The first half of FY22 (May 1-October 31, 2021) saw the IMF South Asia Regional Training and Technical Assistance Center (SARTTAC) adhere largely to the annual workplan endorsed by its Steering Committee in July 2021—notably on regional and national training. In all, 25 training events (courses, workshops, and webinars) took place in FY22 H1, representing nearly 95 percent of planned training activities. Focusing on the second quarter, this training included several workshops covering emerging areas of surveillance and capacity development at the IMF. Regional workshops were held on Ministries of Finance's Role in Addressing Climate Change in October 2021, and on Digitalization in Public Financial Management (PFM) Service Delivery in September 2021, as detailed in a later section. In addition, a set of webinars was held on cybersecurity risks with the Reserve Bank of India, also joined by the Securities and Exchange Board of India.

Technical assistance (TA) delivery continued to lag behind expectations, hampered by a willingness of member countries to accept virtual engagement and/or a lack of follow through by selected agencies in moving work forward. Notwithstanding these challenges, SARTTAC tried to adapt to agency’s needs as best as possible, including doing an offsite remote TA mission in Bangladesh on the quarterly GDP program, thus allowing officials better connectivity and uninterrupted time in receiving this support. Overall, around 47 percent of planned TA activities moved forward in FY22 H1. Despite challenges to remote TA delivery, work in PFM and statistical areas (real sector and government finance statistics) proceeded better than in other areas, while India (namely PFM TA in the state of Odisha) and Maldives fared better than other countries in undertaking planned TA.

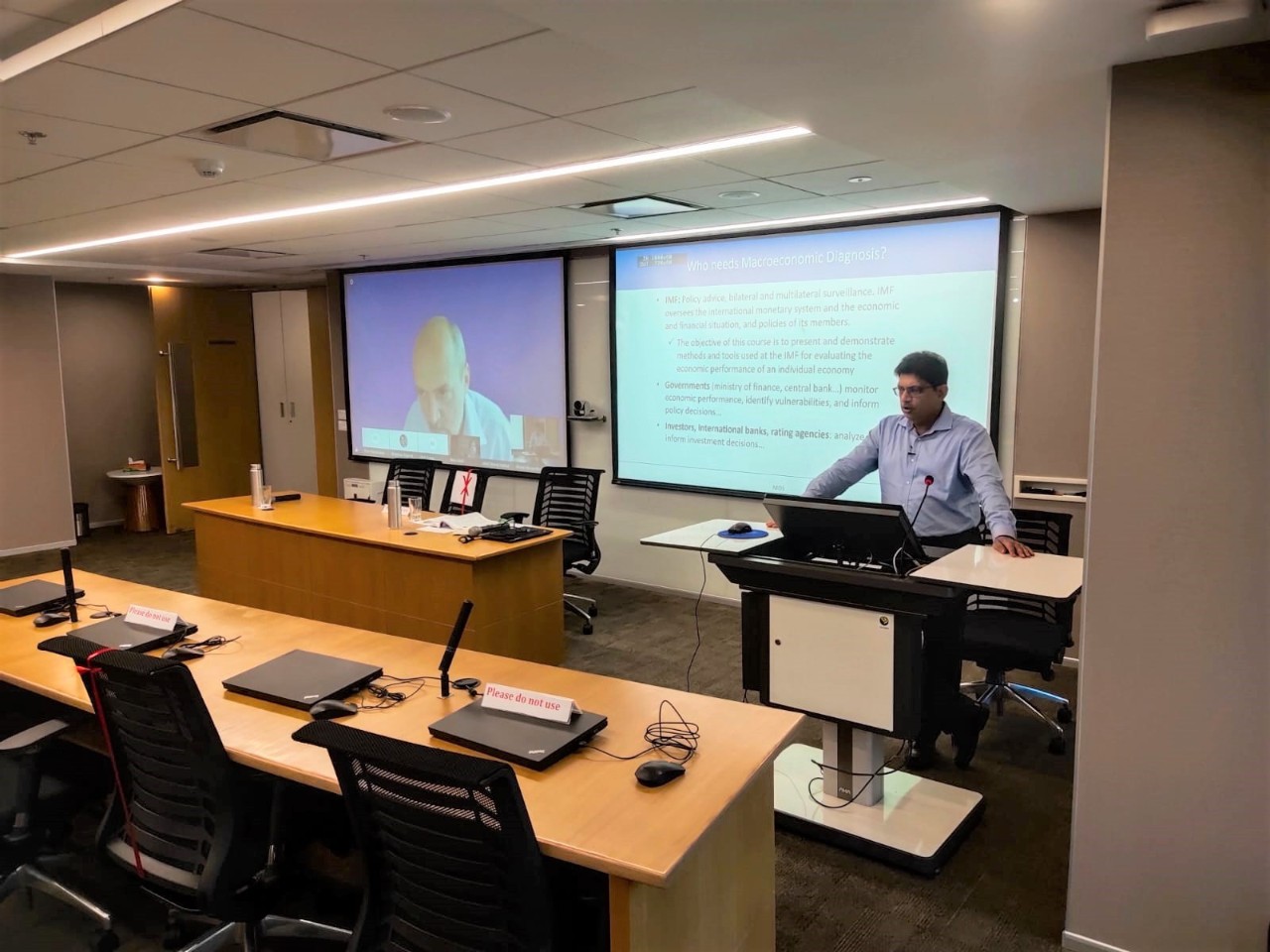

Looking ahead, the resumption of travel and delivery of in-person TA and training will continue to follow IMF headquarters guidance. In the case of SARTTAC, modest steps are being taken towards hybrid delivery, particularly with reference to an offsite TA mission in Bangladesh and a regional course on macroeconomic diagnostics in September 2021 Further updates will be provided at a mid-year Steering Committee Meeting planned in early January 2022, including proposed revisions to SARTTAC’s annual workplan. In the meantime, some reflections are provided below on adaptations that have been made in remote training delivery—some of which will be used to inform the move to hybrid engagement.

Workshop on Digitalization and Public Financial Management

A five-day virtual workshop on Digitalization and Public Financial Management (PFM), organized by the IMF South Asia Regional Training and Technical Assistance Center (SARTTAC) and Capacity Development Office in Thailand (CDOT), was held during September 20-24, 2021. A first of its kind for SARTTAC, the workshop was joined by more than 125 officials from 14 South and Southeast Asia countries, namely from ministries of finance. Below, Ankit Singh, Economic Analyst in SARTTAC, discusses with Raju Sharan, PFM Advisor in SARTTAC, the significance and takeaways of the workshop for the region.

Ankit: What was the aim of the workshop?

Raju: The workshop had three overarching objectives:

- Taking stock of the progress achieved by countries in the region in the digitalization of their PFM systems.

- Exploring the potential offered by emerging technologies elsewhere and identify strategic issues and choices, as countries move further along in their digitalization efforts; and

- Sensitizing participants to results achieved–i.e., what digitalization of PFM can concretely achieve.

The sessions were led by experts and practitioners, coming from both the public and private sectors, including regional officials from Bangladesh, Cambodia, India, and Indonesia, as well as other officials from Europe and other SARTTAC development partners (Australia, Korea, and the United Kingdom) and from the Organisation for Economic Co-operation and Development (OECD) and World Bank. Each session was extremely interactive, with evaluations done by participants at the end of the training suggesting that the issues and discussions resonated with them.

Ankit: What is digitalization of PFM and how has it evolved in recent years?

Raju: Digitalization of PFM refers to the integration of digital technologies into entire spectrum of PFM systems and processes—e.g. budget management and execution, financial reporting, and debt management. Over the years, but more so recently, digitalization has contributed to strengthening the PFM function. Electronic receipts and payments have facilitated payments to and by governments. Electronic Fund Transfers (EFT) has ensured regular and timely settlement with the intended beneficiaries. Digitalization has also improved accounting and reporting on the use of public funds while strengthening accountability itself.

Governments are now looking to leverage technological innovations to transform the delivery of public services. The COVID-19 pandemic provided further motivation to accelerate the pace of digitalization. All around the world, several innovative tools and modes of service delivery have driven this acceleration, and many more are in progress. Ambitious plans, however, need to be matched with coherent strategies to enable countries to prioritize investments in digitalization and to optimize benefits—a focus of this workshop.

Ankit: How can digitalization of PFM benefit governments and citizens?

Raju: For governments, digitalization of PFM functions and processes have enhanced efficiency and contributed to improved service delivery. Apart from advantages accruing from electronic receipts and payments, deeper integration with the banking system leads to quicker reconciliation between fiscal transactions, more effective cash management, and accelerated financial inclusion. Integration of information and communication technology (ICT) into PFM systems has also resulted in considerable savings.

Citizens, too, have benefitted enormously; electronic payments/transfers have resulted in saving of time and money, with some reduction in rent-seeking behavior too, as the need for personal interaction has been reduced. Digitalization of procurement systems and processes has contributed to standardization and helped level the playing field, increase transparency, and economize on expenditure, resulting in superior outcomes in the use of public resources while reducing corruption.

In addition, increased digitalization is bringing about a marked improvement of various functional processes such as macroeconomic forecasting, budget preparation and execution, and accounting and reporting, allowing a richer and quicker analysis of available data and thereby facilitating more effective performance management of government programs.

Going forward, use of emerging technologies in PFM such as mobile money, block chain technology, data science, and machine learning will yield rich dividends in terms planning, delivery, and reporting on government services.

Ankit: What were the key takeaways from the workshop?

Raju: Some key messages that emerged from the workshop were:

- Digitalization is no longer an option but a necessity if governments are to maintain their credibility on delivering services to citizens.

- Efforts need to be driven by a longer-term vision and a well-coordinated strategy that cuts across government ministries and organizations and adopts a citizen-centric approach.

- Governments should look to adopt a flexible, agile, and modular approach to digitalizing PFM, accompanied by suitable business process improvements. The preferred approach requires an iterative solution backed up with sustained investments (of smaller amounts) over a longer period. An agile funding approach promotes and supports innovation.

- The adoption of new technology-driven PFM solutions requires a sound financial management information system (FMIS) and good data governance, as well as motivated and dedicated multi-disciplinary teams with an appropriate blend of skills and experience.

- Finally, effective risk management must be an integral part of the digitalization strategy.

Ankit: What is the status of digitalization in South Asia? Are there any early success stories of digitalization in the region and what are the main challenges going forward?

Raju: All SARTTAC member countries have favored a transition to digitalization. However, the pace of change has been uneven, depending upon maturity of existing systems and practices, capacity to implement changes, and also the capacity to absorb new knowledge, processes, and technologies. Nonetheless, the enthusiasm to embrace change is evident, and we at SARTTAC are keen to partner with member countries as they pursue their reform agendas, which place a huge emphasis on accelerating digitalization of PFM systems and processes.

Digitalization is no longer an option but a necessity if governments are to maintain their credibility in delivering services to citizens. Countries are keen to build on the momentum created by the PFM digitalization process, but to realize these ambitions, they now need to develop a coherent strategic framework to enable them to prioritize investments in digitalization and to optimize benefits. Transition to digitalized PFM will also require a supportive political environment and new and increased capacities, as well as, crucially, a change in institutional models and traditions, including more inter-departmental and inter-agency cooperation.

Ankit: How might the topics of the workshop translate into future technical assistance to SARTTAC member countries?

Raju: Our initial efforts would be directed at organizing webinars on some select topics to build capacity. Topical areas include enhancement of cyber security and use of emerging technologies. This approach would then hopefully lead us to offer technical assistance to countries as they gain confidence to take the next steps to leverage technologies to strengthen PFM practices and solutions. Addressing cybersecurity issues, for example, will necessitate a layered defense mechanism, including raising the awareness of officials, leveraging advancements in technology, and strengthening processes. Again, SARTTAC stands ready to support.

Reflections on Remote Delivery

In this section, Jagriti Arya, Course Administrator in SARTTAC, shares her views on challenges and opportunities presented by virtual delivery of training courses—a staple in SARTTAC since the start of the COVID-19 pandemic.

Until March 2020, the regular work environment at SARTTAC meant regional and national training courses delivered in-person, mainly at the Center in New Delhi. However, the pandemic has changed the way we work and interact with others. As a team, we had to come up with solutions to keep SARTTAC’s training running as timely and smoothly as possible. Thanks to new technologies and quite a few brain storming sessions, we were able to pivot to a virtual training environment fairly quickly. Since the first remote training event in June 2020, SARTTAC has delivered (through October 2021) 49 courses and workshops, 61 webinars and a seminar on the Ministry of Finances’ Role in Addressing Climate Change, with a sizable number planned in the remainder of FY22, although also with hope of a resumption in selected in-person training.

This approach to training presented us with quite a few challenges, but also some opportunities. The primary challenge upfront was the learning curve of new systems for both administrators and participants. Multiple technical training sessions with the participants, done in advance of courses, ensured that they were comfortable using new virtual meeting applications. In addition, course times were truncated to facilitate the availability of both trainers and participants, while the latter also had to meet competing demands placed on their time from work requirements,

especially as member countries emerged from lockdown situations.

Another challenge has been the delivery and receipt of training from home. Since the start of the pandemic, SARTTAC staff have mostly worked from home, in accordance with IMF headquarters (HQ) guidance. As a result, like so many others in this environment, personal and professional lives were blurred initially. However, this hurdle was overcome with the support of colleagues and better understanding of the virtual office environment. For those receiving training, internet connectivity at home is often not reliable enough for virtual delivery. While internet connectivity in the office is better, the office may not afford the environment to concentrate fully on training, as noted above.

On the other hand, imparting training virtually has been a win for both SARTTAC and its member countries. Moving to a virtual environment has presented an opportunity to cater to a larger audience with lesser overhead. We have also been able to offer a wider variety of training events by partnering more easily with other regional capacity development centers, by bringing in HQ experts on more topical issues (notably through webinars), and by being more agile in meeting new requests, which when done virtually involve fewer logistical arrangements and thus can be more easily accommodated.

Yet, as feedback from course participants suggests, virtual training is not a perfect substitute of face-to-face training, which are more interactive in most cases, as participants can no longer hide behind the screen (despite our admonitions to “turn on your cameras”). In person training is also more productive, as it facilitates peer learning and allows more material to be covered.

Perhaps, the future belongs to a hybrid approach wherein some participants can attend in person while many others can tune in virtually, in keeping with SARTTAC having the greatest impact possible in South Asia through training using the generous resources provided by member countries and development partners.

Technical Assistance: August - October 2021

BANGLADESH

Public Financial Management: A mission (August 4-31) on strengthening budget execution was delivered to Bangladesh’s Ministry of Finance (MoF). It assisted in developing a roadmap for designing and implementing controls that can monitor annual and multi-year commitments, enhancing the robustness of the overall PFM framework in Bangladesh. The mission also reviewed the existing procurement processes with respect to invoicing, payments, tracking and reporting.

Real Sector Statistics: Assistance was provided to Bangladesh Bureau of Statistics to develop a Quarterly Gross Domestic Product (QGDP) program (October 10-14). The mission was delivered remotely, with around 15 officials gathered offsite in Bangladesh at a venue made available by SARTTAC, providing them as well SARTTAC a greater opportunity to interact as a group in a non-disruptive environment, also aided by better audio-visual resources and internet connectivity. Support was focused on identification, collection, and organization of high frequency data for producing QGDP, determining a compilation framework for QGDP and generating estimates of quarterly value added by economic activity.

Financial Sector Regulation and Supervision: A financial sector supervision mission (the first part of which took place in January-February 2021) was delivered to Bangladesh Bank (August 16-October 5), and focused on continued support for implementing a risk-based supervision framework.

BHUTAN

Real Sector Statistics: A mission (beginning August 6 till November 2021) assisted the Royal Monetary Authority of Bhutan in the development of a Monthly Index of Economic Growth (MIEG). Focus was on improving source data needed to compile the MIEG, following up on the progress made on the recommendations in a previous mission on data collection and analysis.

INDIA

Public Financial Management: As a part of ongoing capacity development engagement with the Indian state of Odisha, three Public Finance Management missions were delivered during the quarter. The first (August 18 – September 29) supported the development of a commitment control system (CSS) in the state. The second mission (August 18 – October 31) provided continued support on improving cash management and cash flow forecasting. The third (September 20-29) assisted in further building out Odisha’s medium term fiscal framework. The framework will serve as an input for the preparation of Odisha’s upcoming annual budget. Support for drafting a Fiscal Strategy Report was also provided.

MALDIVES

Revenue Administration: A mission (August 30 - September 13) assisted the Maldives Inland Revenue Authority (MIRA) with Mutual Agreement Procedure (MAP) and Advance Pricing Arrangement (APA) administrative processes. The mission reviewed Maldives’ current MAP and APA regulations and assessed further administrative enhancements required to meet international good practices.

Real Sector Statistics: Support was provided to supported Maldives’ National Bureau of Statistics (August 22 - September 2) in the development of a MIEG. A template for the index’s compilation, as well as an experimental MIEG series, were developed during the mission and monthly data sources currently available were assessed.

NEPAL

Government Finance Statistics: A mission (September 12-17) on compiling fiscal statistics aligned with the Government Finance Statistics Manual 2014 was delivered to officials from Nepal Rastra Bank and Financial Controller General’s Office. It carried forward the work done in a previous mission (November 2020) on Nepal’s historical Government Finance Statistics (GFS) estimates and expansion of GFS coverage to include extrabudgetary units.

SRI LANKA

Real Sector Statistics: SARTTAC’s ongoing support to Sri Lanka on rebasing its GDP to 2015 base year continued during the quarter (August 16-20). A review of the preliminary supply use tables for the updated benchmark year and the preliminary rebased time series for value added and GDP from 2015 to 2020 was undertaken together with the Department of Census and Statistics.

IMF Departments: FAD (Fiscal Affairs), MCM (Monetary and Capital Markets), STA (Statistics)

SARTTAC Funding Programs: GFS (Government Finance Statistics), PFM (Public Financial Management), RA (Revenue Administration), and RSS (Real Sector Statistics)

Access SARTTAC TA Reports on secured website (Requires Login Credentials)

Macroeconomic Frameworks: Four regional macroeconomics training courses were delivered during the quarter. The first on Fiscal Frameworks (August 2-13) reviewed the role of government in macroeconomic management and the objectives of fiscal policy. It revisited essential macro-fiscal tools and methodologies and concluded with thematic presentations by participants. This course was followed by training on Macro-Econometric Forecasting and Analysis (September 13-24). It gave participants a rigorous foundation in the estimation of macro-econometric models and their application in forecasting and policy analysis. Participants worked in groups to gather hands-on experience in estimation, forecasting and nowcasting techniques.

The third macroeconomics course was on Selected Topics in Managing Capital Flows, delivered in co-operation with the South East Asian Central Banks (SEACEN) Research and Training Centre (September 13-17). It provided participants with an understanding of capital flow management tools and the benefits and risks of capital account liberalization using international accounts data. Finally, training on Macroeconomic Diagnostics (September 27-October 7) strengthened participants ability to comprehensively assess a country’s macroeconomic situation. The course emphasized practical tools for use in day-to-day macroeconomic analysis and relied on case studies relevant to the SARTTAC region to illustrate how these tools are applied and can contribute to the policymaking process. The course tested SARTTAC’s capabilities to deliver hybrid training, with several lectures delivered from the Center’s training facilities in New Delhi.

Revenue Administration: Auditors and investigators from revenue authorities in the region joined a workshop on Risk Based Audit and Investigation Techniques (September 6-10). The course introduced participants to concepts like risk-based review of income tax returns and revision of audit plans as new information becomes available and new risks emerge

Public Financial Management: Tackling Public Investment in Challenging Times (September 6-10) was the first of the four regional courses on PFM delivered this quarter. While an earlier workshop in February 2021 provided training around the IMF Public Investment Management Assessment, this workshop informed participants on how to improve public investment planning, allocation, and implementation activities. The workshop commenced with the presentation on a note, prepared by IMF’s Fiscal Affairs Department (FAD), titled “How to Manage Public Investment during a Postcrisis Recovery”. The workshop also devoted time to mainstreaming climate change considerations into public investment planning. The remaining three courses were delivered in partnership with IMF’s Capacity Development Office in Thailand (CDOT). The first, a workshop Effective Cash Management under Fiscal Stress (August 2-6), explored solutions to the challenges faced by government cash managers since the onset of the COVID-19 crisis. Participants also made presentations on the challenges their countries faced during the crisis and the measures they took in dealing with the liquidity pressures. The workshop also featured a demonstration of FAD’s newly developed cash forecasting tool. Details on the course on Digitalization and Public Financial Management (September 20-24) can be accessed at <Link to Raju’s interview>, and on Addressing Climate Change in Asia: What is the Role of Ministries of Finance and Public Financial Management Institutions? (October 25-28) (see box below).

Addressing Climate Change in Asia:

|

Government Finance Statistics: A workshop on Special Topics on Public Sector Debt Statistics (PSDS) was delivered (August 23-27). The invitation to the course was also extended to selected countries covered by IMF’s CDOT under its GFS program. The training refreshed participants on the PSDS framework, its relationship with GFS (including reconciliation between stocks and flows data), analysis and classification of key components of PSDS, and valuation of debt instruments. Participants also made presentations on the production and use of PSDS for policy making, where they raised country-specific issues.

Real Sector Statistics: In response to demand from SARTTAC member countries’ statistical agencies and central banks broad-based training was done for recently appointed staff on the compilation of National Account Statistics (October 25-29). This course was intended to benefit both compilers and users of these statistics by improving the understanding of methodologies and their interpretation.

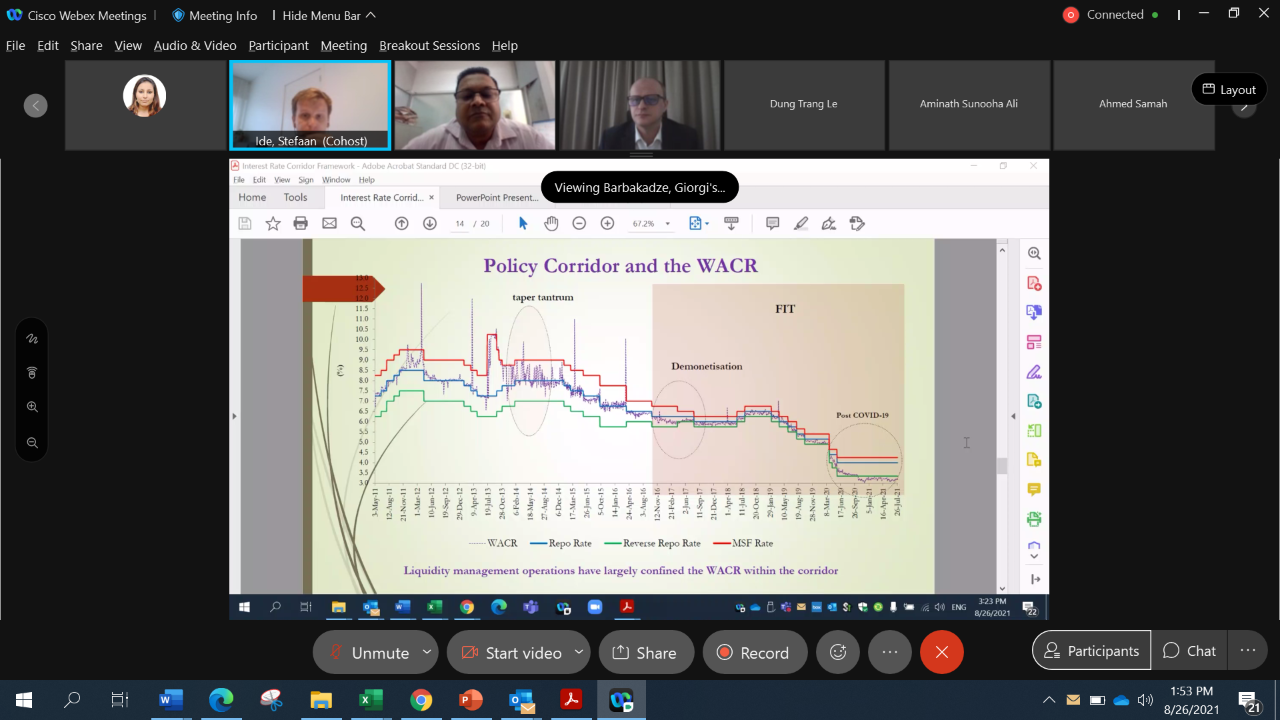

Monetary Policy and Foreign Exchange Market Operations: The first two courses in series of three courses on monetary policy operations, jointly organized by SARTTAC and CDOT, were delivered during the quarter. Each was designed to facilitate exchange of experiences between central banks within and across regions. Topics were the Interest Rate Corridor (August 24-26) and Liquidity Monitoring and Forecasting (October 26-29). During the last day of each course, time was devoted by trainers for office hours so that participants could discuss issues pertinent to their own work in greater depth. A third course on the Collateral Framework for Central Bank Liquidity-Providing Operations is planned in January 2022.

NATIONAL TRAINING

Monetary Policy and Foreign Exchange Market Operations: At the request of Bangladesh Bank, a customized course was delivered to provide a theoretical and practical background for implementing an interest-rate focused Monetary Policy Framework (September 12-23). The course included lectures on monetary policy implementation, money market operations, and liquidity forecasting. The lectures were also complemented with hands-on exercises which simulated the liquidity committee decision-making process.

REGIONAL WEBINARS

Real Sector Statistics: Webinars on Gross Fixed Capital Formation in Intellectual Property (August 11) and Non-Observed Economy (September 22) were organized. The webinars provided an overview of the concepts as described in the System of National Accounts Manual 2008, followed by a demonstration of estimation approaches based on international standards.

NATIONAL WEBINARS

Financial Sector Regulation and Supervision: At the request of the Reserve Bank of India’s (RBI) training institution, the RBI Academy, webinars for non-supervisor officers were delivered on Corporate Governance (October 11-12) and on Cyber Security Issues (October 25-26). The webinars on corporate governance dealt with the concept of corporate governance and the principles of good governance, while ones on cyber security looked at cyber risks in central bank activities and measures to strengthen cybersecurity. In addition to RBI, invitation to the webinars was extended to the Securities and Exchange Board of India.

Four webinars to Nepal Rastra Bank on banking supervision were also delivered (September 12-16). They focused on Remote Supervision of Banks and included both on-site and off-site perspectives. The webinars took a close look at supervision of credit risk, liquidity risk and operational risk in a remote supervision environment.

More articles from the same issue

RECENT and UPCOMING ACTIVITIES

- Technical Assistance

- Training and Webinars

- Upcoming Training Courses

- Upcoming Webinars

- IMF Online Courses

Previous Issues <