?

I have spent almost 23 years at the IMF, and in that time, I have had the privilege of working in four departments, spanning surveillance, lending programs and capacity development. During 2019-21, I was the fiscal economist on IMF’s Sri Lanka country team, and that gave me an excellent opportunity to interact closely with many of the advisors in SARTTAC. I realized that SARTTAC played an important role in building capacity to help development in the region, so transitioning to a capacity development role was attractive. Of course, the other big attraction of the Deputy Director position at SARTTAC was that it would give me an opportunity to return home to India.

What is the most interesting thing you have learned in your new assignment?

I believe that SARTTAC is an important part of the IMF’s network of regional capacity development centers, since it caters to a diverse group of countries in South Asia. On the one side of the spectrum, we have a have a large country such as India, which has a considerable need for national macroeconomic training, and also makes an important financial commitment to SARTTAC, and then on the other side of the spectrum we have lower-capacity countries such as Nepal and Bhutan, which need more technical assistance. As such, we have to customize our training and technical assistance to the specific needs of our members.

Given your earlier experience working with IMF member countries including Sri Lanka, how can SARTTAC fine tune its capacity development work to be more effective?

For capacity development to be effective, it has to be fully integrated with lending programs, where they exist, and the surveillance dialogue, which takes place with all IMF member countries. This is even more important in program countries like Sri Lanka that have been buffeted by severe economic shocks. Based on my Fund experience, an effective vehicle for delivering CD is through customized training and technical assistance. For example, in the case of Sri Lanka — which has an IMF program — most of our CD work is rightly focused on macroeconomic stability and supporting the IMF program objectives. On the other hand, our focus in India is mainly on national macroeconomics training program with the Indian Administrative Service, Indian Economic Service, and the Reserve Bank of India for their incoming and mid-career cohorts. I believe that SARTTAC is well placed to make these kinds of training more relevant for their members.

How has been your experience coming back to India?

I am happy to be back in India after a long time and that nostalgia cannot be matched by anything else. The sense of being in your own country, hearing your own language, music, and the hustle and bustle of daily life are experiences that cannot be replicated anywhere else. My SARTTAC colleagues have been awesome, including my fellow instructors. For me, living in Delhi was also special since I studied here and I have many close friends in the area, and the opportunity to see them again and reconnect with them is refreshing. Of course, being able to be close to my family in Kerala was also a key factor in deciding to seek this job. There are many historic places in India which I have never visited—Kashmir, Rajasthan, Amritsar, and the northeastern part of India, and I plan to make time to see them.

Nitin Jain joined SARTTAC as Financial Sector Regulation and Supervision Advisor in May 2023, replacing Jacques Loubert, who departed in August 2022. He is on deputation from Reserve Bank of India (RBI) and now working under the guidance of the IMF Monetary and Capital Markets Department. Over the course of his 17-year career in central banking, he has gained extensive experience in banking regulation and supervision, corporate strategy and governance, and the central bank’s role as banker to banks. He has represented RBI in various national and international fora such as the Bank for International Settlements and Network for Greening the Financial System. He has also worked with European Central Bank for three years, where he was involved in supervisory policy making and on-site examination of significant institutions.

Nitin holds a Ph.D. in Economics from University of Lucknow (India), is a certified Financial Risk Manager (FRM), and earned a Post Graduate Award in Financial Regulation and Supervision from the University of Warwick (U.K.). Prior to joining the RBI, he worked as an Assistant Professor at Jaipuria Institute of Management, Lucknow.

Charline Ramspacher joined SARTTAC as Macroeconomic Advisor in July 2023, replacing Christian Johnson, who returned to IMF headquarters in May 2023. She is working under the guidance of ICD at IMF headquarters and specializes in financial, monetary, and structural and gender issues. Previously, she worked as an economist and lecturer at the IMF Africa Training Institute in Mauritius for seven years. Before joining the IMF, Charline was a senior policy advisor specialized in market infrastructures, collateral management issues, and payment systems at the Central Bank of Luxembourg. Prior to that, she held various front office positions at Goldman Sachs in the U.S., London and Zurich, as well as Clearstream Banking Luxembourg. She holds an MBA from Temple University (U.S.).

More articles from the same issue

- Seventh Annual Meeting of SARTTAC Steering Committee

- A conversation with the new Deputy Director in SARTTAC

- Staff Announcements

RECENT and UPCOMING ACTIVITIES

- Technical Assistance

- Training and Webinars

- Other Activites

- Technical Assistance Reports Disseminated on Partners Connect during FY24 Q1

- Upcoming Training Courses

- IMF Online Courses

Previous Issues <