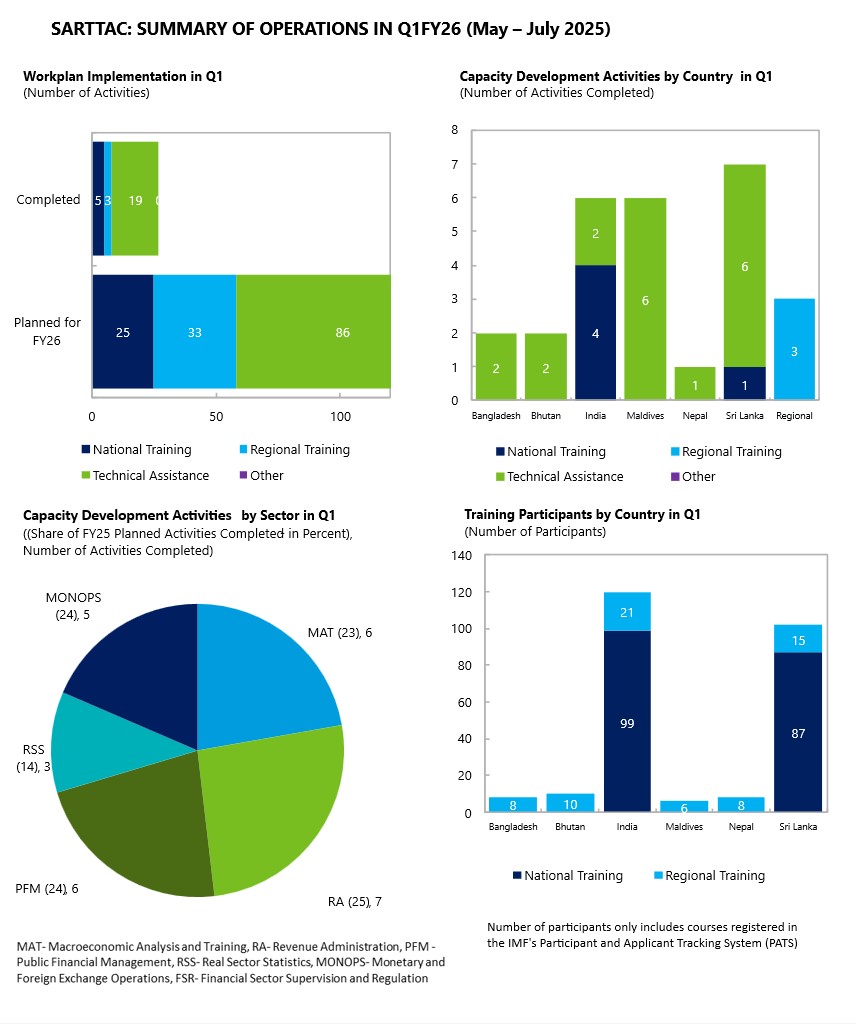

SARTTAC started FY26 with a strong capacity development (CD) delivery to South Asia through regional and tailored national trainings, seminars on selected topics, and extensive technical assistance to its members. In the first quarter of FY26 (May-July 2025), SARTTAC delivered a total of 27 CD activities. This comprised 20 technical assistance (TA) missions and 7 training courses/workshops, at the regional and national level. The webinar series on digitalization in revenue administration and on select national accounts issues fostered peer learning and complemented training and TA activities.

In the first quarter of FY26, new regional and tailored national trainings were delivered and distinguished guests visited SARTTAC and delivered keynote lectures:

- A new regional training course on Fintech Market Development and Policy Implications was delivered to address members’ emerging demand in this area (July 14-18, 2025). The course focused on fintech concepts, new financial technologies and associated policy issues including regulatory challenges.

- A new Macroeconomic Diagnostics training was delivered to mid-career Indian Economic services (IES) officials (June 30-July 4, 2025). The course content was tailored in collaboration with the Ministry of Finance of India and focused on macroeconomic frameworks, fiscal sustainability and macro-financial linkages. In addition to the standard lectures on macroeconomic diagnostics, for the first time SARTTAC Resident Advisors - representing the IMF Institute for Capacity Development, Fiscal Affairs Department, Monetary and Capital Markets Department and Statistics Department) - delivered lectures on topics related to their workstreams during the course.

- Distinguished external speakers delivered keynote lectures in SARTTAC’s national courses on macroeconomic issues for India. Two courses—Macroeconomic Diagnostics (May 5–14, 2025) and Financial Programming and Policies (May 15–23, 2025) were delivered for newly inducted IES officers. This featured keynote addresses by Dr. V. Anantha Nageswaran, Chief Economic Advisor for India, and a session on Outcome-based Policy Making by Dr. Arunish Chawla, Secretary, Department of Investment and Public Asset Management, Ministry of Finance. Furthermore, Mr. Ranil Salgado, IMF Senior Resident Representative for India, presented the findings of the IMF Article IV 2024 Consultations for India.

- For the first time, a tailored training was delivered to officials from India’s Central Board of Indirect Taxes and Customs (CBIC). A new course on Revenue Administration Gap Analysis (July 7-11, 2025) was delivered to CBIC’s officials, in collaboration with National Academy of Customs Indirect Taxes and Narcotics (NACIN)in Palasamudram, India. The course was country-tailored with use of Indian data and technical discussions specific to CBIC.

SARTTAC’s seminar series fostered peer-to-peer learning:

- A cross-regional webinar on cybersecurity in revenue systems was delivered.

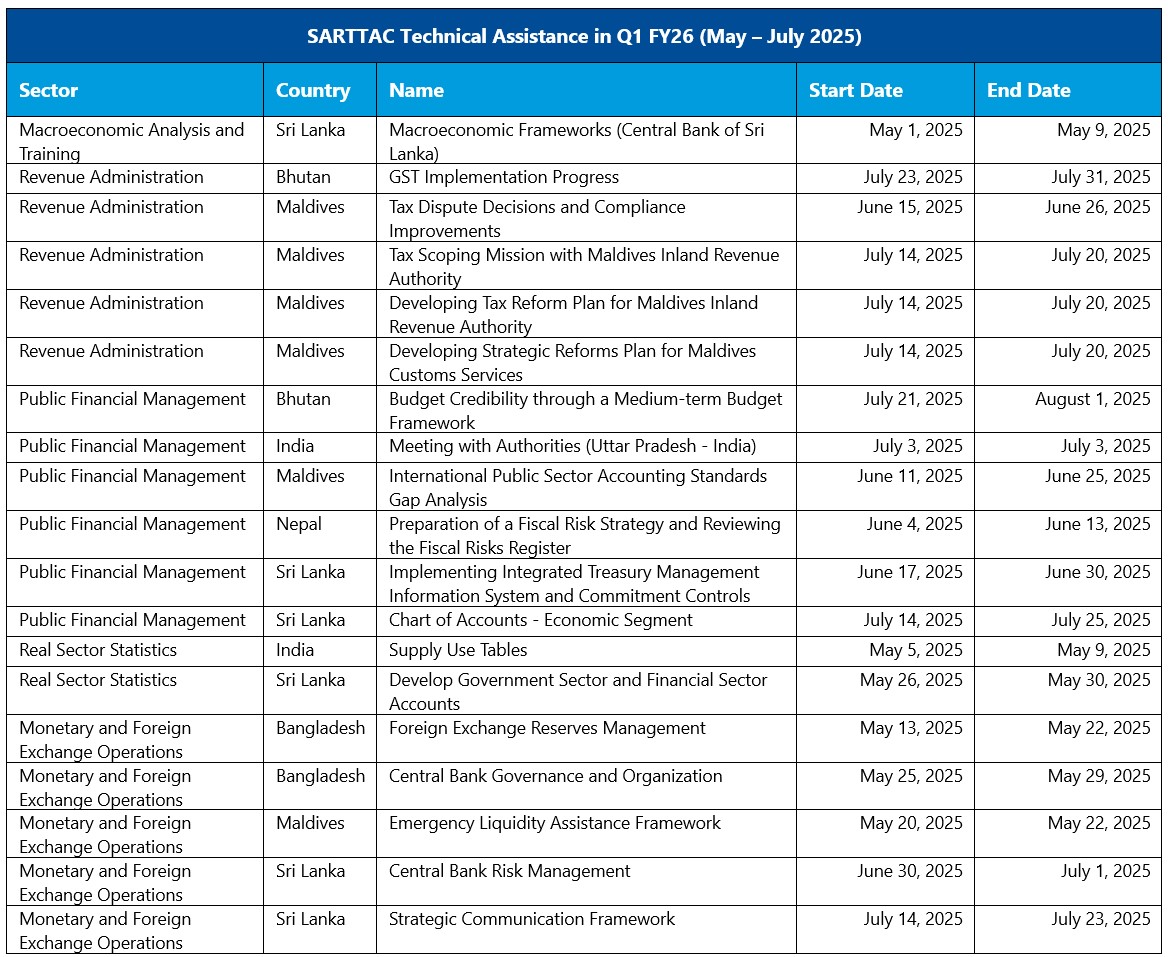

- Seminars on selected statistical issues - seasonal adjustment, compilation of business registers and use of tax and administrative data in national accounts - were delivered in the dedicated seminar series for the Ministry of Statistics and Programme Implementation (MOSPI) of India.

Seminars on selected statistical issues for MOSPI

Tailored TA supported SARTTAC member countries in the implementation of priority economic and financial reforms:

- In Bhutan, a TA mission on the Medium-Term Budget Framework (July 21–August 1, 2025) reviewed progress and identified next steps for enhancing budget credibility. During the mission, a workshop for officials from the Department of Planning, Budget and Performance focused on medium-term budget estimates and supporting a more policy-driven approach to budgeting, garnering synergies between training and technical assistance.

- In Bangladesh, a TA mission on Foreign Exchange Reserves Management—conducted virtually in April and in-person in Dhaka (May 13–23, 2025) - assisted the Bangladesh Bank (BB) in improving its reserves framework, asset allocation framework and allocation of tasks.

- In India, a TA mission on Supply and Use Tables (SUT) (May 5–9, 2025) supported MOSPI in developing benchmark 2022/23 SUTs, a key component of the ongoing GDP rebasing exercise.

- In Maldives, a TA mission on Tax Dispute Decisions and Compliance Improvements (June 15–26, 2025) supported the Maldives Inland Revenue Authority (MIRA) in improving their dispute resolution process, a reform priority.

SARTTAC’s training delivery was strong in the first quarter of FY26, with five tailored national training courses and two regional trainings courses. Tailored training to SARTTAC member countries on Macroeconomic Foundations was continued to respond to countries’ requests. SARTTAC’s trainings supported enhancing capacity in macroeconomic frameworks, revenue administration and statistical compilation:

- New tailored trainings were delivered to Indian officials. A new macroeconomic diagnostics course with focus on applied economic policy was delivered to IES officials. This complemented two consecutive and complementary trainings delivered to incoming Indian Economic Service (IES) officers – Macroeconomic Diagnostics (May 5-14, 2025) and Financial Programming and Policies (May 14-23, 2025). This provided participants with a comprehensive foundation in macroeconomic frameworks, sustainability of external debt, and macroeconomic vulnerabilities. Furthermore, a new dedicated training for officials of India’s CBIC on Revenue Administration Gap Analysis was delivered.

- A tailored national course on Macroeconomic Foundations was delivered in Sri Lanka, in collaboration with the CBSL’s Centre for Banking Studies. A tailored national training was delivered in Colombo to about 90 junior officers of the Central Bank of Sri Lanka (CBSL), Ministry of Finance, and the Department of Census and Statistics (July 7 – 15, 2025). The course covered macroeconomic diagnostics topics including macroeconomic framework, fiscal sustainability, and macro-financial linkages. CBSL officials also delivered lectures on recent economic developments and challenges, and monetary policy in Sri Lanka. Read More.

- A first-time regional training on Fintech Market Development and Policy Implications was delivered (July 14-18, 2025). It provided participants with comprehensive knowledge on fintech concepts, new financial technologies and associated policy issues including regulatory challenges.

- A regional training on Quarterly National Accounts statistics was delivered (June 23-27, 2025). The training emphasized practical challenges in quarterly gross domestic product (QGDP) compilation and provided a platform to strengthen technical capacity and exchange insights based on participant’s country experience on developing and compiling QGDP estimates. Officials from national statistics agencies and central banks in South Asia attended the course. Hands-on workshops complemented the lectures, equipping participants with practical skills and compilation tools while fostering interaction between compilers and data users across the region.

Quarterly National Accounts (QNA) Statistics

(June 23–27, 2025)

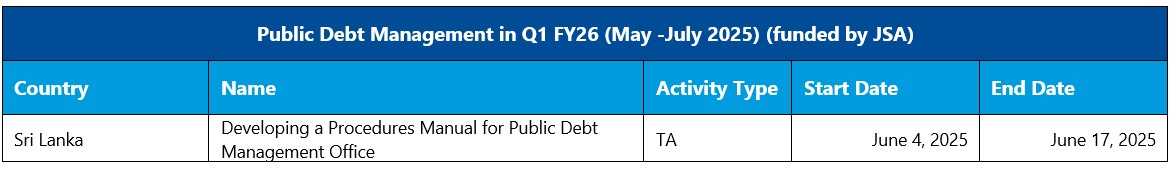

During the first quarter of FY26, SARTTAC delivered 20 TA missions, supporting all its member countries in advancing key economic and financial policies and reforms:

- In Bangladesh, two TA missions supported the BB in enhancing its foreign exchange reserves management framework (May 13–23, 2025) and in modernizing its governance and organizational structures, strengthening decision-making processes, strategic planning, and internal accountability (May 25–29, 2025).

- In Bhutan, two TA missions supported: i) the Planning, Budget, and Performance Department in advancing the development of a Medium-Term Budget Framework (July 21-August 1, 2025); ii) the Department of Revenue and Customs (DRC) in reviewing progress in implementing the Bhutan Integrated Tax System (BITS), the Goods and Services Tax (GST), new Income Tax Act (ITA) and Excise Tax Act (ETA) (July 23-31, 2025).

- In India, a TA mission (May 5-9, 2025) supported the MOSPI in developing benchmark 2022/23 SUTs to support the GDP rebasing exercise, including training on balancing current price SUTs and compiling volume-based SUTs and input-output tables. SARTTAC also met with senior representatives, including Mr. Deepak Kumar IAS, Additional Chief Secretary, Finance and Mr. Pandhari Yadav IAS, Principal Secretary, Finance, from the Indian state of Uttar Pradesh (July 3, 2025) to discuss potential Public Financial Management (PFM) capacity development support.

- In Maldives, five TA missions supported: i) Maldives Monetary Authority (MMA) in designing and implementing an Emergency Liquidity Assistance framework (May 20–22, 2025, virtual) and an in-person follow-up (June 15–23, 2025); ii) Ministry of Finance in updating the accrual based International Public Sector Accounting Standards (IPSAS) transition roadmap and preparing an associated capacity development plan (June 11–25, 2025); iii) Maldives Inland Revenue Authority (MIRA) in improving tax dispute resolution mechanisms (June 15–26, 2025); iv) A joint SARTTAC and the IMF Fiscal Affairs Department mission (July 14–20, 2025) reviewed MIRA’s implementation of previous CD recommendations and emerging CD priorities and met with the Maldives Customs Services (MCS) to assess progress and challenges in customs reform, institutional setup, and compliance risk management.

- In Nepal, a TA mission (June 4-13, 2025) supported the Ministry of Finance in producing a Fiscal Risk Statement (FRS) that identifies major fiscal risks and their likelihood, quantifies the risks where possible, and summarizes mitigation measures. Publication of FRS is a structural benchmark under Nepal’s Extended Credit Facility (ECF) program with the IMF.

- In Sri Lanka, seven TA missions were delivered, supporting: i) CBSL in developing its Forecasting and Policy Analysis System (May 1-9, 2025), enhancing strategic messaging and digital communication (July 14–23, 2025), and strengthening decision-making with a focus on risk management (June 30–July 1, 2025); ii) the Ministry of Finance in drafting a Standard Operating Procedures Manual for the new Public Debt Management Office (June 4–17, 2025), implementing the Integrated Treasury Management Information System (ITMIS) and Commitment Controls (June 17–30, 2025), and finalizing the economic segment of the revised chart of accounts to improve fiscal reporting (July 14-25, 2025); and iii) the Department of Census and Statistics in developing institutional sector accounts and improving expenditure-based GDP estimates (May 26–30, 2025). Read More.

Customizing Training for India

A new macroeconomic diagnostics course with focus on applied economic policy was delivered to IES officials at SARTTAC (June 30-July 4). The course program was designed in collaboration with the MOF and focused on macroeconomic frameworks, assessing monetary and fiscal policy stance, fiscal sustainability and macro-financial linkages. Other key policy issues such as the goods and service tax, public debt management, fiscal risks and challenges with compiling statistical data were also covered. The course emphasized practical tools for use in day-to-day macroeconomic analysis and relating it with Indian data. Relevant case studies were used to demonstrate the application of these tools to contribute to the policymaking process. Furthermore, this was the first course in which all SARTTAC Resident Advisors from the different Capacity Development Departments (the IMF Institute for Capacity Development, the Fiscal Affairs Department, the Monetary and Capital Markets Department and the Statistics Department) delivered lectures.

Applied Economic Policy for Indian Economic Service Officers

(June 30- July 4, 2025)

For the first time SARTTAC delivered a customized course to officials of the Central Board of Indirect Taxes and Customs (CBIC). The first course on Revenue Administration Gap Analysis (July 7-11, 2025) was delivered to officials of the CBIC at NACIN in Palasamudram, India. The course focused on: (i) Value Added Tax (VAT) Tax Gap Estimation (TGE) methods; (ii) international good practices; (iii) practical exercise of RA-GAP top-down model for VAT; (iv) strategies for building capacity in tax gap estimation; and (v) integration of TGE with compliance risk management (CRM). The course delivery was country-tailored with use of Indian data and technical discussions specific to CBIC.

Revenue Administration Gap Analysis (July 7-11, 2025)

A first-time regional training on Fintech Market Development and Policy Implications (FINTECH) was held at SARTTAC (July 14-18, 2025) to respond to members’ emerging demand. The course provided participants with comprehensive knowledge on fintech concepts, new financial technologies and associated policy issues including regulatory challenges. The course material focused primarily on fintech payments, fintech funding, cryptocurrencies and decentralized finance, and risks and concerns arising from developments in these areas, including financial stability and financial inclusion. The program featured lectures, workshops, and group presentations, engaging participants from South Asian countries, mainly central bank officials, with a focus on enhancing their regulatory and policy-making capabilities in fintech.

Participants were actively engaged, both during the lectures and case studies, reflecting on the variety of country experiences and the range of strategic choices adopted to date. The participants’ group presentations on a specific fintech product or service led to animated discussions and proved to be a fruitful learning experience for the participants given the diverse set of cases chosen (i.e., PhonePe (Payment App in India), Camsfinserv (Account Aggregator in India) and Razorpay (Payment Gateway and e-Payment Service Provider in India).

Classroom Training on Fintech Market Development and Policy Implications

(July 14-18, 2025)

During the first quarter of FY26, SARTTAC provided extensive technical assistance to Sri Lanka with seven TA missions to Central Bank of Sri Lanka (CBSL), Ministry of Finance (MoF) and the Department of Census and Statistics:

Engagement with the Central Bank of Sri Lanka

A Macroeconomic Frameworks TA mission (May 1-9, 2025) offered technical support and training to CBSL’s modeling and forecasting team and assisted in making further enhancement of CBSL’s Forecasting and Policy Analysis System (FPAS) and monetary policy communication strategies. A Central Bank Risk Management workshop (June 30-July 1, 2025) was delivered jointly with the IMF Monetary and Capital Markets Department and the IMF Legal Department. The workshop addressed CBSL Board members and Senior Management and aimed at strengthening CBSL’s decision-making with a focus on risk management. Additionally, a Strategic Communication Framework (July 14-23, 2025) mission supported improvements in CBSL’s strategic messaging and digital communication effectiveness with various stakeholders through training, recommendations, and reviewing progress on prior strategic communication initiatives.

Engagement with the Department of Census and Statistics (DCS)

A mission (May 26-30, 2025) assisted the Department of Census and Statistics (DCS) in developing institutional sector accounts (ISAs) and improving estimates of expenditure-based GDP (GDP-E). Experimental ISAs up to capital account (net lending/borrowing) were compiled during the mission.

Engagement with the Ministry of Finance (MoF)

Technical support was extended to the Public Debt Management Office (PDMO), MoF in Developing a Standard Operating Procedures Manual (SOPM) for debt management operations from June 4–17, 2025. This mission was funded by the Japan Administered Account for Selected IMF Activities (JSA).

Furthermore, a mission on Implementing Integrated Treasury Management Information System (ITMIS) and Commitment Controls (June 17-30, 2025) focused on addressing limitations in the ITMIS related to commitment controls and arrears management to improve budget execution in Sri Lanka. It identified necessary system enhancements and recommended strict timelines for implementing compulsory recording of purchase orders and invoices to strengthen financial controls. Furthermore, the Chart of Accounts - Economic Segment (July 14-25, 2025) mission assisted Sri Lanka’s Department of State Accounts in finalizing the economic segment of the revised government chart of accounts (CoA) to enhance fiscal reporting and budgeting practices in line with international standards. This technical assistance is part of ongoing efforts to improve government accounting and reporting for the 2026 budget cycle.

Otar Gorgodze joined SARTTAC as the Financial Sector Regulation and Supervision Resident Advisor in July 2025. He has extensive experience in the financial sector and change management, and has held pivotal roles in enhancing banking supervision and the regulatory approach to financial technology. Previously in IMF, he served as a long-term expert on supervisory practices in banking and microfinance supervision in Rwanda. His career at the National Bank of Georgia is distinguished by his leadership in implementing an agile risk-based supervisory approach, fostering an open regulatory environment for new technologies, integrating microprudential and macroprudential oversight, strengthening bank recovery planning and crisis management. Prior to his work in financial supervision, he held various positions at the central bank and led interbank and FX market reforms. He has also worked in the private banking sector as a credit officer and equity strategist. He holds CFA and FRM designations.

More articles from the same issue

A Focus on Technical Assistance

- Customizing Training for India

- Regional Training on Fintech Market Development and Policy Implications

- Sri Lanka: Strong Technical Assistance Engagement

- Staff Announcement

- Summary of Operations in Q1 FY26

- Training and Webinars

- Technical Assistance

- Activities under the Public Debt Management Program funded by the Japan

- Technical Assistance Reports Disseminated on Partners Connect during FY26 Q1

- SARTTAC Website

- Staff Members

- Follow @IMFSARTTAC on Facebook

- Follow @IMF-SARTTAC on LinkedIn

- Follow @SARTTAC on X

Previous Issues <