SARTTAC’s Fifth Annual Steering Committee (SC) Meeting, held virtually on July 7, was joined by around 85 participants, including most SC representatives from member country central banks and ministries of finance, development partners, and the IMF. The meeting focused on SARTTAC’s operations and activities during FY21 (i.e. May 2020 – April 2021), including the effectiveness of virtual delivery, and laid out a workplan for FY22 for the SC’s endorsement. That workplan now envisages a pick up in the number of activities and overall resource usage (i.e. field person weeks) by 34 and 22 percent, respectively, in FY22.

The SC was apprised of growth in global demand for capacity development (CD) during FY21, macroeconomic developments in South Asia and IMF country work in the region, and progress in implementing the Fund’s Capacity Development Management and Administration Program (CDMAP), including its significance for external partners in CD. Perspectives from the Asia and Pacific Department (mission chief and resident representative) on making CD more effective in the region were also shared, with emphasis placed on the need for providers to align with national reform plans and for recipients to take clear ownership throughout the process to ensure timely and impactful results.

The members of the SC commended SARTTAC for the work accomplished during FY21 despite the challenges posed by the pandemic. They stressed the importance of broader engagement with public sector entities in member countries and welcomed CD support on emerging issues such as gender, climate change, digitalization, and cybersecurity. Initiatives were acknowledged aimed at making virtual delivery more effective and aligning CD activities better with partner priorities, notably through greater use of cohort training centered around agencies’ own learning and development programs. In light of still challenging conditions for delivery of remote technical assistance, a mid-year update of SARTTAC’s workplan is expected to be prepared by November 2021 for the SC’s endorsement.

The meeting was preceded by a SARTTAC Training Directors Meeting on July 1, which for the first time brought together officials from the six SARTTAC member countries to discuss training needs and effectiveness—also with a focus on virtual delivery. The meeting itself was informed by a survey sent to training directors and course participants. The results of that survey indicated broad satisfaction in the content and administration of training by SARTTAC, but also signaled a clear preference for a return to face-to-face delivery as early as possible. The SC itself was apprised of the training directors meeting and survey, recognizing the need to transition to hybrid delivery to increase training effectiveness and improve the learning experience.

Despite on-the-ground challenges posed by the second wave of the COVID-19 pandemic that affected much of South Asia in the first quarter of FY22, SARTTAC, in close collaboration with member countries, undertook a number of TA missions and regional (three) and national (four) training courses, along with selected webinars . Amongst the regional courses was a well-received first-time offering on high frequency indicators and the monthly index of economic growth, with support from IMF Statistics Department and Data for Decision (D4D) Fund . Since May 1, 2021, 14 TA reports have been disseminated on SARTTAC’s secured website. TOP ^

SARTTAC Training Directors Meeting—Needs and Effectiveness in the Virtual Environment

SARTTAC held its first Training Directors Meeting on July 1, with more than 40 senior officials charged with training management and administration at ministries of finance, central banks, and statistical agencies joining virtually from the six member countries. The meeting featured a lively roundtable discussion in which training directors commented on virtual delivery, learning challenges, and their training priorities. It was anchored by a pre-meeting online survey from SARTTAC seeking feedback from training administrators and participants on the effectiveness of the remote learning and ways to improve the administration and delivery of training programs. The survey touched on the relevance and usefulness of training by SARTTAC to agencies’ mission and development needs. Around two-fifths of the respondents were from India, with the rest from the five other member countries.

The consensus from both the training directors meeting and online survey was a high level of satisfaction, in particular the relevance of courses, topics, and lectures offered at SARTTAC, including training courses in FY22. Respondents appreciated the knowledge and engagement of faculty and valued the enlightening discussions around lectures and in hands-on workshops. They commended the quality of training materials and integration of online learning videos in the course structure as an effective method of course delivery and learning.

Other main observations from the meeting and survey are as follows:

- Three-hour remote training days are seen as the best duration, but are no substitute for in-person delivery. Longer training days were seen as a drawback, taking participating staff away from official duties, even if the expectation by SARTTAC is that they should be relieved of such during a course or workshop. Still, the feedback received found the combination of a three-hour training day in the virtual environment with official work and outside study to be very taxing, especially when done over a two-week period (the typical length of SARTTAC macroeconomic training). However, a shorter training day (compared to face-to face delivery) gave less time for workshops (complementing lectures) and explanation of more difficult concepts, which were valued, along with group discussions and peer-to-peer exchanges.

- Connectivity and/or IT equipment is not a major constraint for remote training. However, a quarter of the respondents to the survey indicated it as a challenge as far as joining training from home. During the training directors meeting, discussions were more nuanced, with some value seen in providing alternative arrangements, such as connecting from a third (local) location with good IT infrastructure. For SARTTAC, the challenge is also one of aligning training times with lecturers’ availability. With many faculty joining from North America, afternoons in South Asia are generally a better option for the training period. However, SARTTAC has asked that all daily training end by 6:30 p.m. Indian Standard Time (IST) to better ensure that participants can access IT equipment from the office (rather than from home). That said, COVID-19 lockdowns in member countries have forced some home receipt of training, including at times with participants joining from mobile devices.

- Administration of virtual training is broadly satisfying. The timing and content of training notifications were seen by survey respondents as informative enough to allow agencies to nominate qualified candidates. A minimum of two months of advanced notification of training was agreed by most as ideal, as was one month’s notice on informing candidates of their acceptance to a course. Respondents generally supported two-weeks’ time to receive course materials, but some favored receiving it earlier if the selection procedure itself is completed earlier. During the training directors meeting, SARTTAC was also encouraged to rationalize its notification system to ensure relevant agency contacts received notifications in order to reduce the need for repeated follow up.

- Nomination of candidates for training is in keeping with good norms. Respondents to the survey indicated criteria for nominating candidates centered around a needs perspective, with supervisors endorsing candidates based on their suitability for a particular course, ensuring participation enhanced the nominated official’s skills in their current job or helped prepare them for the next one, thereby building a strong cohort and institutional capacity.

During the training directors meeting, SARTTAC emphasized that while direct virtual engagement might be limited to several hours per training day, participants often were asked to complete offline individual or group activities as part of the training, so ideally official work would be limited—similar to the environment for face-to-face training. At the meeting, some officials suggested stretching out the duration of the standard course delivery period to better balance training and work, especially in times when the pandemic itself made work assignments and flows less predictable.

Regarding specific areas for future training, attending agencies noted a range of topics and activities. Training around financial stability issues, bank supervision and examination, and anti-money laundering/combatting terrorist financing (AML/CFT) issues were mentioned by several in attendance, along with central bank internal audit and controls and foreign exchange (FX) reserves management and FX regulation. In statistical areas, big data analytics and trade statistics were a few topics noted. On fiscal matter, training interest was expressed in the value-added tax (VAT) gap model developed by the IMF. In emerging areas of capacity development (CD), climate bonds taxonomy and data norms were noted. Similar requests for training were expressed in SARTTAC’s fifth annual Steering Committee meeting on July 7.

Finally, meeting participants shared views on how SARTTAC could better leverage its regional presence. Suggestions for possible future engagement included becoming a knowledge-sharing hub (e.g. for central banks), supporting more direct work on conducting economic research, and providing training to business journalists. All will be taken into consideration, with SARTTAC looking forward to future gatherings of training directors as stalwarts and partners in meeting the CD needs of South Asia.

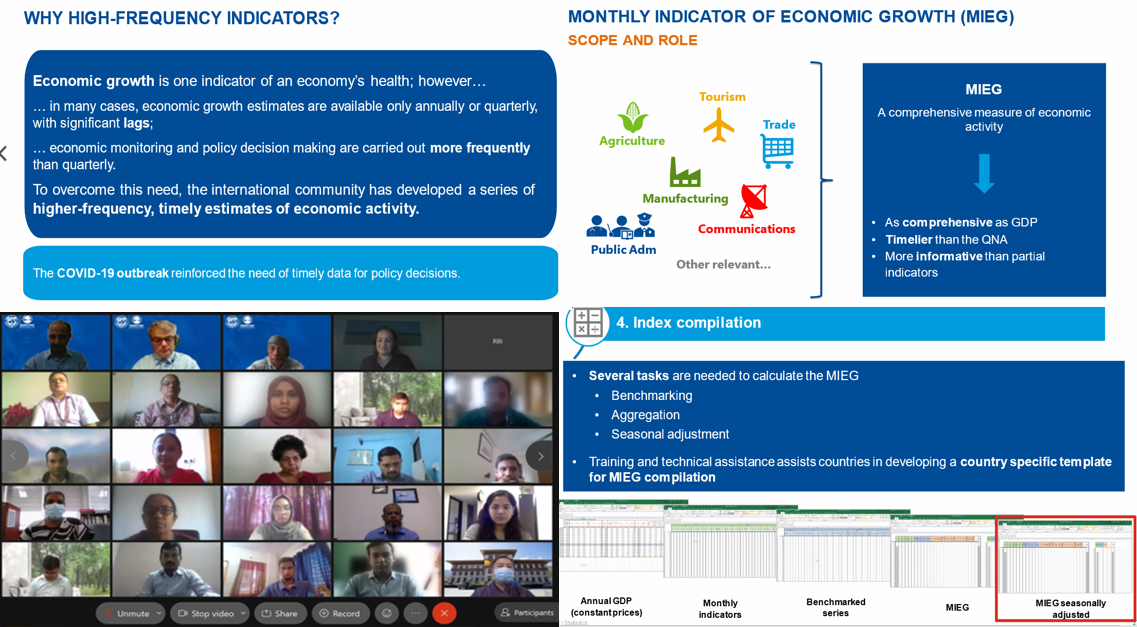

First-Time Training on High Frequency Indicators and the Monthly Index of Economic Growth

SARTTAC, in collaboration with the IMF Statistics Department (STA) and through additional support from the Data for Decision Fund (D4D) , delivered a first-time regional course in mid-July 2021 on high frequency indicators (HFI) and their use in compiling indices of economic activity (IEA). Leading the activity were Rodger Sceviour, Real Sector Statistics Advisor in SARTTAC, and Margarida Martins, Senior Economist, STA Real Sector Division. They were joined by Mr. Roger Jullion, expert for STA and formerly Director of the Income and Expenditure Accounts Division at Statistics Canada.

The course, which was joined by around 60 officials from SARTTAC’s six member countries, provided participants with lectures and exercises on preferred techniques and best practices for compiling IEAs—either Quarterly Gross Domestic Product (QGDP) or a Monthly Index of Economic Growth (MIEG). Amongst the national accounts program of statistical agencies in the member countries, a broad range of timeliness and frequency of compilation is exhibited, with some countries having a QGDP program that is sufficiently timely, while others only have an annual program.

Given recent economic volatility, demand exists for more timely and frequent measures of economic activity from users, including ministries of finance and central banks. SARTTAC itself has received requests for technical assistance (TA) from both statistical agencies and central banks to develop these statistics. In these circumstances, a good first step was seen as providing regional training on this subject matter. The course was therefore designed to enable compilers to develop a QGDP or MIEG program using sub-annual high frequency data. As the methods are similar for constructing QGDP and a MIEG, the course covered the compilation of both indices. In this manner, all SARTTAC countries could benefit, rather than those only interested in a specific IEA.

Participants broadly welcomed content of the training in light of the need for higher frequency indicators, but sought more hands-on experience to digest the material. Looking ahead, the course material is expected to feature in future TA engagement by SARTTAC. For Bangladesh Bureau of Statistics and the National Bureau of Statistics of Bhutan, it is already relevant to their compilation of QGDP. Alternatively, it can be used by any member country to develop a MIEG, with SARTTAC currently providing TA to the Royal Monetary Authority of Bhutan and the National Bureau of Statistics of Maldives in this area.

Technical Assistance: May - July 2021

BANGLADESH

Government Finance Statistics: A mission (May 30- June 3) assisted the Ministry of Finance in advancing improvements in Government Finance Statistics /Public Sector Debt Statistics (GFS/ PSDS) quality, coverage, and timeliness. The mission assisted the authorities in finalizing GFS for 2016/17 – 2018/19 and compiling GFS for 2019/20. Additionally, it assessed the work done on recommendations from previous missions.

BHUTAN

Public Financial Management: A mission (July 19-23) supported the transition from using a Chart of Accounts (CoA structure aligned with Government Finance Statistics Manual (GFSM) 1986 to a unified CoA structure, which is aligned with the GFSM 2014. The mission, which will be part of a series in FY22, was preceded a national workshop on modernizing the CoA.

Government Finance Statistics: In continuation of earlier SARTTAC missions to support the adoption of GFSM 2014 framework in Bhutan, a mission was delivered virtually (July 27-August 3). It provided assistance on issues related to extending and refining GFS for budgetary central government and identified areas of improvement which are necessary for aligning data with GFS guidelines.

MALDIVES

Public Financial Management: Two missions were delivered to Maldives. The first focused on the fiscal risks posed by state-owned enterprises (SOEs) (June 28-August 10), and providing tools and guidance to help strengthen SOE reporting practices for better monitoring and management of risks. The second mission (July 12-August 27) is supporting the implementation of a SOE health check tool developed by IMF. The tool will help in monitoring the financial performance of SOEs. Technical feedback on how to interpret the results obtained from the tool is also being provided. Both activities were preceded by a national workshop on SOE governance, reporting, and risk management (see section on Training).

Real Sector Statistics: Two missions assisted the National Bureau of Statistics (NBS) in improving the quality of statistics. The first mission (May 2-6) focused on improving the construction materials price index and preparing plans to develop a producer price index for construction. The second mission (June 1-14) assisted the NBS in updating the supply use tables (SUT), which will feature in an upcoming GDP-rebasing exercise.

SRI LANKA

Monetary Policy and Foreign Exchange Market Operations: At the request of the Central Bank of Sri Lanka (CBSL), SARTTAC delivered a mission (June 6-July 2) to support the ongoing modernization of its monetary policy framework. Focus was on strengthening monetary policy implementation and providing guidance to the CBSL on how to ensure the desired monetary policy stance, i.e. the level of the policy interest rates is effectively transmitted.

IMF Departments: FAD (Fiscal Affairs), MCM (Monetary and Capital Markets), STA (Statistics)

SARTTAC Funding Programs: GFS (Government Finance Statistics), PFM (Public Financial Management), RA (Revenue Administration), and RSS (Real Sector Statistics)

Access SARTTAC TA Reports on secured website (Requires Login Credentials)

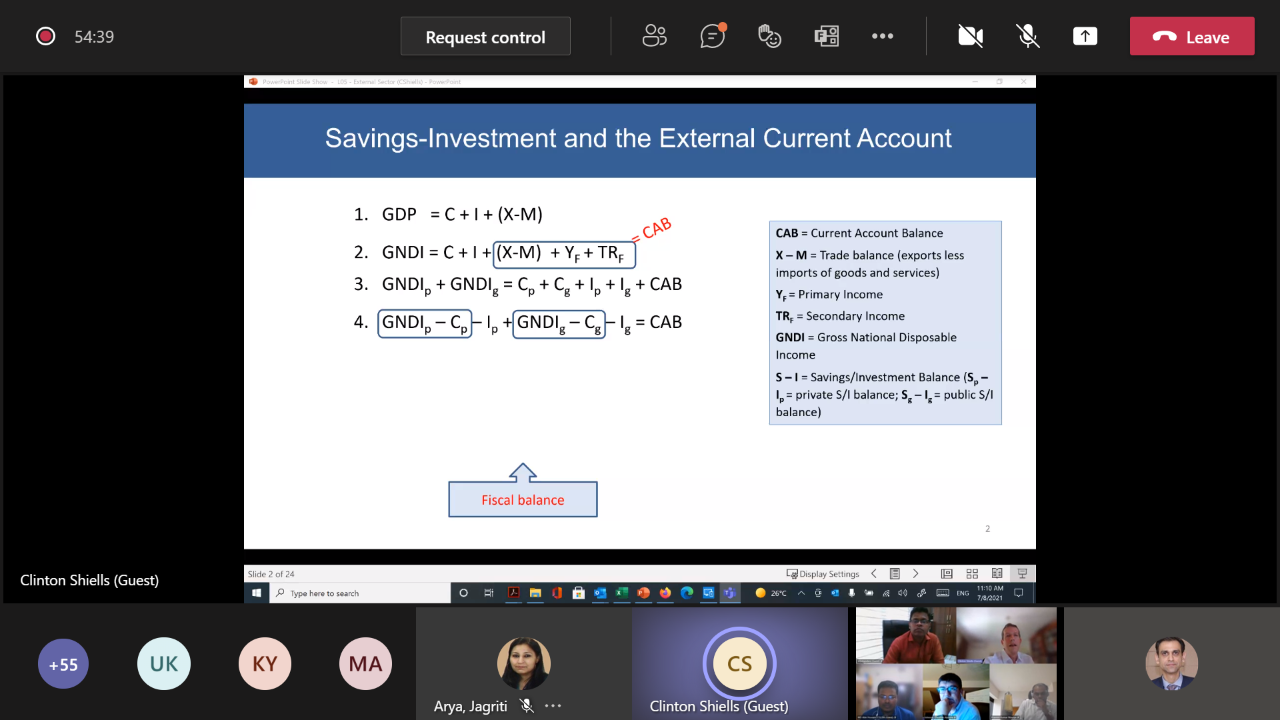

Macroeconomic Analysis and Training: A Financial Programming and Policies course was delivered virtually (July 5-16). It introduced participants to a macroeconomic framework to diagnose imbalances and correct them through a coordinated set of adjustment policies. The case studies, which focused on India, also took into consideration the impact of COVID-19 pandemic on the economy and the policies available to mitigate its impact.

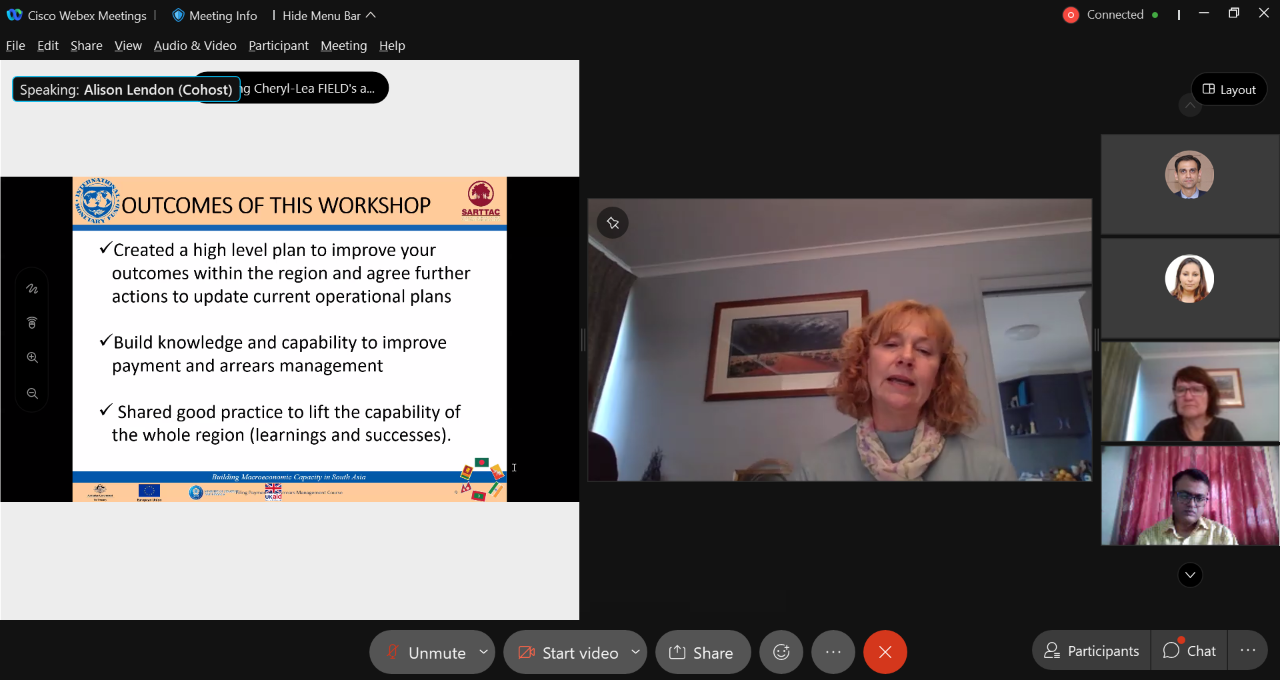

Revenue Administration: A course on Collections and Arrears Management (July 12-16) provided officials a good understanding of both the theoretical concepts behind managing payment risks and the practical application of those concepts. The course also provided hands on guidance in the use of tools and techniques which are relevant due to the impact COVID-19 on revenue collection in the SARTTAC region.

Real Sector Statistics: A course on High Frequency Indicators and the Monthly Index of Economic Growth was delivered (July 12-16). For more details on the course, see HFI training in features section.

NATIONAL TRAINING

Revenue Administration: A course on Risk-Based Audit and Investigation Techniques (May 17-21) was delivered to officials from India’s Central Board of Direct Taxes. It covered areas ranging from the components of audit risk to audit procedures and practical issues such as the management of audit working papers, and also specifically addressed the new faceless assessment practices implemented in India.

Public Financial Management: A workshop delivered to officials in Bhutan focused on the government’s Chart of Accounts’ (CoA) Modernization (May 17-21) and explanations of CoA concepts, including the purpose and utility of the segments in an integrated structure. The workshop also provided participants exposure to the CoA structure in the Government Finance Statistics Manual 2014 framework. Another workshop was provided to officials from ministries and organizations involved in managing State-Owned Enterprises (SOEs) in Maldives to help strengthen SOE Governance, Reporting and Transparency, and risk monitoring and management (July 5-7). Finally, a workshop was conducted for officials from India’s Office of the Comptroller and Auditor General (CAG) on Fiscal Risk Management (July 27-Aug 2). Both national and state-based officials participated in the workshop. It provided an overview of the types fiscal risks, including those created by the impact of COVID-19 pandemic, tools developed by the IMF for assessing them, standards for their disclosure, and the lessons from the IMF's fiscal transparency evaluations. A webinar for wider audience in the CAG preceded the training (July 26), providing an overview of the main concepts and tools associated with fiscal risk analysis and management.

REGIONAL WEBINARS

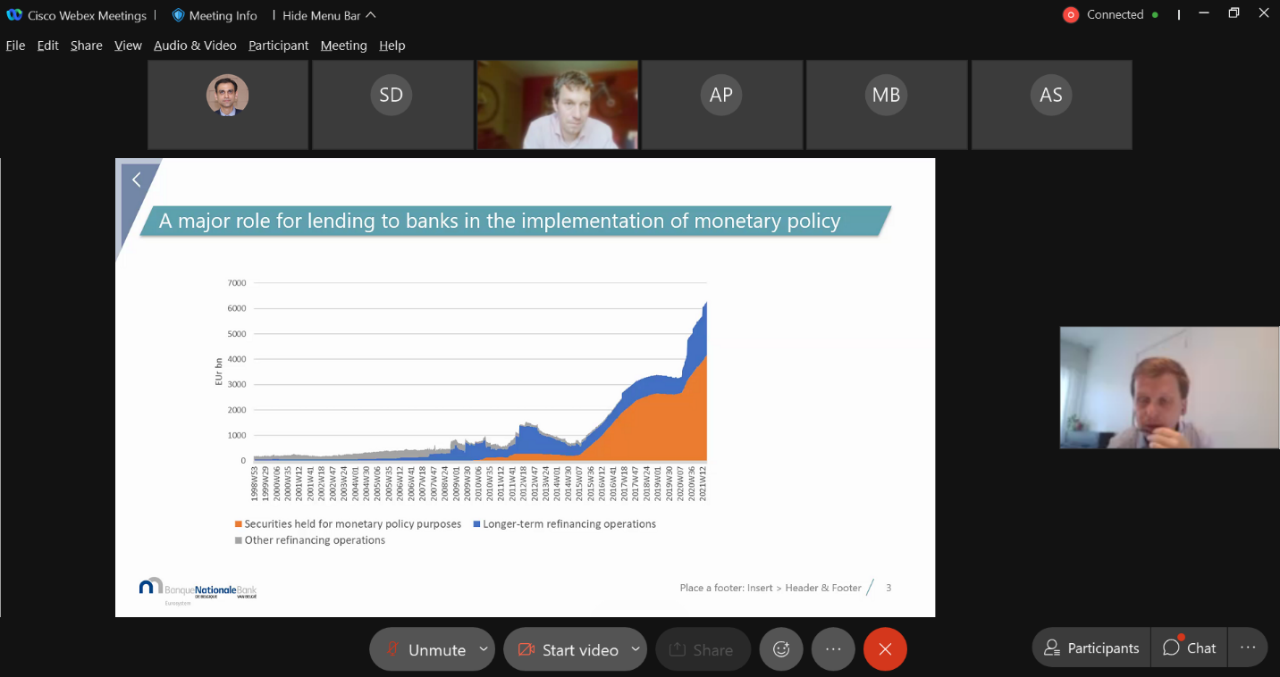

Monetary Policy and Foreign Exchange Market Operations: A webinar on the design and experience of Longer-Term Refinancing Operations in the Euro-system was presented to official from the region (July 29). Relevance of the topic has been enhanced during the COVID-19 pandemic, as many central banks have relied on this instrument to ease stress in funding markets. It was the first webinar in a series in FY22, which will focus on challenges associated with monetary operations in the SARTTAC region.

NATIONAL WEBINARS

Financial Sector Regulation and Supervision: Two webinars were delivered to officials from Nepal Rastra Bank on supervisory issues in the context of the COVID-19 pandemic, along with the IMF Monetary and Capital Markets and Asia and Pacific Departments (July 6). Additionally, as part of specialized training program for senior supervisors organized by College of Supervisors of the Reserve Bank of India, SARTTAC advisor delivered presentations on the Basel II framework’s Pillar 2 - Supervisory Review Process (June 24 and July 15).

More articles from the same issue

FEATURES

- SARTTAC Training Directors Meeting—Needs and Effectiveness in the Virtual Environment

- First-Time Training on High Frequency Indicators and the Monthly Index of Economic Growth

RECENT and UPCOMING ACTIVITIES

SARTTAC at a GLANCE

Previous Issues <