During the fourth quarter of FY24, Ms. Giorgia Albertin began her tenure as the Director of SARTTAC on February 1, 2024. She has replaced Mr. David Cowen who has moved back to IMF headquarters as an Advisor in the IMF Asia and Pacific Department (APD). The period also witnessed the departure of an international staff, Mr. Andrew Evans, Government Finance Statistics and Public Sector Debt Statistics advisor, who has shared his thoughts on his stint at SARTTAC here. In addition, Mr. Krishna Srinivasan, Director APD also visited SARTTAC to take stock of SARTTAC’s operations and hold discussions on Phase II priorities.

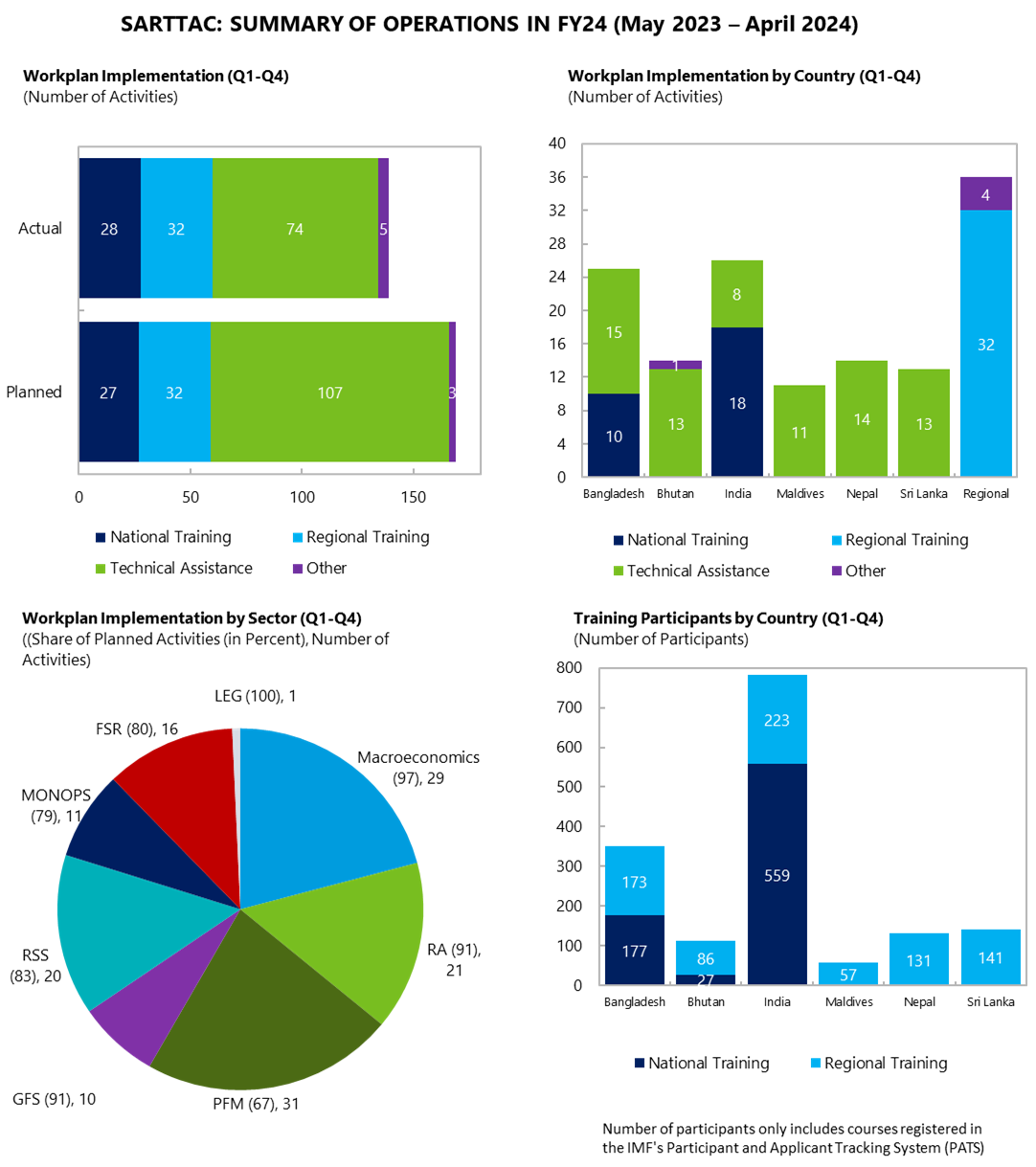

Overall, 40 capacity development (CD) activities were delivered during the Q4, which is the highest for any quarter in FY24. Out of the total 40 activities, 17 were training events and the remaining 23 were technical assistance missions (TA). Over two-thirds of the TA missions addressed reform priorities of three IMF program countries (Bangladesh, Nepal and Sri Lanka) in the region.

RA (Revenue Administration), PFM (Public Financial Management), GFS (Government Finance Statistics), RSS (Real Sector Statistics), MONOPS (Monetary and Foreign Exchange Operations), FSR (Financial Sector Supervision and Regulation)

During Q4 FY24, 11 regional and 6 national training events took place and are listed here. Starting in February, three regional trainings were delivered under SARTTAC’s Revenue Administration (RA) program – Effective Leadership for Revenue Administration (IMF’s first training in English on the topic), International Tax Administration (IMF’s fist in-person delivery of the training) and Integrated Risk Management (IRM) in Customs (first training on a customs topic in SARTTAC). The first one (February 19-23) provided valuable insights into the concept of ‘adaptive leadership’ and developed participants’ capabilities to recognize and meet adaptive challenges in their areas of work. Lectures covered critical leadership skills such as, stakeholder engagement, management of teams, conflict resolution, negotiation, and effective communication. The second training (April 1-5) focused on the fundamentals of international taxation and tax planning by multinational enterprises. Organizational and governance arrangements for international tax administration in the broader concept of compliance risk management, and relevant aspects of strategic and operational planning were also explained. The third RA training of the quarter (April 22-26) dealt with implementing the IRM approach in customs to strengthening customs controls while encouraging economic operators’ voluntary compliance and improving trade facilitation and increasing efficiency of customs operation in an environment of limited resources.

Support for the region’s statistical organizations’ efforts at improving macroeconomic statistics was provided through trainings on compiling High-Frequency Indicators and Monthly Indicators of Economic Growth (March 18-22) and Supply Use Tables/Input Output Tables (April 29-May 3). In addition, a regional workshop on Public Financial Management (PFM) issues (April 23-25) was held in Bhutan. Mr. Rishi Goyal, Ms. Stefania Fabrizio, and Ms. Jiajia Gu (all from the Gender Unit in the IMF Strategy Policy and Review Department) delivered a brown bag seminar on mainstreaming gender in the macroeconomic analysis work of the Fund and its member countries during a course on gender and macroeconomics (April 22-26). This was the second offering of this course at SARTTAC. At the national level in Bangladesh, a seminar for high level officials from Bangladesh Bank on risk-based supervision (April 18-19) and a training on introduction to budget management (March 10-14) were organized. The latter training also supplemented authorities’ own 12-week budget management course for mid-level officials. It familiarized officials with international good practices and relationship between macroeconomic forecasting, medium term, and annual budgeting.

23 TA missions were delivered during the fourth quarter spread across all SARTTAC countries and sectors as listed here. Highlights include a fiscal risks mission to Bangladesh (March 3-7) in support of related structural benchmarks as part of Bangladesh’s ongoing programs with the IMF, a mission to the Indian state of Odisha (April 15-19) in preparation of an upcoming Public Investment Management Assessment (PIMA) and Climate PIMA (C-PIMA) mission and the first mission (February 19-23) to the Indian state of Assam under a project to strengthen budget credibility and medium term fiscal planning following a scoping mission in late 2023. In Sri Lanka, a mission (April 29-May 10) assisted the central bank in further enhancing its Forecasting and Policy Analysis System and Monetary Policy communication in light of a new central bank act.

Meeting with Government of Assam, Finance Department to discuss the Assam TA support plan and Medium-Term Fiscal Framework training (From Left to Right: Ms. Laya Madduri IAS, Secretary; Mr. Stephen Turnbull, PFM Advisor at SARTTAC; Dr Ravi Kota IAS, Chief Secretary and Mr. John Grinyer, STX). (February 19-23, 2024)

Andrew Evans completed a three-year assignment as GFS and PSDS Advisor in SARTTAC in April 2024. He has since returned to the United Kingdom’s HM Treasury, working on finance performance and improvement. Below, Andrew shares experience of his time in SARTTAC and impressions of life in Delhi.

SARTTAC: What motivated you to join SARTTAC as the Government Finance Statistics and Public Sector Debt Statistics (GFS and PSDS) Advisor in 2021?

At a European government statistical meeting, an IMF representative, who I knew, approached me and asked whether I had ever considered an international posting. I said we loved Washington DC so it would be something that I would be keen to do. However, he told me that the post was in India! I had never been to Asia, but it sounded exciting, and I wanted to do something different and out of my comfort zone, so I joined SARTTAC.

SARTTAC: How did the COVID-19 pandemic affect the planning and delivery of capacity development in the member countries, especially since you started your assignment during the pandemic? How has CD delivery changed since the end of the pandemic?

The pandemic had a huge impact on CD delivery. Some of the member countries in our region struggled with bandwidth and IT issues which made delivering virtually challenging. Post pandemic, meeting in person has become the norm again. This is important in building professional relationships which are crucial particularly for technical assistance and take time to establish. Especially, delivering regional training courses in person entails a completely different dynamic that cannot be replicated virtually.

SARTTAC: What were some of the positive changes in the six member countries on strengthening GFS and PSDS during your assignment?

I have seen many positive changes in our member countries for compiling GFS and PSDS. Bangladesh has formed a cross government GFS Working Group to help navigate them in meeting their ambitious goals. I have worked with India to help them meet the G20 data gaps initiative reporting requirements for GFS. Nepal is looking to be the first country in the region to compile GFS for the whole general government sector by expanding its coverage to include extra budgetary units.

SARTTAC: You were based in New Delhi (India) for almost two years. How was your overall experience of living in India? Any Indian food / dish you developed a strong liking for or events / celebrations you particularly enjoyed?

My Indian experience has been phenomenal. I have loved the history and the architecture particularly the tombs, temples, and palaces. I love the colorful costumes seeing people not afraid to experiment with color is a joy, since I come from a country where people stick to wearing black, navy, or grey. My neighbors have embraced me into the society and included me in all the local festive celebrations with Diwali and Holi being the highlights. I have become a huge fan of very energetic Punjabi dance music. I always enjoy butter chicken (like the UKs Indian inspired new national dish chicken tikka Masala) or a chicken Biriyani.

SARTTAC: What are several prominent strengths which SARTTAC should focus and build upon? How can the Center better serve the member countries?

SARTTAC has a team of very experienced international experts and a well-established support team. The center is still young, and it should continue to adapt and evolve. There should be more collaboration between the experts, their parent departments and country teams to deliver the required TA and training which benefits the member countries.

SARTTAC: With your experience in working on macroeconomic statistics, do you see any changes/challenges that may affect how countries collect, compile, and report data on GFS/PSDS?

I think the only challenge for GFS and PSDS would be a lack of country endorsement otherwise there are only opportunities to improve fiscal statistics. With cross representation on the IPSAS and GFS methodology boards the differences between the two frameworks are narrowing. As countries adopt IPSAS for fiscal reporting and develop unified COAs that are also aligned to GFS, the quality improvements that can be made for GFS and PSDS are enormous.

SARTTAC: Now that you have left SARTTAC, what’s next?

For now, I am returning to the United Kingdom’s HM Treasury to work on finance performance and improvement. I am looking forward to spending time with my family and reconnecting with friends Having enjoyed the SARTTAC role, I hope in the future to have an opportunity for another international posting.

SARTTAC: Do you have any final thoughts or messages to share with our readers in South Asia?

I would just like to say thank you to everyone, I have connected with during the last three years. I have made many friends in the member countries that I will stay in touch with. I think there are many opportunities for the member countries to deliver in the GFS domain. I admire their resilience and ambition and wish them good luck for the future.

Andrew during CD Engagement with India, Bhutan, Bangladesh and Maldives

Sanjay Kumar commenced his tenure in SARTTAC as the Public Debt Management Advisor in March 2024. With over 31 years of professional experience at the Reserve Bank of India and the Commonwealth Secretariat, he specializes in sovereign debt management, local currency bond market development, legal and institutional frameworks governing public debt management, formulation and implementation of medium-term debt strategies and promoting debt transparency. He holds postgraduate degrees in Economics and Business Management, with a specialization in finance.

SARTTAC organized a two-day high-level seminar for Executive Directors and Directors of Supervisory and Regulatory Departments of Bangladesh Bank (BB) on April 18-19, 2024. The aim was to raise awareness of the success factors and challenges that may arise, while transiting to effective Risk-based Supervision (RBS) Framework. Introductory session provided an overview of risk focused supervision delving into the objectives and processes of RBS, and the primary features of an effective risk-based supervisory approach. Subsequent sessions explored the dynamic relationship between RBS and prudential regulation, operational supervisory processes and elaborate discussion on supervisory dialogue, decision-making procedures, preventive measures, and corrective actions from the senior experienced officials from the regional authorities. On the second day, the seminar featured a panel discussion covering key conditions essential for successful implementation, along with the common challenges encountered in the region during the transition to a risk-focused approach. Mr Khurshid Alam, Deputy Governor (DG), BB, Ugyen Choden, DG, Royal Monetary Authority (RMA) of Bhutan, and Senior officials from Reserve Bank of India (RBI) and Central bank of Sri Lanka (CBSL) participated as a panelist. The discussions were intense, the questions were incisive, and the energy was high during the panel discussion.

From the interactions, it was evident that take-aways from the seminar would significantly aid BB in transitioning to RBS from the current compliance-based system. The seminar catalyzed senior management's buy-in for their transition to RBS. Participants reported valuable experiential learnings, regional insights, and a deeper understanding of the model. The discussions highlighted - tailored insights into the structure, varied functional units under RBS, and implementation challenges, which were unanimously appreciated by the attendees, including the Deputy Governors from the region. For many, this was a unique opportunity to learn from the experiences of the regional supervisors, with an interactive exchange of views on the similarities and differences in the supervisory frameworks and practices prevalent in the region. H.E. Mr. Md. Mustafizur Rahman, High Commissioner of Bangladesh to India also joined the welcome dinner reception hosted for the participants.

The seminar is in line with the broader CD efforts of Fund, to support implementation of RBS as it is one of the major policy decisions of BB which would bring significant changes in its supervisory landscape. This is also a key reform supported by Bangladesh’s Extended Credit Facility and Extended Fund Facility arrangements with the IMF, aimed to be finalized by end-2025. The seminar will be followed by further technical assistance from SARTTAC to facilitate the transitioning at BB from the current system of supervision to the forward-looking RBS.

47 officials from Ministry of Finance of Bhutan, India and Nepal participated in a regional workshop held in Bhutan in April 2024 to discuss select public financial management (PFM) issues. Led by our PFM Advisors, with virtual participation by colleagues from the Institute of Capacity Development (ICD) and Fiscal Affairs Department (FAD), the training was developed to discuss budget considerations in a post COVID-19 environment and provide an overview of the International Monetary Funds’ fiscal risk and public investment management toolkits and assessments. The course also provided an opportunity for each country to strengthen their relationships and share their PFM reform experiences on a regional platform, by discussing their current and future PFM reform initiatives.

SARTTAC staff, the senior Bhutanese government officials and Government of India participants were invited to a reception hosted by His Excellency Mr. Sudhakar Dalela, the Indian Ambassador to Bhutan to learn more about the funding support and development assistance that the Government of India (GoI) is providing to the Government of Bhutan.

More articles from the same issue

- A conversation with Andrew Evans - Government Finance Statistics and Public Sector Debt Statistics (GFS and PSDS) advisor in SARTTAC

- Staff Announcements

- High level Seminar on Risk Based Supervision (RBS) for Executive Directors (EDs) and Directors of Bangladesh Bank

- Regional Training on Select PFM Issues

- Technical Assistance

- Training and Webinars

- Technical Assistance Reports Disseminated on Partners Connect during FY24 Q4

Previous Issues <