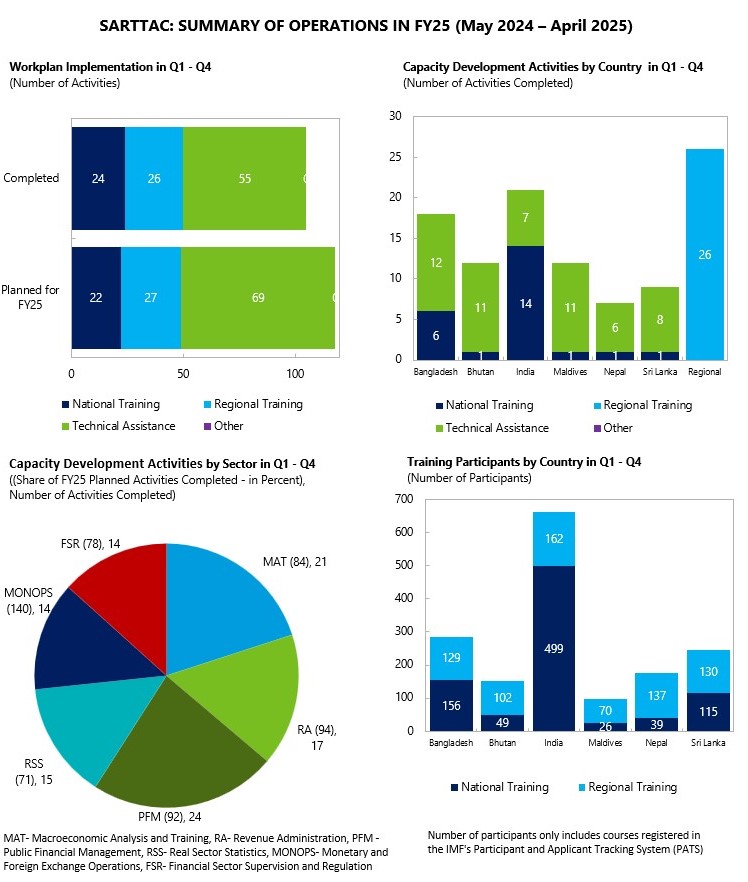

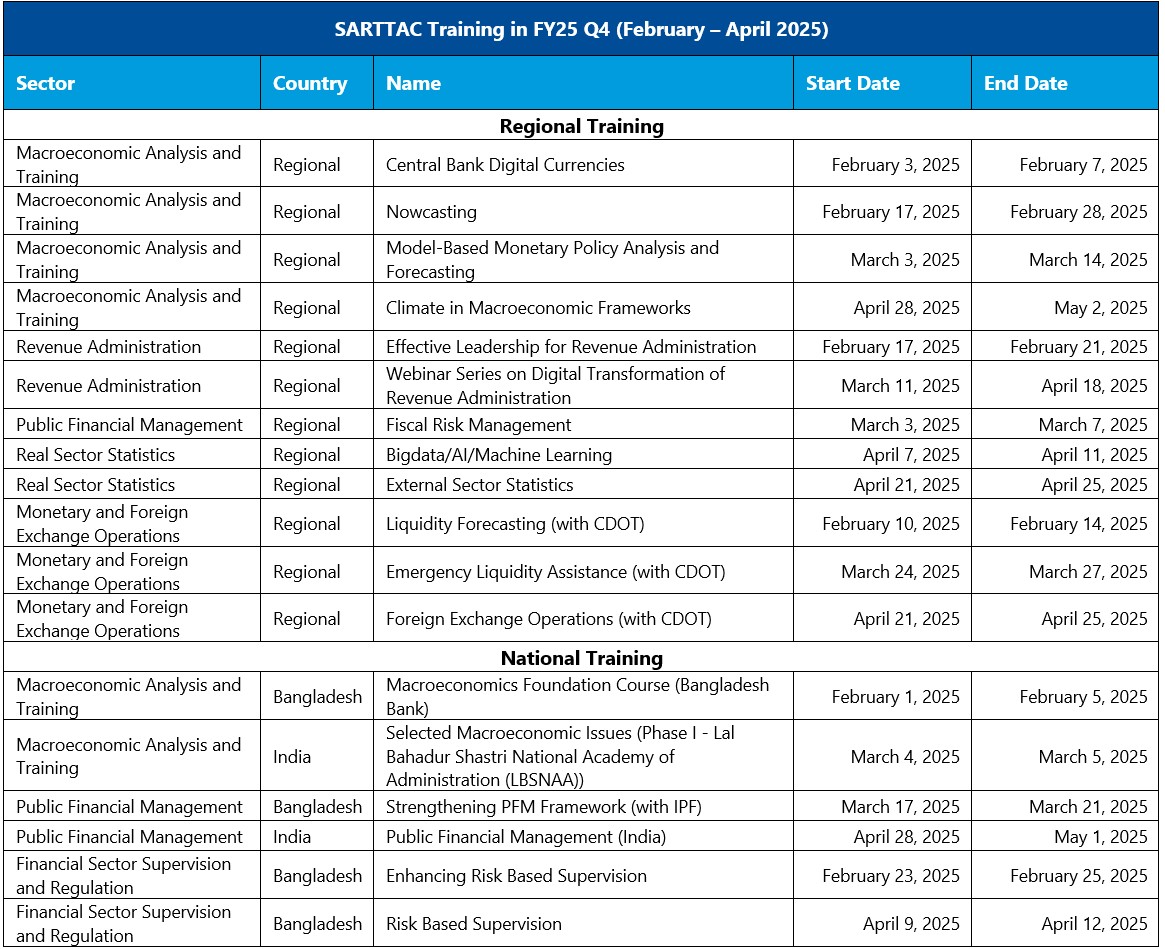

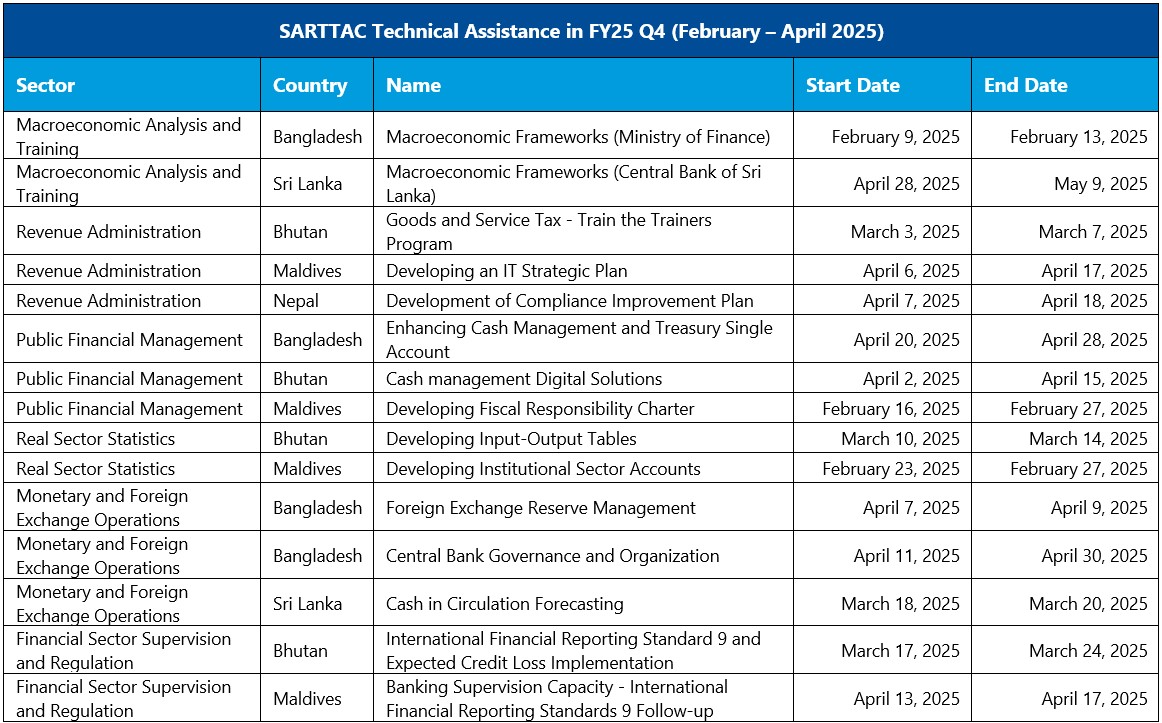

In the fourth quarter of FY25 (February – April 2025), the IMF South Asia Regional Training and Technical Assistance Center (SARTTAC) delivered a total of 33 Capacity Development (CD) activities. This comprised 15 technical assistance (TA) missions and 18 training activities, both at the national and at the regional level. Furthermore, SARTTAC coordinated the organization of the IMF Asia and Pacific Department (APD) FY25 field retreat (March 31-April 1, 2025) which was held in New Delhi and brought APD front office staff together with staff in field offices. Discussions focused on improving the functioning of field offices, greater co-ordination with HQ departments and integration of Fund CD and surveillance.

Asia and Pacific Department FY25 Field Offices Retreat (March 31 – April 1, 2025)

New regional and national trainings were delivered and tailored CD supported SARTTAC member countries in the implementation of their economic policy and reform programs:

- Engagement to support Bangladesh was strong, marked by four national training programs and four technical assistance missions. A first-time tailored Macroeconomics Foundation Course (February 1–5, 2025) aimed at building analytical capacity among Bangladesh Bank (BB) and Ministry of Finance (MOF) staff was delivered. A Public Financial Management (PFM) training (in collaboration with Institute of Public Finance (IPF)) introduced mid-level officials to international best practices in budgeting, cash and investment management, fiscal reporting, and risk management. Two separate trainings on Enhancing and Implementing Risk-Based Supervision (RBS) (February 23–25 and April 9–12, 2025), supported the BB in strengthening regulatory capacity and extending the RBS framework to more banks. Furthermore, TA supported improving foreign exchange reserve management (April 7-9, 2025) and strengthening governance and organization (April 11-30, 2025) at BB. At the MOF, TA supported broadening the macroeconomic framework foundation tool to include satellite models on climate and debt dynamics (February 9-13, 2025) and reviewed progress (April 20-28, 2025) in consolidating government cash resources under a treasury single (TSA) account system and the cash forecasting practices. Please see more details here.

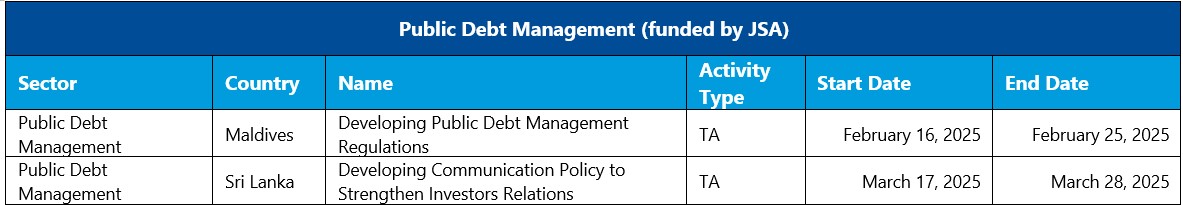

- Engagement with Sri Lanka and Maldives to strengthen public debt management intensified. In Sri Lanka (March 17-28, 2025), support was provided to the newly established public debt management office in developing an investor relations strategy and communication policy with an emphasis on clarity, transparency and consistency in communication. TA in Maldives (February 16-25, 2025), delivered jointly with the IMF Fiscal Affairs Department, focused on developing public debt management regulation under the new public debt law as well as on the structure of the debt management office and the coordinating mechanism between different government agencies.

- For the first time, SARTTAC delivered a workshop for Indian States on strengthening PFM frameworks was delivered (April 28 to May 1, 2025). Officials from finance department from Indian states—Goa, Kerala, Odisha, Punjab, Rajasthan, Tripura, Uttar Pradesh, Tamil Nadu, and West Bengal – attended the workshop at SARTTAC premises in Delhi. Discussions focused on strategic budgeting, fiscal transparency, fiscal risk management, public investment management, and procurement and commitment control. More details on this training can be accessed here.

- A first regional training on Big Data (April 7-11, 2025) was conducted to build capacity among officials in using Big Data and Machine Learning for high-frequency indicator development and macroeconomic analysis. The training is discussed in detail here.

- SARTTAC and the IMF Capacity Development Office in Thailand (CDOT) jointly delivered three regional trainings to officials from central banks in South and South-East Asia. The first course on Liquidity Forecasting and Reserve Estimation (February 10–14, 2025), provided a comprehensive introduction to liquidity monitoring and forecasting, covering theoretical frameworks, statistical tools, hands-on exercises, and group simulations using IMF tools for effective open market operations. This was followed by a training on Emergency Liquidity Assistance (ELA) (March 24–27, 2025). The course offered a comprehensive overview of ELA frameworks, combining theoretical foundation with practical case studies and simulations to enhance participants’ understanding of ELA implementation, governance, and communication. Furthermore, specialized training on Foreign Exchange (FX) operations (April 21-25, 2025) focused on reference exchange rates, market development, and effective FX management was also delivered.

Engaging discussion during Emergency Liquidity Assistance training (March 24 – 27, 2025)

- SARTTAC’s engagement with India’s Lal Bahadur Shastri National Academy of Administration (LBSNAA) was strengthened with a revamped module on macroeconomics (March 4-5, 2025) delivered as part of Phase I training for the Indian Administrative Service. The training utilized customized lectures and workshops to analyze the GDP, fiscal accounts and public debt at the state level in India.

Selected Macroeconomic Issues Course for Phase 1 IAS Officers at LBSNAA (March 4 – 5, 2025)

Selected Macroeconomic Issues Course for Phase 1 IAS Officers at LBSNAA (March 4 – 5, 2025)

- SARTTAC provided targeted CD support to Bhutan's Department of Revenue and Customs (March 3–7, 2025) through a Train-the-Trainers program, addressing the specific needs of the Bhutan Integrated Tax System and the Goods and Service Tax project teams.

- In Sri Lanka, a mission (April 28-May 9, 2025) concluded the TA project on macro-frameworks with the Central Bank of Sri Lanka on improving their forecasting and policy analysis system.

During the fourth quarter of FY25, SARTTAC offered a wide range of trainings across all workstreams. This comprised 11 regional trainings and 6 national trainings for India and Bangladesh. In addition, a new webinar series on digital transformation in revenue administration was launched, the details on which can be accessed here.

- Three courses focused on strengthening macroeconomic frameworks in the region:

- A regional course on Nowcasting (February 17-28, 2025) equipped participants with advanced tools to produce real-time economic forecasts. Delivered through a mix of lectures and hands-on workshops using Indian data and EViews software, the course covered statistical techniques such as ARIMA models, factor models, and the Kalman filter. Participants explored standard nowcasting approaches including MIDAS and U-MIDAS, as well as machine learning methods. A key highlight was a case study replicating the Atlanta Federal Reserve’s GDPNow report.

- A first in-person regional course on Model-Based Monetary Policy Analysis and Forecasting (March 3-13, 2025) course was delivered at SARTTAC. The course provided rigorous training on Dynamic New Keynesian models for monetary policy analysis, focusing on responses to macroeconomic shocks. Participants gained hands-on experience through updated country case studies and a guest lecture by Banco de la República, Colombia on Macro Models in Central Bank’s Policy Making.

- A first regional course on Climate in Macroeconomic Frameworks (April 28-May 2, 2025) course was delivered at SARTTAC, addressing the growing need to integrate climate change impacts into macroeconomic policy design. Over one week, participants were trained in Excel-based tools and models, including the C-Macro framework Toolkit, Natural Disaster-Debt Dynamics Tool, and Debt, Investment, Growth, and Natural Disasters (DIGNAD), to assess climate-related risks and vulnerabilities. Each tool was taught through hands-on workshops, concluding with group presentations. The course provided officials with practical skills to incorporate climate considerations into national economic frameworks and support resilient and sustainable policymaking in the face of climate challenges.

- A regional training on Central Bank Digital Currencies (CBDCs) (February 3-7, 2025) focused on exploring CBDC adoption and design, along with their macroeconomic impact, particularly on monetary policy transmission and financial inclusion.

- A regional course on External Sector Statistics (ESS), (April 21–25, 2025), delivered in collaboration with the IMF Statistics Department, trained officials on updated ESS compilation methodologies, including aspects of globalization, digital trade, and revisions to macroeconomic statistics standards.

- In the fiscal area, trainings on effective leadership for revenue administration (February 17-21, 2025) and fiscal risk management (March 3-7, 2025) were delivered. The first training catered to the senior and middle-level officials of leadership teams of revenue administrations from SARTTAC member countries, who are currently or potentially responsible for building the strategic and operational plans. Key themes included adaptive leadership, stakeholder engagement, communication, and managing change without formal authority. The second training enhanced awareness and capacity in fiscal risk management among mid- to senior-level officials from finance ministries. It focused on key fiscal risks, transparency, and institutional practices, and introduced IMF tools including the State-Owned Enterprise Health Check Tool, Debt Guarantees and Loans Assessment Tool, and Public Fiscal Risk Assessment Model. Sessions covered macro-fiscal risks, government guarantees, public-private partnerships, and fiscal reporting, supported by practical group exercises. Country presentations enriched the dialogue through experience-sharing on institutional frameworks and risk assessments.

Classroom training in Effective Leadership for Revenue Administration (February 17-21, 2025)

During the fourth quarter of FY25, SARTTAC delivered 15 TA missions across various workstreams in the region:

- In Bangladesh, SARTTAC delivered 4 TA missions which supported: i) the MOF in extending their macroeconomic framework to include the Debt Dynamics Tool and Climate Macro Framework Toolkit (February 9–13, 2025) and in expanding the institutional coverage of the Treasury Single Account (TSA) system and improve cash management and forecasting (April 20-28, 2025); ii) the BB towards improving its foreign exchange reserves management framework (April 7-9, 2025, virtual support) and strengthening its governance framework and organizational structure, and in developing a comprehensive governance reform roadmap (April 11-30, 2025, virtual support).

TSA and Cash Management TA Mission in Bangladesh (April 20-28, 2025)

TSA and Cash Management TA Mission in Bangladesh (April 20-28, 2025)

- In Bhutan, SARTTAC delivered 4 TA missions which supported: i) the Department of Revenue and Customs (DRC) in developing internal training strategies for the upcoming Goods and Services Tax (GST) rollout (March 3-7, 2025); ii) the National Statistics Bureau (NSB) in converting Supply and Use Tables (SUTs) into Input-Output Tables (IOTs), including hands-on training (March 10-14, 2025); iii) the Royal Monetary Authority (RMA) by reviewing the progress made on implementing the Risk-Based Supervision framework, Expected Credit Loss framework, and liquidity regulation (March 18-24, 2025); iv) the MOF and RMA on TSA implementation and assessed digital solutions for cash and debt management (April 2-15, 2025).

- In Maldives, SARTTAC delivered 4 TA missions and supported: i) the MOF in developing a Charter of Fiscal Responsibility, outlining measurable fiscal objectives and performance metrics (February 16-27, 2025); ii) assisted the Maldives Bureau of Statistics in compiling Annual Institutional Sector Accounts (February 23-27, 2025);iii) helped the Maldives Inland Revenue Authority (MIRA) to develop an Information Technology Strategic Plan aligned with the Medium-Term Revenue Strategy (April 6–17, 2025); iv) the Maldives Monetary Authority (MMA) was also supported by a mission on strengthening its regulatory and supervisory capacity (April 13-17, 2025).

Concluding meeting for the Fiscal Responsibility Charter TA Mission in Maldives (February 16-27, 2025)

Concluding meeting for the Fiscal Responsibility Charter TA Mission in Maldives (February 16-27, 2025)

- In Nepal, SARTTAC delivered 1 TA mission which supported the Inland Revenue Department to enhance compliance risk management and develop Compliance Improvement Plans under the Domestic Revenue Mobilization Strategy. A workshop held during the mission also shared international best practices (April 7-18, 2025).

- In Sri Lanka, SARTTAC delivered 2 TA missions that assisted the Central Bank of Sri Lanka (CBSL) in enhancing its liquidity forecasting framework for projecting currency in circulation (March 18-20, 2025, virtual support) and developing its Forecasting and Policy Analysis System and refining its monetary policy communication strategy (April 28–May 9, 2025).

Meeting with the authorities in Sri Lanka during the Forecasting and Policy Analysis System mission (April 28–May 9, 2025)

Meeting with the authorities in Sri Lanka during the Forecasting and Policy Analysis System mission (April 28–May 9, 2025)

|

Nitin Jain completed a two-year assignment as FSR Resident Advisor in SARTTAC in April 2025. He has since returned to the Reserve Bank of India (RBI), working in the Department of Supervision. Below, Nitin shares experience of his time in SARTTAC. |

What motivated you to join SARTTAC as Financial Sector Regulation and Supervision (FSR) Resident Advisor in 2023, taking a break from the long illustrious career with the Reserve Bank of India (RBI)?

Answer: After gaining rich experience in supervision and policymaking at RBI and ECB, I was keen to apply and adapt those learnings in a multi-country setting. SARTTAC offered the opportunity to work on regulatory development across jurisdictions and engage directly with central bank leadership in the region. The shift from regulatory design to strategic advisory was intellectually rewarding and operationally challenging. I also saw this as a chance to deepen my understanding of regional challenges in a global setup—and bring back those insights to inform future supervisory reforms in RBI. A regional advisory platform like this sharpens both delivery and design perspectives.

How was your experience of working in SARTTAC different from your work experience in RBI? What has been the most rewarding experience working as the FSR Advisor in SARTTAC?

Answer: At RBI, I worked on policymaking, supervision, regulation, and corporate strategy and inspections in a structured environment with well-established systems. SARTTAC, in contrast, required tailoring global standards to diverse jurisdictions with varying levels of regulatory maturity. The shift from being a regulator/supervisor to an advisor demanded greater adaptability, stakeholder engagement, and empathy. The most rewarding experience was working closely with central bank leadership across South Asia—co-developing solutions, building trust, and shaping supervisory reforms from concept to implementation. I also greatly benefited from working alongside SARTTAC colleagues and domain experts from IMF HQ who brought deep global knowledge and practical insights—these exchanges sharpened my understanding of how international principles can be adapted to local realities.

What were some of the positive changes in the six member countries in FSR during your assignment?

Answer: Across the region, there was strong momentum toward strengthening supervisory frameworks—be it through adopting risk-based supervision (RBS), implementing IFRS 9, or initiating climate risk regulation. Bhutan made tangible progress in operationalizing RBS, while Maldives and Nepal moved forward on ECL model design and implementation. Bangladesh began streamlining supervisory processes under RBS and rolled out structured capacity-building for its senior management. Sri Lanka deepened its credit and liquidity risk assessment approaches. One major plus was the visible increase in ownership and engagement—from leadership to working-level staff. All member countries, in particular, actively participated in IFRS 9 discussions, engaging in technical deliberations with clarity and confidence. Their maturity and curiosity were equally a learning experience for me and reflected the growing depth in supervisory thinking in the region.

What should be the focus areas in FSR for the six member countries, going forward? How do you see SARTTAC evolving in next five years to meet the needs of member countries in the domain of FSR?

Answer: In the coming years, member countries may need to sharpen their risk based supervisory focus in areas such as:

- Implementation of IFRS9 Expected Credit Loss (ECL) framework.

- Fintech and digital-only banking models, including outsourced service risks.

- Cybersecurity resilience frameworks with emphasis on critical infrastructure and third-party risk.

- Operational resilience, especially business continuity, IT disruptions, and fraud controls.

These are no longer niche issues—they are becoming core to financial stability. SARTTAC is well placed to support this transition as a capacity-building hub in the region—offering toolkits, diagnostics, and calibrated peer benchmarks.

You also organized some study tours and peer learning in the banking sector in the South Asia region? What are your thoughts on it?

Answer: Study tours and peer learning initiatives were particularly impactful. Authorities greatly valued the insights and practical experiences gained through these programs. Nearly all participants provided overwhelmingly positive feedback, emphasizing how these activities enabled them to contextualize and integrate global best practices into their respective national frameworks.

What will you be doing next? Do you have any final thoughts or messages to share with our readers in South Asia?

Answer: I have already returned to the RBI and started working in Dept. of Supervision. I look forward to applying the diverse insights gained at SARTTAC into my supervisory role. The exposure of cross-jurisdictional practices, practical challenges, and leadership-level engagement has been enriching.

To colleagues in South Asia, I would say—the region stands at a critical inflection point, at the cusp of rapid financial growth, deeper formalization, and accelerated adoption of emerging technologies. This growth story is also about shaping a regulatory culture that is agile, forward-looking, and grounded in local realities. Investing in talent, nurturing collaboration, and staying open to experimentation will be key. SARTTAC has created a strong ecosystem for peer learning, and I hope this platform continues to evolve as a trusted partner for the region’s future-ready supervisory journey.

SARTTAC deepened its CD support in transformational areas by delivering a new regional training on big data and machine learning in April 2025.

This course - organized jointly with the IMF Statistics Department - aimed at supporting country officials in leveraging big data and machine learning for generating high-frequency and detailed statistics to enhance macroeconomic monitoring and research in the region. Notably, it provided hands-on training covering various big data applications and machine learning to enhance macroeconomic statistics and nowcasting, offering insights from both producer and user standpoints.

Officials from the six SARTTAC member countries, comprising economists, statisticians and data scientists involved in data collection and analysis, indicator development, modeling, and economic research from national statistical organizations, central banks, and ministries of finance attended this course.

Certificate presented to participant of Big Data and High Frequency Indicators for Macroeconomic Statistics (April 07– 11, 2025)

Certificate presented to participant of Big Data and High Frequency Indicators for Macroeconomic Statistics (April 07– 11, 2025)

SARTTAC launched a new series of monthly webinars on key aspects of digital transformation (DT) of revenue administrations (RAs), designed for senior managers and executives from RAs, who are responsible for implementing and managing their organization’s DT reforms.

The webinars combine sharing of good practices on DT reform with country experiences, to maximize learning outcomes. Besides SARTTAC member countries, the series is open to tax officials from the member countries of IMF’s other regional centers in the Asia-Pacific region (Caucasus, Central Asia, and Mongolia Regional Capacity Development Center (CCAMTAC), Pacific Financial Technical Assistance Centre (PFTAC), and CDOT).

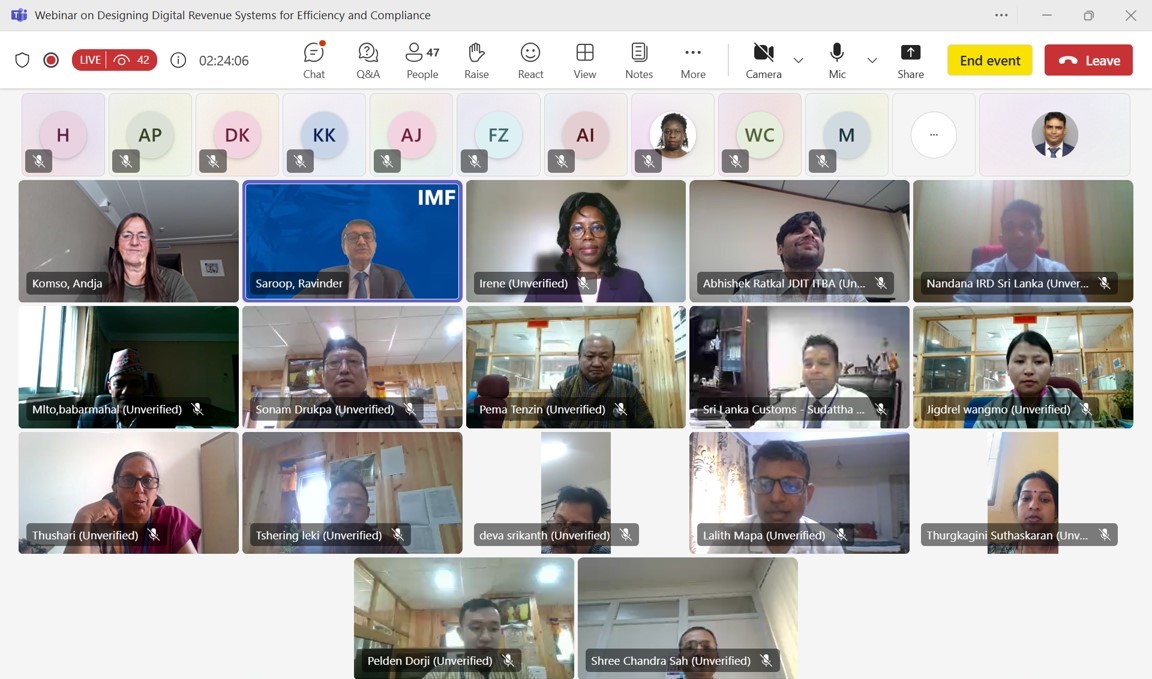

The webinar series started in March 2025 with foundational concepts and is progressing to advanced topics. The introductory webinar (March 19, 2025) provided an overview of digital transformation concepts in the context of revenue administration and the various phases of progression. The second webinar (April 16, 2025) focused on the design of digital revenue systems for efficiency and compliance, applying technology across the entire tax compliance lifecycle.

Delivered through a collaboration of the IMF headquarter GovTech staff and with the support of resident advisors in PFTAC and CCAMTAC, and the resident RA advisors in Bhutan and Sri Lanka, the webinars received a very positive response, with participation of more than 100 tax and customs officials from 16 member countries of SARTTAC, PFTAC and CCAMTAC in each webinar.

In the upcoming webinars, sessions on Information technology (IT)-driven business process re-engineering and effective compliance management through use of third-party data and data analytics will be combined with sessions on advanced topics such as the key drivers of DT reform (people, process, technology and budget), the choice and use of emerging technologies (blockchain, artificial intelligence and machine learning), development of IT Strategic Plan (ITSP), digital solutions for tracking and enforcing cross-border tax obligations, digital forensics, and cybersecurity.

Second Cross-Regional Webinar (April 16, 2025)

Second Cross-Regional Webinar (April 16, 2025)

SARTTAC hosted a one-week in-person training program on Strengthening Public Financial Management (PFM) Framework for Indian States from April 28 to May 1, 2025, at its training facility in New Delhi. The training course enabled twenty-five mid-senior level officers from the States Governments of Goa, Kerala, Odisha, Punjab, Rajasthan, Tripura, Uttar Pradesh and West Bengal to develop a better understanding of key public financial management issues and practices.

The workshop provided its participants a good understanding of PFM reform methodologies and enhanced knowledge in the areas of budget statements and tagging mechanisms, strategic budgeting including strengthening medium-term fiscal frameworks, fiscal transparency, fiscal risk and public investment management practices and procurement and commitment control. The workshop culminated in a detailed presentation by the State of Odisha setting out its recent PFM reform successes.

Future SARTTAC PFM workshops are being designed to help States to explore more fully fiscal risk analysis methodologies and reporting mechanisms including the development of fiscal risk statements.

Strengthening Public Financial Management (PFM) Framework for Indian States (April 28 - May 1, 2025)

More articles from the same issue

A Focus on Technical Assistance

- In conversation with Nitin Jain – Financial Sector Regulation and Supervision (FSR) Resident Advisor in SARTTAC.

- Regional Training on Big Data and High Frequency Indicators for Macroeconomic Statistics (April 07– 11, 2025)

- Cross-Regional Webinar Series on “Digital Transformation of Revenue Administration”

- Strengthening Public Financial Management (PFM) Framework for Indian States

- Summary of Operations in FY25 Q1 - Q4

- Training and Webinars

- Technical Assistance

- Activities under the Public Debt Management Program funded by the Japan

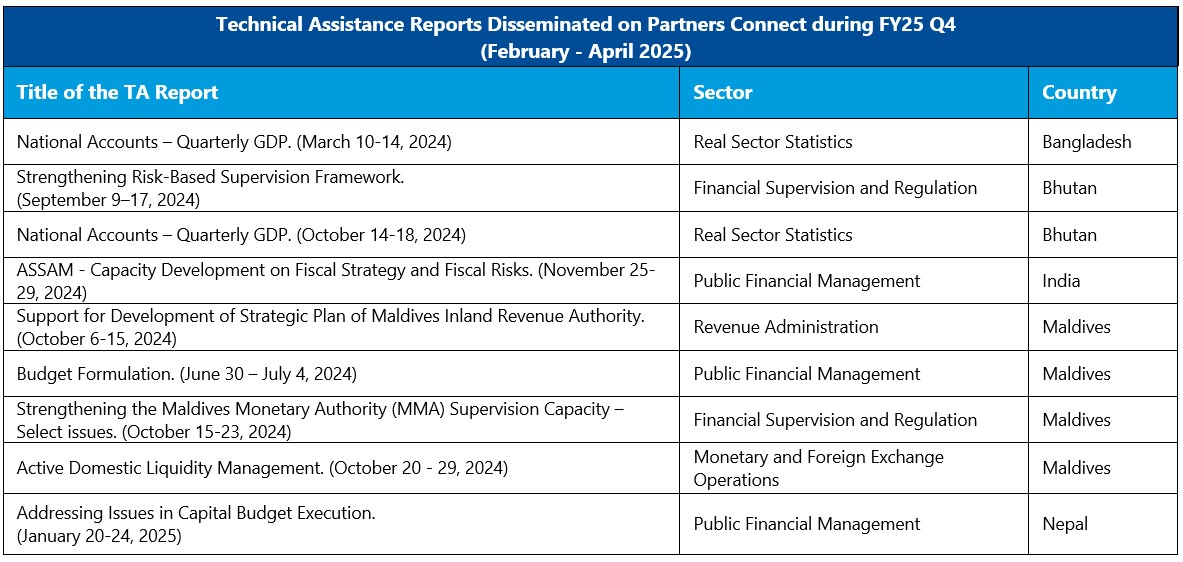

- Technical Assistance Reports Disseminated on Partners Connect during FY25 Q4

Previous Issues <