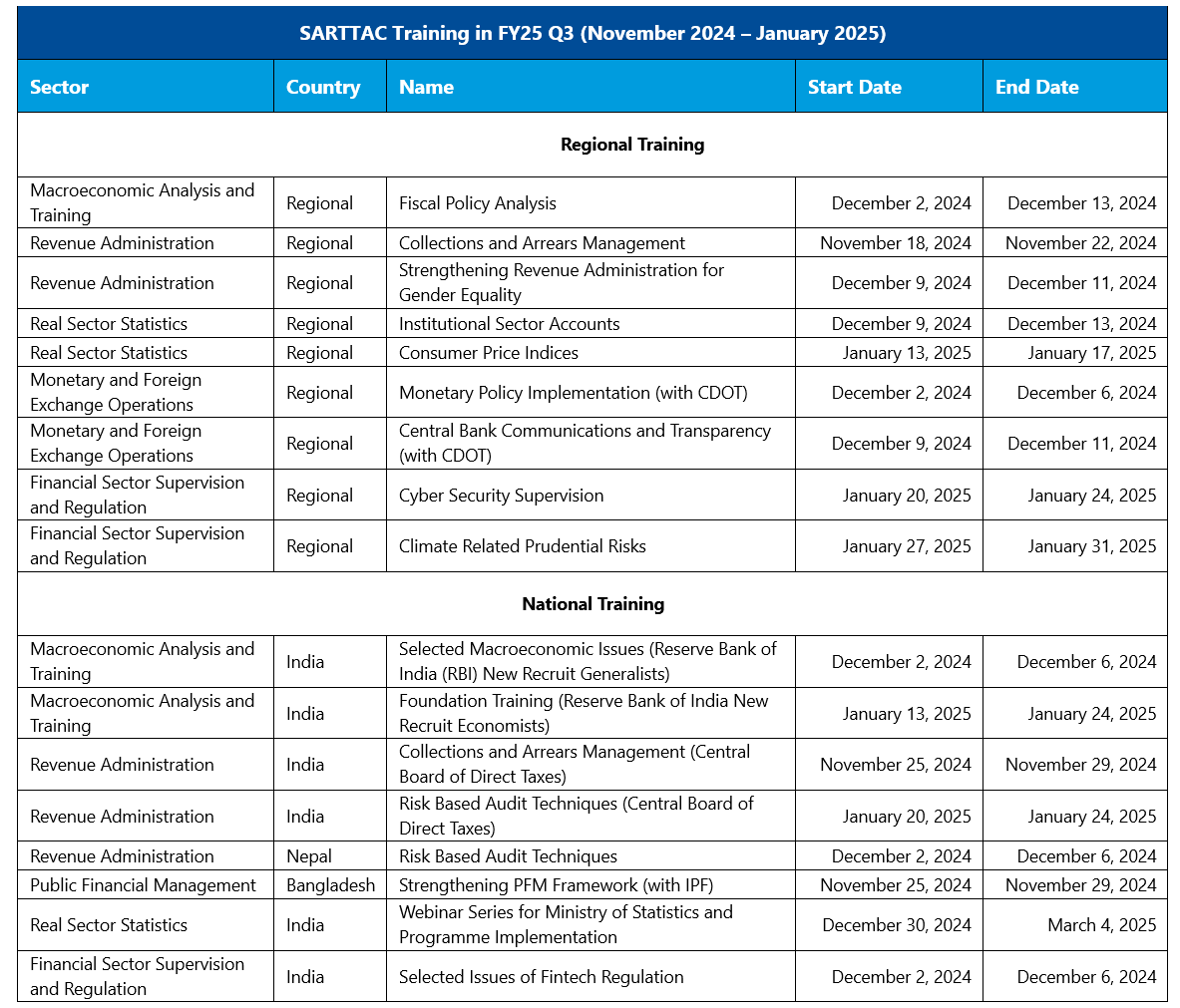

In the third quarter of FY25 (November 2024 – January 2025), the IMF South Asia Regional Training and Technical Assistance Center (SARTTAC) delivered a total of 26 Capacity Development (CD) activities, comprising nine technical assistance (TA) missions and seventeen training courses, both at the national and at the regional level.

Several new trainings were delivered and hosted, for the first time, in selected member countries fostering ownership and engagement:

- the first regional workshop on climate risk supervision was conducted. It was co-hosted with the Central Bank of Sri Lanka in Colombo (January 27-31, 2025). This workshop supported thirty-five officials from Central Banks and Ministries of Finance in the region in developing onsite examination protocols and supervisory tools and updating monitoring processes to capture climate related risks.

- a new regional course on Cyber Risk Supervision was conducted at SARTTAC (January 20-24, 2025) in New Delhi. It focused on cybersecurity frameworks, supervisory tools, incident reporting, and leveraging security intelligence to strengthen the resilience of banks and financial market infrastructure.

- a new regional workshop on ‘Strengthening Revenue Administration for Gender Equality’, was held at SARTTAC (December 9–11, 2024). This focused on gender-related issues in revenue administration, focusing on inclusive workforce policies and enhancing women’s participation in the tax system.

- a new webinar on ‘Experiences in Gender Budgeting: A Cross-Country Perspective’, was conducted, as part of a new webinar series on Macroeconomics and Gender Equality, organized jointly by SARTTAC, the African Training Institute (ATI), and Middle East Regional Technical Assistance Center (METAC). The seminar focused on the integration of a gender perspective into the budgetary process and showcased experiences from India, Morocco, and Sub-Saharan Africa.

In parallel, SARTTAC technical assistance missions continued to actively support member countries in implementing their economic policies and reforms. Notably, TA missions supported the Bangladesh Bank in enhancing regulatory capacity and training statistics officials; Bhutan's Royal Monetary Authority in establishing a haircut calibration framework; the Central Bank of Sri Lanka (CBSL) in modernizing its strategic communication and strengthening organizational capacity; India’s Ministry of Statistics and Programme Implementation in strengthening institutional sector accounts; and Nepal’s National Statistics Office in developing institutional sector accounts and strengthening capital budget execution.

During the third quarter, SARTTAC delivered a series of high-impact training courses that supported member countries in enhancing macroeconomic analysis and forecasting, monetary policy implementation, financial supervision and regulation, public financial management and revenue administration:

- SARTTAC and the IMF Capacity Development Office in Thailand (CDOT) jointly delivered two regional trainings on Monetary Policy Implementation (December 2-6, 2024) and Central Bank Communications and Transparency (December 9-11, 2024). These trainings brought together central bank officials from across South and Southeast Asia to facilitate exchange of cross-countries experiences and were delivered in Bangkok, Thailand. The training on Monetary Policy Implementation focused on practical challenges faced by emerging and developing economies in implementing monetary policy. Key topics included liquidity forecasting, interest rate corridor frameworks, money market development, reserve requirements, and central bank communication. The training on Central Bank Communications and Transparency focused on how central banks can improve their communication with public and market participants and enhance transparency and accountability (more details on this training can be accessed here).

- Two trainings on macroeconomic issues were delivered as part of the ongoing cohort macroeconomic training program for the Reserve Bank of India (RBI). The trainings covered the four main macroeconomic sectors (real, fiscal, external, and monetary) and their interlinkages using Indian data. The trainings strengthened participants ability to assess India’s macroeconomic situation, including the stance of fiscal and monetary policy; financial stability; exchange rate misalignments. More details on these trainings can be accessed here.

- A new training on FINTECH Regulation (December 2-6, 2024) was delivered to mid-level RBI officials across supervision, payments, and policy departments. It focused on key issues including crypto assets, digital privacy, big tech, and global regulatory standards. Participants discussed India’s large retail crypto market and evolving regulatory responses. The workshop provided practical guidance on licensing, supervision, and managing risks, with strong participant engagement throughout the sessions.

- As part of SARTTAC’s ongoing cooperation with Bangladesh’s Institute of Public Finance a tailored training on Strengthening Public Financial Management (November 25-29, 2024) was delivered to Bangladesh government officials.

Certificate presentation to participant of Strengthening Public Financial Management Framework

(Nov 25-29, 2024)

- Two new regional courses on Cyber Risk Supervision (January 20-24, 2025) and on Implementing Effective Regulation and Supervision of Climate-related Financial Risks (January 27-31, 2025) – were delivered, addressing emerging concerns of financial sector supervision agencies in the region. The first course targeted non-specialist financial sector supervisors and aimed to enhance their understanding of the cyber threat landscape, regulatory approaches, and supervisory practices. It provided practical insights on integrating cyber risk management into supervisory frameworks, drawing on international standards and best practices. Key topics included governance, risk assessments, regulatory frameworks, and tools to enhance cyber resilience. The second training on climate related risks was held in Sri Lanka (Colombo) and hosted by the CBSL. It focused on emerging supervisory frameworks for climate-related financial risks, covering key topics such as the Basel Committee principles, climate scenario analysis, and supervisory tools to detect and mitigate transition and physical risks. Practical examples from the European Union and South Africa helped contextualize global best practices. Interactive sessions, including case studies and group work, allowed participants to share country experiences and challenges.

IMF SARTTAC Course on Implementing Effective Regulation and Supervision of Climate-related Financial Risks, Colombo, Sri Lanka (Jan 27-31, 2025)

- A new regional workshop on ‘Strengthening Revenue Administration for Gender Equality’ was held at SARTTAC (December 9–11, 2024). It focused on gender-related issues in revenue administration, focusing on inclusive workforce policies and enhancing women’s participation in the tax system. Sessions included case studies, International Survey on Revenue Administration (ISORA) data analysis, and practical tools to identify bias and promote equality. Participants developed country-specific action plans and expressed strong engagement throughout. The workshop marked a key step in raising awareness and supporting gender-responsive reforms in revenue administrations across the region.

- A regional training course on Institutional Sector accounts (ISAs) was delivered during December 9-13, 2024. The course introduced participants to the methodological framework, concepts, definitions and potential data sources for the compilation of ISAs aligned with the international methodological standards to improve the overall quality of macroeconomic statistics. The course presented theoretical and practical issues related to the compilation of the sequence of accounts (current and capital accounts, financial accounts, other changes in volume of assets accounts, and revaluation accounts) and balance sheets according to institutional sectors.

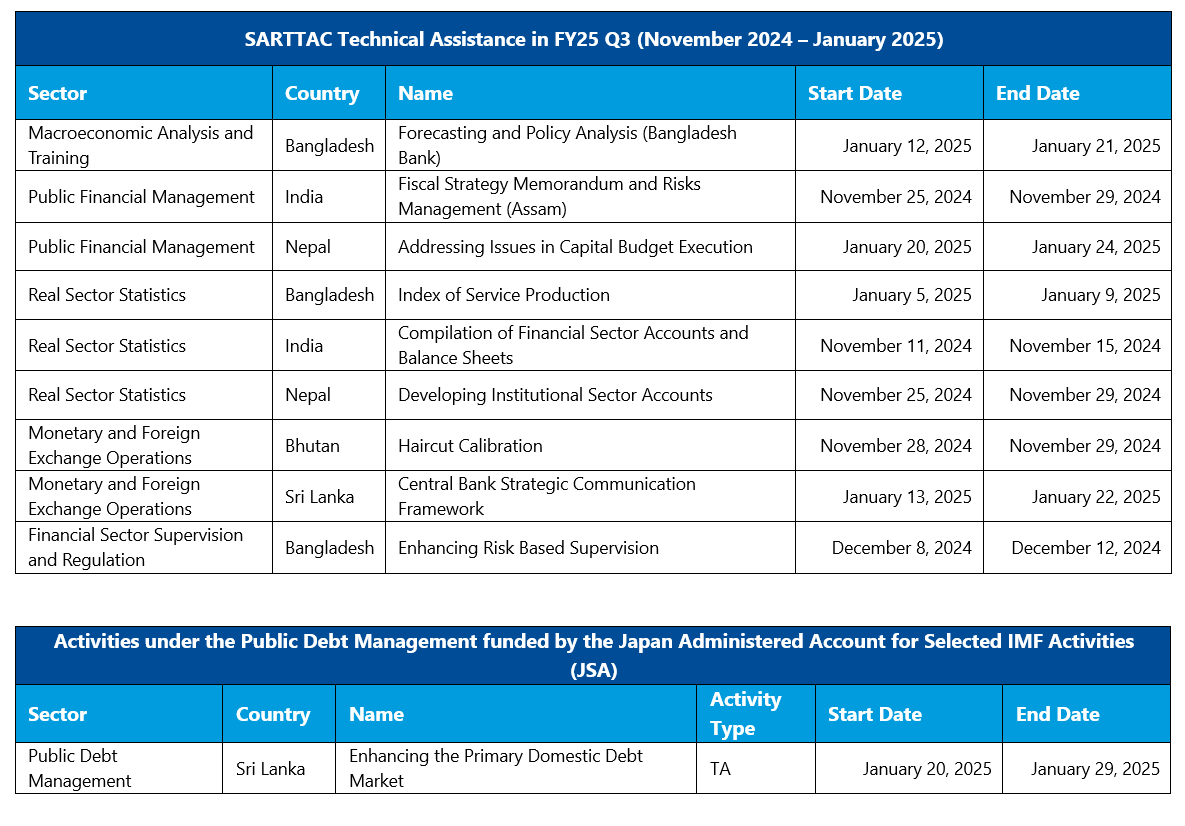

During the third quarter of FY25, SARTTAC delivered nine TA missions to most of its member countries and across different workstreams (see below). In particular:

- In Bangladesh, a TA mission (December 8-12, 2024) supported the Bangladesh Bank (BB) in strengthening its regulatory and supervisory capacity by facilitating the progress in the risk-based supervision framework. Furthermore, a mission (January 12-21, 2025) worked with BB in incorporating medium-term macroeconomic forecast into the monetary policy statement, a structural performance benchmark under the ongoing ECF/EFF/RSF arrangement. Another mission during January 5-9, 2025 (jointly financed by SARTTAC and IMF’s Data for Decision Fund) trained officials of Bangladesh Bureau of Statistics in compiling the Index of Service Production.

- In Bhutan, a virtual mission (November 28-29, 2024) assisted Royal Monetary Authority (RMA) in establishing a haircut calibration framework. It built on SARTTAC’s earlier missions to RMA on developing an Interest Rate Corridor Framework (August 2024), Domestic Liquidity Management Framework: Operational Aspects (May 2021) and Preparing the Monetary Policy Implementation Framework (December 2019).

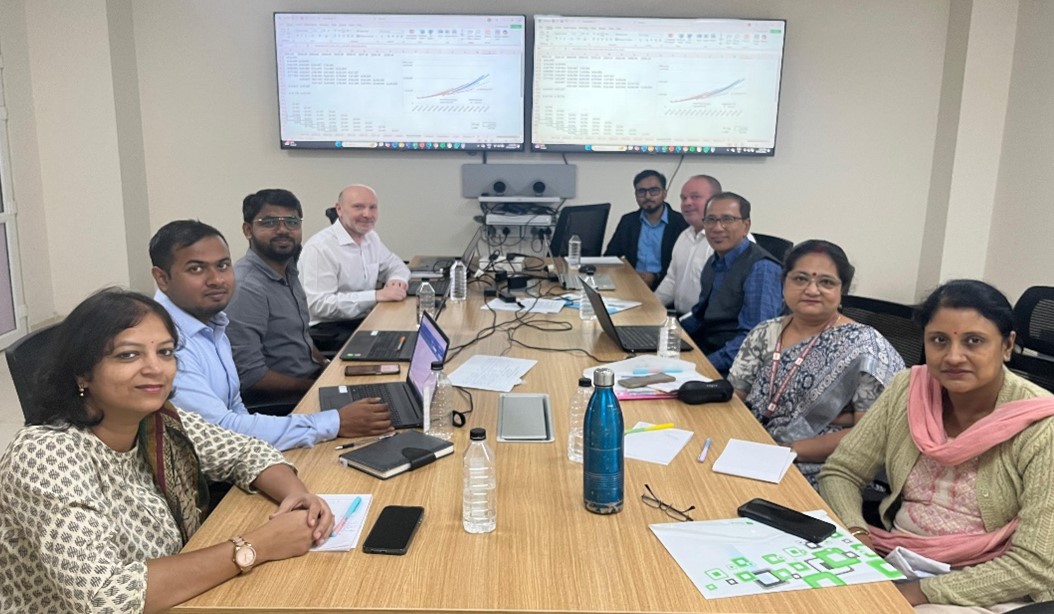

- In India, a mission (November 11-15, 2024) supported the Ministry of Statistics and Programme Implementation in improving the institutional sector accounts and balance sheets. For Indian State of ‘Assam’, a mission (November 25-29, 2024) worked with officials from the Budget Department and Economic Affairs team to analyze economic and fiscal data and develop a Fiscal Strategy Memorandum. Concepts of fiscal risk management were also introduced to the team using the IMF-Fiscal Risk Assessment Tool.

Fiscal Risk Management Mission to Indian state of Assam

(November 25-29, 2024)

- In Nepal, a mission (November 25-29, 2024) supported the National Statistics Office in development of institutional sector accounts. Another mission (January 20-24, 2025) assisted the National Planning Commission and the Ministry of Finance in strengthening capital budget execution.

- In Sri Lanka a mission (January 13-22, 2025) supported CBSL to modernize its strategic communication framework, streamline organizational set-up and strengthen the capacity of the communication function.

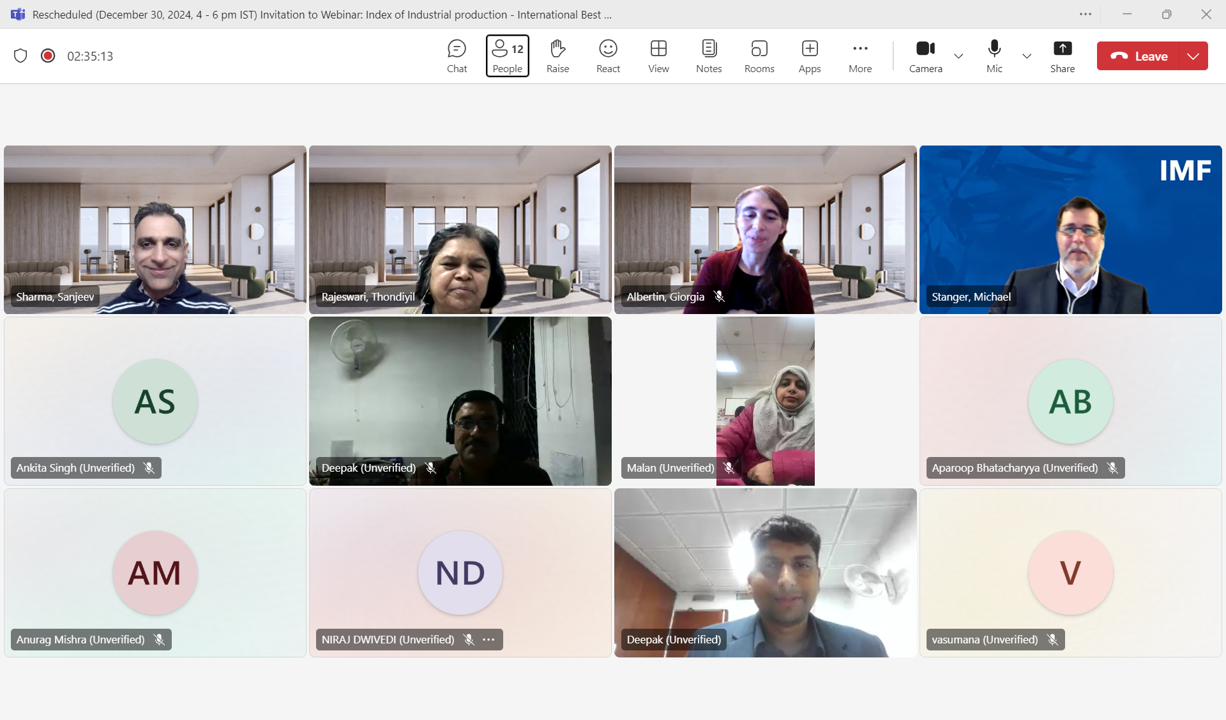

In December 2024, SARTTAC launched a new dedicated monthly seminar series for the Ministry of Statistics and Programme Implementation of India (MOSPI). SARTTAC stepped-up its engagement with MOSPI by launching a new monthly seminar series as an innovative tool to train a larger number of officials at MOSPI. The seminars focused on specialized topics related to national accounts, Index of Industrial production and prices. This contributed to enhance the skill sets of MOSPI staff and supported the ongoing rebasing exercise of national accounts, Consumer Price Index and Index of Industrial Production.

Index of Industrial Production Webinar

Index of Industrial Production Webinar

(December 30, 2024)

SARTTAC and the Capacity Development Office in Thailand (CDOT) jointly delivered a regional course on Central Bank Policy Communications and Transparency in Bangkok, Thailand. The course (December 9-11, 2024) was attended by thirty-six participants from ten central banks: Bangladesh, Bhutan, Cambodia, Lao PDR, India, the Maldives, Nepal, Philippines, Sri Lanka and Vietnam. This course addressed the challenges that central banks in emerging markets and developing economies face regarding policy communications and transparency. Key topics included the role of modern central bank communication, transparency and accountability, communication tools, channels and audiences, the communication of monetary and foreign exchange policies and operations, and the classification of central bank communications using machine learning tools. The program featured a blend of lectures, discussions, and case studies from Canada, Czechia, and Thailand, along with simulation exercises conducted during the workshop.

Regional course on Central Bank Policy Communications and Transparency in Bangkok, Thailand.

Regional course on Central Bank Policy Communications and Transparency in Bangkok, Thailand.

(December 9-11, 2024)

In addition, SARTTAC delivered its first technical assistance (TA) mission on the Strategic Communication Framework for central banks in Sri Lanka. At the request of the Central Bank of Sri Lanka (CBSL) and building on the earlier regional training, a SARTTAC TA mission (January 13 – 25, 2025) supported the CBSL in modernizing its strategic communication framework. The SARTTAC team engaged with the Communication Department (CMD) and other departments currently involved in fulfilling communication functions at CBSL. The TA mission also included training sessions for CMD staff, focusing on "Building a Framework for Institutional Communications" and "Measuring the Effectiveness of Communications." The mission conducted thorough diagnostics and discussed a roadmap for strengthening CBSL’s communication function.

TA mission to CBSL in modernizing its strategic communication framework

TA mission to CBSL in modernizing its strategic communication framework

(January 13 – 25, 2025)

Going forward, the mission will be complemented by another TA mission on Messaging to Target Audiences and Digital Media, planned for FY26. The objectives of this mission will be to improve the understanding of the central bank’s target audiences and how they are communicated with, strengthen the CMD’s skills in message development techniques, tailor messages to target audiences, layer central bank communications across different channels, coordinate the message management process, and enhance its capabilities to communicate via digital channels.

SARTTAC and RBI have a strong and longstanding partnership, anchored by a shared commitment to foster economic resilience and policy effectiveness through targeted knowledge exchange and skill development. The RBI, with its deep experience in macroeconomic policy, monetary management, and financial regulation, has been leveraging SARTTAC’s expertise, notably on international best practices. SARTTAC has been delivering customized training programs for the RBI, focusing on macroeconomic modeling, monetary policy analysis, financial stability, and external sector assessments, with hands-on workshops fostering knowledge exchange between RBI officials and IMF experts. RBI experts often participate as guest lecturers, sharing insights on India’s economic management experiences.

SARTTAC training to the RBI was tailored to the different needs of RBI generalist and economist streams. The generalist stream received a more conceptual and applied overview of macroeconomic principles. The training was designed to enhance their understanding of key economic concepts and policy frameworks. It emphasized interpreting macroeconomic data, understanding policy trade-offs, and analyzing economic reports. The sessions were interactive, featuring case studies and discussions on real-world policy challenges. The generalist training was more focused on policy application and communication. This differentiated approach ensured that both streams acquired relevant economic skills suited to their roles within the RBI.

Selected Macroeconomics Issues for Reserve Bank of India General Inductees, (December 2-6, 2024)

In parallel, for the economist stream, the focus was on advanced technical and analytical skills. The training involved in-depth modules on macroeconomic modeling, policy simulations, and data analysis using software like EViews and MATLAB. The sessions were designed to strengthen participants’ abilities to conduct rigorous macroeconomic analysis and develop policy recommendations. Specialized topics like debt sustainability, monetary policy modeling, forecasting, stress testing, and external sector analysis were also covered.

Trainer and the trainees engaged in practical exercises during Macroeconomics Foundation Course for Reserve Bank of India Economists (Jan 13-24, 2025)

Looking ahead, the RBI-SARTTAC partnership is expected to continue playing a crucial role. As economies navigate uncertainties stemming from global economic conditions, climate change, and geopolitical developments, the demand for evidence-based policymaking and analytical rigor will remain paramount. The collaboration between SARTTAC and RBI underscores the role of capacity building in supporting economic policies and reforms to advancing macroeconomic stability and inclusive growth.

More articles from the same issue

A Focus on Technical Assistance

- Scaling-up SARTTAC’s Engagement with India’s Ministry of Statistics and Programme Implementation

- Strengthening Central Banks Communication

- Partnering with Reserve Bank of India

- Summary of Operations in FY25 Q1 - Q3

- Training and Webinars

- Technical Assistance

- Activities under the Public Debt Management Program funded by the Japan

- Technical Assistance Reports Disseminated on Partners Connect during FY25 Q3

Previous Issues <