A mid-year meeting of SARTTAC’s Steering Committee (SC) was held on January 7. The meeting was joined by around 50 participants, mainly from member country central banks and finance ministries, from development partners, and from the IMF. The main focus was on execution of SARTTAC’s FY22 (May 2021 – April 2022) workplan through December 2021 and the changes proposed for the balance of the fiscal year, the challenges and opportunities presented by virtual delivery of capacity development (CD), and progress on the mid-term evaluation of SARTTAC’s Phase I funding cycle. The SC was also presented with an overview of IMF’s CD activities across the globe and an update on the IMF’s surveillance work in the region, including recent Article IV consultations amongst the SARTTAC member countries.

The SC representatives appreciated SARTTAC’s continued adaptability of virtual training to the needs of member countries, but welcomed planned moves to in-person delivery.

In all, 95 percent of programmed regional and national training delivery through December 2021 was completed successfully. The SC also recognized the value of training done in emerging areas of CD done by SARTTAC in FY22, such as digitalization and PFM, the role of finance ministries in addressing climate change, and cyber risks facing regulators in the financial sector. SARTTAC noted plans to return to in-person training in late FY22, subject to improvements in the region’s COVID-19 situation and approvals from IMF headquarters, with a regional Nowcasting course now slated for end-March 2022.

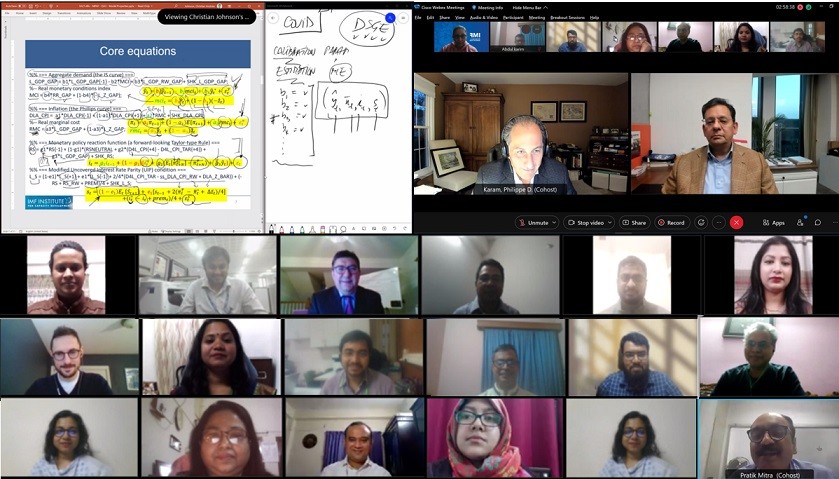

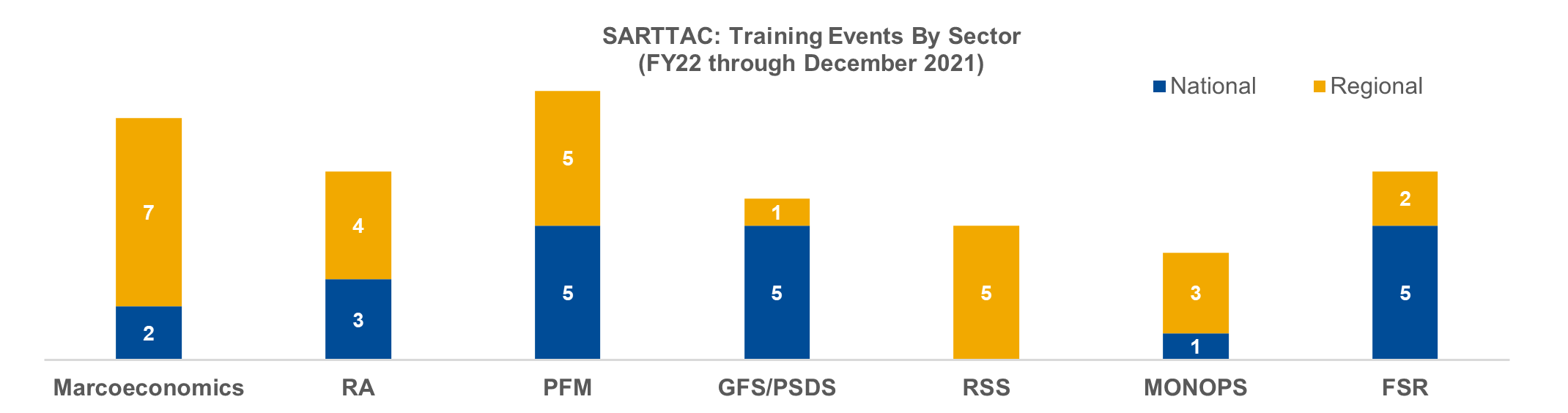

Training remained active across all CD programs, which the SC commended. In total, 48 events were delivered during May-December 2021, out of which 21 were national and the rest regional, with additional four done in January 2022, including a hybrid workshop on budget communication in Bhutan. Through December, the largest number of events were concentrated in Public Financial Management (PFM) (10) and Macroeconomics (9) workstreams. The bulk of national training was focused on India (16) given better established cohorts like the Central Board of Direct Taxes and Office of the Comptroller and Auditor General (CAG), including a series of Government Finance Statistics (GFS) compilation workshops for state-level offices of the CAG.

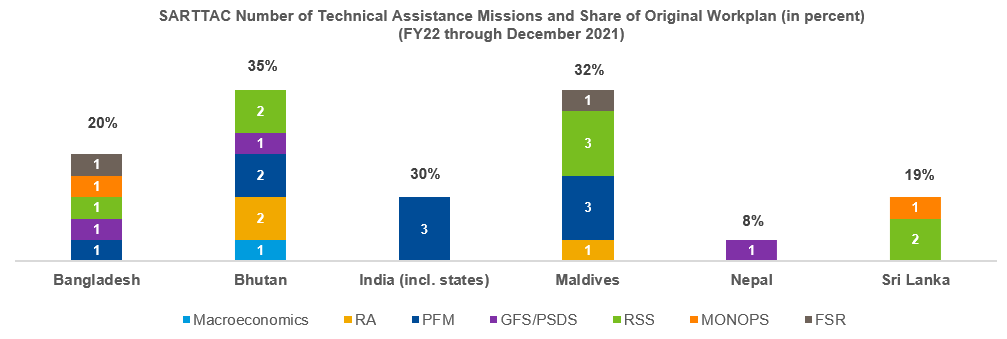

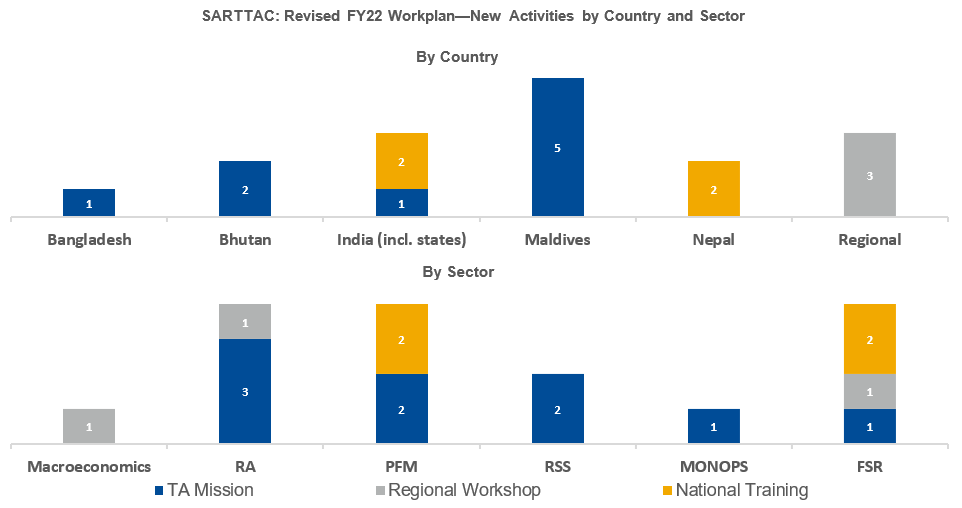

At the same time, the SC recognized challenges posed in the delivery of technical assistance (TA), which lagged in FY22 against the workplan endorsed at the last SC meeting in July 2021. During May-December 2021, only about 25 percent of TA in the FY22 workplan was completed or ongoing. This under-execution was in part because of the delta variant surge in much of South Asia and related disruptions during the first quarter of FY22 (May-July 2021) and the growing preference of some TA recipients for in-person delivery of TA. Bangladesh, Bhutan, and Maldives received the largest share of TA during May-December 2021 and took up more relative to the workplan than Nepal and Sri Lanka (for India, TA focused on programmed work on PFM in the Indian state of Odisha). The GFS, PFM and Real Sector Statistics (RSS) programs in SARTTAC saw greater progress in implementing respective workplans for the year, the last area under the guidance of Mr. Rodger Sceviour, the departing RSS Advisor, who discusses his 3½ years in SARTTAC.

In their remarks, SC representatives endorsed the revised workplan and welcomed SARTTAC’s responsiveness to new demand for CD proposed by member countries. In all, the revised workplan has 16 new activities, including the March 2022 Nowcasting course and new PFM CD in the Indian state of Tamil Nadu, but it also factors in a reduction in overall activities by around 10 percent against the original workplan, mainly due to a postponement or cancellation of planned TA at the behest of country authorities. Recognition was given by the SC to some good aspects of the virtual mode, which should remain a part of CD delivery going forward, especially in training and around shorter events, as the past two years had broadened SARTTAC’s reach and audience. Members and partners also encouraged further engagement by SARTTAC in emerging areas of CD, notably on climate change, central bank digital currencies, cybersecurity and fintech, and gender issues and inclusive growth.

The SC was further briefed on plans by SARTTAC to extend Phase I of its operations (2017-2022) by one year to end-FY23 (i.e. to April 2023), which members and partners supported. An update of plans to move to Phase II was also discussed, in keeping with the strong overall engagement in CD by member countries and a desire for further support from SARTTAC. The extension of Phase I has been made possible by budgetary savings before and during the pandemic, of late mainly related to the absence of mission- and training-related travel and slower execution of TA (as noted above). A new five-year contribution from Australia Treasury, agreed in late 2021 and welcomed by the SC, also provides additional resources in FY22 and FY23, against Australia’s original contribution to SARTTAC.

Finally, separate from its original Phase 1 budget, SARTTAC is benefitting from resources provided under the IMF’s COVID-19 Crisis Capacity Development Initiative (CCCDI) (https://www.imf.org/en/Capacity-Development/what-we-do/covid19-crisis-capacity-development-initiative). A new CCCDI-funded Macro-Fiscal Advisor (Mr. John Grinyer) joined the Center in January 2022, enabling SARTTAC to provide intensified support on building more robust medium-term fiscal frameworks and improving fiscal risk analysis and management—important aspects of CD as member countries seek sounder fiscal footing emerging from the pandemic

A Chat with Rodger Sceviour

Rodger Sceviour recently completed a three-and-a-half-year assignment in SARTTAC as the Real Sector Statistics (RSS) Advisor. During his tenure, he engaged in each of SARTTAC’s six member countries, including intensive virtual support during the past two years on strengthening national accounts statistics and indicators through a range of technical assistance and training activities. Below, SARTTAC’s Mudit Mittal discusses with Rodger his experience working on South Asia.

Mudit: What motivated you to join SARTTAC in 2018 as the Real Sector Statistics Advisor?

Rodger: During my tenure at Statistics Canada, we commenced a CD (capacity development) program with several countries in the South Caribbean region entitled the Project for the Regional Advancement of Statistics in the Caribbean (PRASC). I was actively involved and the team leader for the countries of Belize, Suriname and St. Vincent and the Grenadines. I found that work to be very fulfilling and wanted to make CD delivery my full-time endeavor. I therefore began my search for positions at organizations doing CD. After learning of the new position as RSS advisor at SARTTAC, it was only a short period of time before I was in New Delhi and providing CD.

Mudit: What were some of the positive changes in the six member countries on strengthening RSS during your assignment?

Rodger: Bangladesh and Sri Lanka successfully rebased their National Accounts Statistics (NAS) program to a more recent base year, introduced improvements in their sources and methods, which are now consistent with the System of National Accounts Manual – 2008, and recompiled time series data on Gross Domestic Product (GDP) back to the previous base year. The end result is a NAS program that is more accurate, relevant, and comprehensive. As well, Maldives introduced expenditure-based GDP estimates to complement their production-based measures. Finally, in the absence of a Quarterly GDP program (QGDP), Bhutan made significant progress developing a Monthly Index of Economic Growth (MIEG).

Mudit: You delivered a lot of technical assistance (TA) and training during your assignment. What aspects of your work did you find the most rewarding?

Rodger: In terms of training, the courses I delivered in GDP rebasing, QGDP, and Advanced Topics in National Accounts were the most rewarding. Although I also delivered training on core principles, the training done on advanced topics filled an important gap since the availability of this type of training is otherwise relatively limited. For example, there often does not exist clear and precise training material on topics such as Gross Fixed Capital Formation in Biological Resources. For these reasons, I felt the participants gained a lot of practical knowledge. In terms of TA, I would say the development of a MIEG in Bhutan was most satisfying. It has become very important for users to have access to more timely information on economic statistics. This is especially true during times of increased economic volatility. The MIEG is an excellent product, and a good step eventually to a QGDP program.

Mudit: Due to the COVID-19 pandemic—that is since March 2020, much of the work of the IMF has been conducted from remote and through virtual delivery. How did this effect the planning and delivery of CD in the member countries?

Rodger: In the short term there was a tremendous impact. Of course, the authorities prefer in-person delivery of TA and training. During the first few months of the pandemic, most work was essentially postponed. However, as it became clear that travel disruptions due to the COVID-19 pandemic would extend for some time, virtual TA and training commenced. In the long term, there has been little impact on the quantity of TA and training in most countries. However, there have been additional challenges providing CD to National Statistical Offices (NSO) where the quality of the Wi-Fi has been relatively limited.

Mudit: What should be the focus areas in RSS for the six member countries, going forward?

Rodger: Timely rebasing of GDP with a relatively recent base year is very important. These are also two separate issues. A timely rebasing usually implies that the base year of the national accounts be updated at least every five years. This ensures the official GDP estimates make use of latest sources and methods. As well, the base year itself also needs to be recent. For instance, one can update the national accounts on a regular basis, yet the base year itself can be outdated. An implication of this is that the constant price measures use a base year that not as relevant.

As mentioned, with a growing demand for more timely economic statistics, SARTTAC countries should focus more resources on developing QGDP programs, timelier QGDP estimates, or estimation and publication of a MIEG. Finally, the use of satellite accounts could improve the granularity of economic statistics on various subjects. Satellite account provides detailed estimates of statistics that the authorities deem to be relatively important, but they are estimated within a national accounts framework. This approach ensures consistency with the national accounts program. A couple examples would be a Tourism Satellite Account for Maldives, or a Textile Manufacturing Satellite Account for Bangladesh.

Mudit: What are several prominent strengths that SARTTAC brings to the region?

Rodger: In my opinion, having an advisor who specializes in the Economic Statistics of a group of countries is the main advantage. One can have a lot of knowledge on international best practices of NAS.

However, understanding the strengths and weaknesses of statistical systems of a particular country and how modifications can be made to better align them with international standards can most effectively occur when an advisor can focus exclusively on these countries. This is the strength of SARTTAC. The advisor is not only an expert on NAS, but an expert on NAS practices in the region. The SARTTAC advisor can, very precisely, discuss the NAS program in each member country. This knowledge is used to assist these countries. In addition, other CD providers often consult the SARTTAC advisor regarding the recent developments in National Accounts practices.

Another advantage is customized training. We have provided many training courses including broad-based National Accounts training, GDP Rebasing, Sequence of Accounts, and Development of QGDP. These training programs are customized to the region by using publicly available data, as published through the regions’ NSOs. This type of training cannot be provided in a general, non-regional course.

Mudit: Given your experience, any global trends that may affect how member countries collect, compile, and report data on RSS?

Rodger: Definitely. The use of administrative data is transforming the sources and methods of NAS. In particular, value added taxes (VAT) is a great source of information for QGDP compilation. Most SARTTAC countries have a VAT or will soon have one. As VATs develop in terms of compliance and scope, there are issues with using them to infer economic activity. However, as compliance stabilizes, they will be used more intensively in the region. This should improve the quality of NAS in general.

In terms of reporting, there is a growing demand for more timely estimates of economic activity. In the past, this demand was usually limited to publication of QGDP. However, users require statistics that are even more frequent. As a result, SARTTAC has been providing assistance to member countries with developing a MIEG.

Mudit: Your plans after leaving SARTTAC?

Rodger: I intend to continue providing CD in various forms—both TA and training, possibly for the IMF, World Bank, Asian Development Bank, United National Statistical Division, or with other development partners. I also plan to develop a YouTube series on best practices and practical recommendations in the estimation of NAS and will be devoting considerably more time to that.

Mudit: Any inspiring words for our readers?

Rodger: The main point I would like to make is that the work matters. Of course, there are many challenges in any CD program. First, priorities will change based on external events. Second, it is important to ensure reporting to the authorities, partners, and IMF headquarters is timely. Finally, making the best use of time requires coordinating activities with other CD providers. As an advisor, it is necessary to manage these challenges to effectively provide CD. One also must be careful to remember the big picture, that is, the work matters but also the outcomes matter. Updating the CPI is important because many contracts are tied to it. The monetary and fiscal authorities require an accurate and timely QGDP program to effectively deliver policies. An accurate GDP rebasing has implications on debt sustainability and tax burden measures.

For me, working with SARTTAC has been an incredible journey in personal and professional growth. My knowledge of NAS has increased exponentially. As well, as an RSS advisor, one is not just an expert in a single subject matter but gets to work in a range of areas. Developing and using communications skills, organizational skills and planning are equally important.

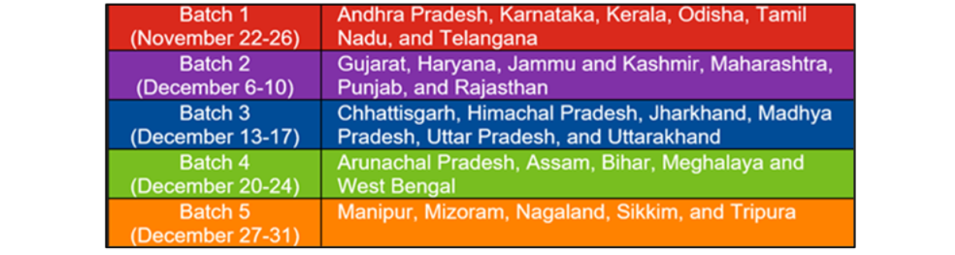

SARTTAC Training for India’s Comptroller and Auditor General Office

In response to a request from India’s Office of the Comptroller and Auditor General (CAG), SARTTAC delivered five one-week virtual courses on government finance statistics (GFS) and public sector debt statistics (PSDS) between November 22 and December 31, 2021. The training was aimed at supporting India’s commitments under the G-20 Data Gaps Initiative (DGI) to begin compiling and disseminating high-frequency GFS and PSDS for a modified general government (budgetary central government (BCG) and state governments) by 2021.

The G-20 DGI is designed to assist policymakers in generating better data for surveilling and managing the global economy. During fiscal years 2019 and 2020, SARTTAC began assisting India in fulfilling this obligation by providing GFS training at the sub-national level and through technical collaboration at the national level on developing a strategy for meeting DGI requirements. In June 2020, two virtual workshops were held by SARTTAC with CAG officials from around the country to kick off this work.

Under the guidance of Andrew Evans, GFS and PSDS Advisor in SARTTAC, these latest five courses built on earlier training. Each course focused on how to translate Indian state accounting data into the GFS framework. The objective of this training was to enable all states to produce GFS-compliant data for the same accounting period, which could then be aggregated to produce aggregated data for total state government of India with the eventual aim of using Union government and state government GFS data to produce annual general government GFS data for India, in keeping with meeting the international standards as required under the DGI requirements #15 and #16.

Dr. Nilotpal Goswami, Director General, CAG, opened the first course comprising officials from state CAG offices in Andhra Pradesh, Karnataka, Kerala, Odisha, Tamil Nadu, and Telangana. Subsequent course also comprised regional batches of five to six state CAG offices, with approximately four officials joining from each state. Supporting the first course was Brooks Robinson, former SARTTAC GFS and PSDS Advisor, providing continuity with earlier training. Divya Malhotra, a former executive at the CAG, also served as an expert in each course.

Much of the training was spent on reviewing each section of the GFS analytic framework and then analyzing the corresponding data that each state had submitted for that section, mapped from their own accounting data to the GFS codes. Several inconsistencies arose across different states in recording the various transactions and much time was spent aligning the individual states data. Despite challenges posed by virtual delivery, significant progress was made with each of the states. However, the overall objective to get each state to complete a set of GFS accounts for the same year with a low statistical discrepancy will require further work, with SARTTAC standing ready to support.

New Staff Announcement

|

Mr. John Grinyer joined SARTTAC as Macro-Fiscal Advisor in January 2022. He began his career 20 years ago as an economist for the UK government and has been working with the IMF since 2012, when he was first appointed as a long-term Macro-Fiscal Advisor to the Ministry of Finance in Botswana. There, he helped to introduce a medium-term fiscal framework and other budgeting reforms. John has also worked as an advisor in other finance ministries including Maldives, Serbia, Afghanistan, Lesotho and Timor Leste. He has since been a public financial management advisor with the IMF’s regional technical assistance center in West Africa (AFRITAC West 2 in Accra, Ghana) and more recently he worked for the IMF as a short-term expert, supporting SARTTAC in its technical assistance on budgeting reforms for the Indian state of Odisha. |

Technical Assistance: November 2021-January 2022

BANGLADESH

Public Financial Management: In response to a request from Bangladesh’s Ministry of Finance, SARTTAC undertook a virtual PFM mission (November 10-24) aimed at strengthening budget documentation. The mission focused specifically on the existing Budget in Brief document that the Ministry publishes when the annual budget is tabled in Parliament and also held a virtual workshop on the principles of clear budget documentation.

Real Sector Statistics: Two missions were delivered to Bangladesh Bureau of Statistics (BBS) during the quarter. The first mission (January 10-14) assisted BBS in updating supply and use tables (SUT) with recently available data sources and balancing them using internationally recommended practices. It was followed by a second mission (January 17-21), which focused on finalizing an updated Consumer Price Index (CPI), following up on the work done in this area during a mission in early 2021.

Monetary Policy and Foreign Exchange Market Operations: A mission conducted with Bangladesh Bank (BB) (November 8-19) focused on the tools incorporated by BB in the pandemic-related crisis period. Forecasting tools developed during previous missions were also evaluated based on how the model behaved in incorporating the crisis episode and the model itself was updated using the latest data.

BHUTAN

Macroeconomics: Assistance was provided to the authorities in developing a customized macroeconomic framework (November 15-19). The framework will help them carrying out independent scenario and forecasting analysis. Follow up to the mission is taking place through regular webinars with the authorities to provide further guidance on customizing the framework.

Revenue Administration: A mission (December 6-March 5) supported the Goods and Services Tax (GST) implementation team in further developing the information technology (IT) systems in compliance with Bhutan’s national IT policy. It was followed up by another mission (currently ongoing) that is assisting revenue authorities in Bhutan in advancing their plans to implement integrated business processes and systems for the upcoming GST.

Real Sector Statistics: Two missions were delivered to the National Bureau of Statistics of Bhutan (NBS). The first mission (December 6-17) assisted the NBS with rebasing the GDP from the year 2000 to 2017 and in the compilation of preliminary estimates of various components of GDP. The second mission (December 6-17), which was delivered concurrently, helped in populating the SUT based on 2017 Economic Census. The new SUT will also be an input to the ongoing rebasing exercise.

INDIA

Public Financial Management: Work with India’s Tamil Nadu state commenced during the quarter. The first mission (January 17-30) supported the authorities in the preparation of a citizen’s budget. The citizen’s budget will improve fiscal transparency by presenting key aspects of the budget in a form which non-specialists can understand. The mission was preceded by training (January 5 and 6) on principles of budget documentation and concepts of a citizen’s budget.

MALDIVES

Macroeconomics: A scoping mission to Maldives (December 6-9) assessed data availability and data management processes, as well as existing modelling and policy advising process. This mission was a first in a planned series to assist authorities in developing a customized macroeconomic framework.

Public Financial Management: A mission (November 15-December 31) assisted the authorities in revising a new draft law governing and regulating public debt management in Maldives. It built on support provided by the IMF Fiscal Affairs Department (FAD) on an earlier version of the draft law. The mission team also presented its analysis on international good practices and how the law will interact with other key pieces of legislation.

Revenue Administration: A mission (November 8-22) assisted in the development of a compliance improvement strategy for the recently commenced income tax and reviewed the Maldives Inland Revenue Authority’s (MIRA) progress in implementing compliance risk management principles. Another mission (January 10-24) supported MIRA in developing a taxpayer compliance strategy for general insurance services providers within the Maldives. Training was also delivered to officials on the risks posed by general insurers and strategies to address those risks.

Government Finance Statistics: Assistance was provided to Maldives’ Ministry of Finance in further improving the quality, coverage, and timeliness of Government Finance Statistics (GFS) and Public Sector Debt Statistics (January 9-20). This included support in preparing the latest annual and quarterly GFS data for financial year 2020 and learning about a new Chart of Accounts project that has been initiated.

Real Sector Statistics: The National Bureau of Statistics of Maldives received support (January 16-20) in compiling SUT, which will subsequently be used as part of the next GDP rebasing exercise. This SUT will also be used as an input in the annual compilation of expenditure-based GDP, as well as the tourism satellite account.

Monetary Policy and Foreign Exchange Market Operations: At the request of the Maldives Monetary Authority (MMA), a mission (December 7-January 15) provided guidance on the functioning and implementation of an interest rate corridor (IRC). The mission also provided training to MMA staff on mastering the operational aspects of a monetary policy implementation framework with an IRC set-up.

SRI LANKA

Public Financial Management: Technical assistance (TA) and training were provided to strengthen the institutional development of the newly established Macro-Fiscal Unit (MFU) in Sri Lanka (January 20-February 9). As part of the TA, the mission reviewed and provided guidance on tools to be used by the MFU, the desired linkages to the budget process, and needed improvements to macro and fiscal data compilation. Training expanded on the basic forecasting and economic analysis methodologies and tools, following up on training delivered in March 2021. Topics cover in the most recent mission included the medium-term fiscal framework and fiscal risk analysis tools developed by FAD.

Government Finance Statistics: A mission (January 24-February 3) supported the Ministry of Finance in further improving the quality, coverage, and timeliness of GFS. Its work included a review of the sectorization of state-owned enterprises and updates on improvements to the Integrated Treasury Management Information System and on the accrual accounting project.

Real Sector Statistics: A final mission in a series to update the Producer Price Index (PPI) in Sri Lanka was delivered (November 1-12). The key mission outcomes included: i) finalizing upper-level weights and detailed item and transaction level weights; ii) calculating and disseminating indices; iii) drafting and disseminating a summary of PPI compilation methods; and iv) linking the old and new PPI to create a continuous time series of data.

IMF Departments: FAD (Fiscal Affairs), MCM (Monetary and Capital Markets), STA (Statistics)

SARTTAC Funding Programs: FSR (Financial Sector Supervision and Regulation). GFS (Government Finance Statistics), MONOPS (Monetary and Foreign Exchange Operations), PFM (Public Financial Management), RA (Revenue Administration), and RSS (Real Sector Statistics)

Access SARTTAC TA Reports on secured website (Requires Login Credentials)

Macroeconomic Frameworks: Four regional macroeconomics training courses were delivered during the quarter. The first on Fiscal Frameworks (August 2-13) reviewed the role of government in macroeconomic management and the objectives of fiscal policy. It revisited essential macro-fiscal tools and methodologies and concluded with thematic presentations by participants. This course was followed by training on Macro-Econometric Forecasting and Analysis (September 13-24). It gave participants a rigorous foundation in the estimation of macro-econometric models and their application in forecasting and policy analysis. Participants worked in groups to gather hands-on experience in estimation, forecasting and nowcasting techniques.

Macroeconomic Frameworks: Two training courses were delivered during the quarter. The first was on Fiscal Sustainability (November 9-19), which looked at its importance in ensuring macroeconomic stability and long-term growth. The course provided a thorough overview of how to assess fiscal sustainability from a policy and tools perspective. It also examined long-term fiscal pressures and risks as well as debt management strategies and the early warning indicators used by the IMF against potential fiscal crises.

The second course, Model-Based Monetary Policy Analysis and Forecasting (December 6-17), provided participants with rigorous training on the use of simple Dynamic New Keynesian ("gap") models to conduct monetary policy analysis and forecasting. The course emphasized analysis of monetary policy responses to macroeconomic imbalances and shocks.

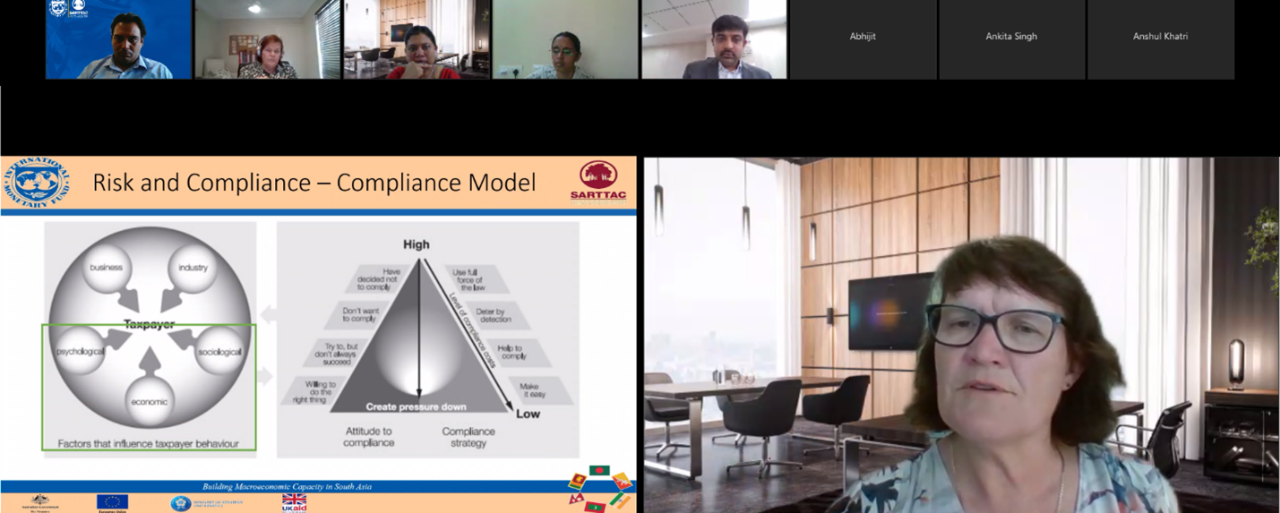

Revenue Administration: Training introduced participants to the Tax Administration Diagnostic Assessment Tool (TADAT) (November 29-December 7), which provides a 360-degree diagnostic of the performance of a tax administration using nine performance areas and 32 indicators. Discussion sessions with practice exercises and case studies mimicking real-life situations were an integral part of the training. The course concluded with a one-hour TADAT online exam; participants who passed the exam were presented with a TADAT certificate.

Public Financial Management: Training on Strategic Budgeting and Integrating Fiscal Strategy with Budget Formulation (November 22-25) provided a foundational discussion on integrating fiscal strategy into a medium-term fiscal plan and related documentation. It also introduced participants to policy analysis concepts, including multi-criteria analysis and cost effectiveness. A panel discussion on monitoring budget results with program and performance objectives helped participants evaluate budget and policy outcomes. Training on Fiscal Transparency (January 17-21) introduced IMF's Fiscal Transparency Code—the international standard of transparency in public finances. Participants were also shown how to identify improvements in a country’s fiscal transparency practices and use digital tools to improve transparency.

Monetary Policy and Foreign Exchange Market Operations: The third training workshop in a series on monetary policy implementation focused on Collateral Framework for Central Bank Liquidity (January 17-19), with all being held jointly with the IMF Capacity Development Office in Thailand for participants from South and East Asia. The training, in a highly interactive format, brought together country officials and IMF experts to discuss the importance of central banks collateral policies in the design and implementation for central bank operating frameworks.

NATIONAL TRAINING

Monetary Policy and Foreign Exchange Market Operations: At the request of Bangladesh Bank, a customized course was delivered to provide a theoretical and practical background for implementing an interest-rate focused Monetary Policy Framework (September 12-23). The course included lectures on monetary policy implementation, money market operations, and liquidity forecasting. The lectures were also complemented with hands-on exercises which simulated the liquidity committee decision-making process.

Revenue Administration: A two day workshop on Behavioral Insights (BI) was delivered to revenue administrators from India’s CBDT (December 1-2). It equipped participants with skills necessary to apply BI techniques to attain high voluntary compliance from taxpayers while keeping compliance costs low for both taxpayers and administrators. CBDT officials also received a TADAT Accreditation Workshop (December 13-21).

Public Financial Management: A hybrid workshop in Bhutan focused on producing Better Budget Communication (January 10-14). Training aimed at improving Bhutan’s budget documents, in particular on (i) developing them as tools to promote effective policy, communication, transparency, and accountability; and (ii) strengthening the link between fiscal strategy and the budget documents. To increase the effectiveness of the workshop, officials from

Bhutan’s Ministry of Finance gathered at an offsite venue, while SARTTAC experts joined from remote, with the set-up helping aid audience participation and group activities. Officials from the Indian state of Tamil Nadu received training (December 11-16) on Fiscal Risks (FR) and IMF tools to support the quantification and reporting of them. This training was the first activity under a new multi-year engagement between the state and SARTTAC. The training provided officials with basic understanding on how to identify and analyze FR, collect the information required to produce a FR register, and prepare an initial fiscal risk statement.

REGIONAL WEBINARS

Revenue Administrations: A webinar on Customs Tax Collaboration (December 7) led by FAD, introduced the benefits of enhanced customs taxation and provided an overview of the gains from sharing data and approaches between customs and tax administrations. Officials from customs and revenue administrations shared their existing collaborative approaches, including effective and automated real-time exchange of data and verification of export-related refunds.

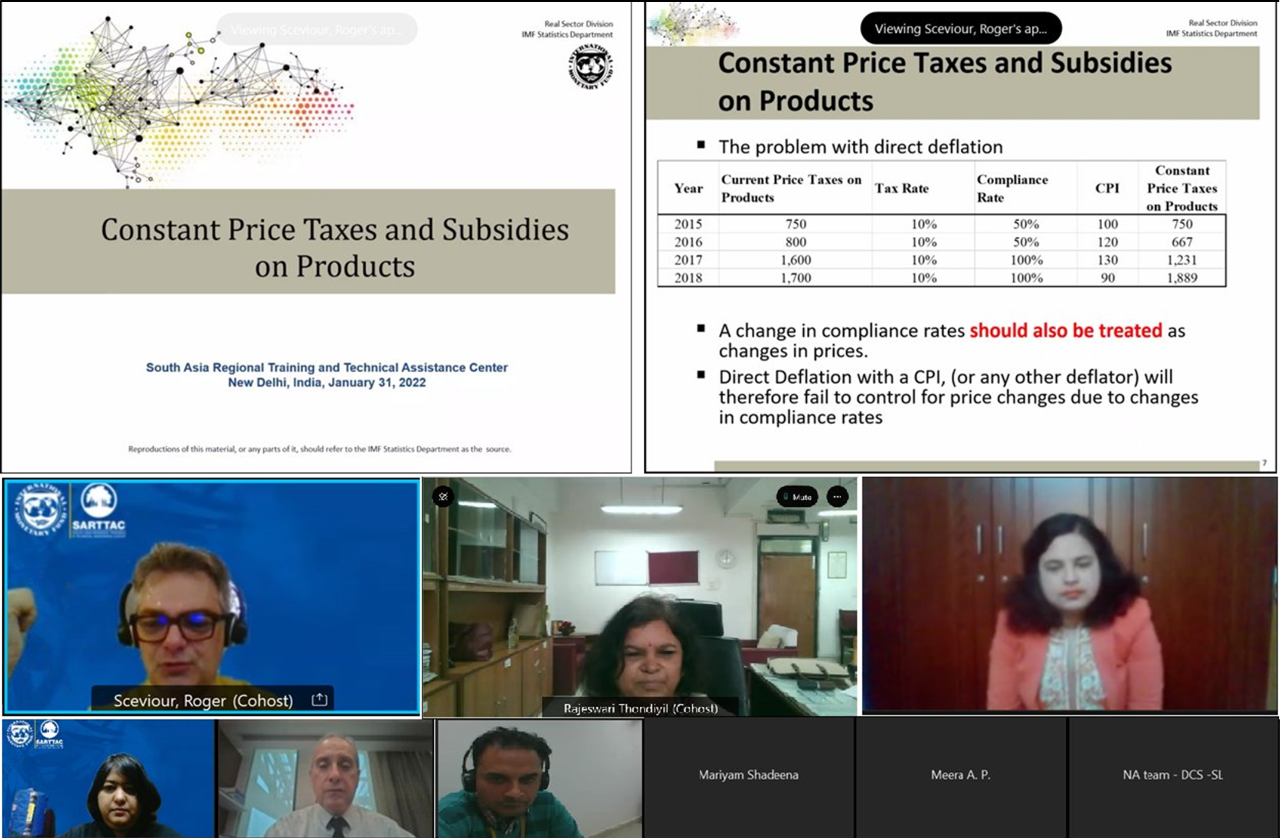

Real Sector Statistics: Two webinars were delivered to officials from statistical organizations in the region. The first focused on Consumption of Fixed Capital (November 23) and the second on Measurement of Constant Price Taxes and Subsidies on Products (January 31). The webinars provided an overview of the concepts as described in 2008 System of National Accounts and methods to compile the related statistics.

Financial Sector Regulation and Supervision: Financial sector supervisors from the region were provided training on Cyber Risk Management (December 1-2). The first day focused on cyber risks in the financial sector and strengthening cybersecurity at financial institutions and the second day on international guidance on cyber risk and global regulatory practices. On December 10, a webinar, on Addressing Climate Risks in Prudential Regulation and Supervision, jointly organized with the IMF Monetary and Capital Markets Department, aimed at raising awareness among banking and insurance supervisors from South Asia on climate-related risks and emerging supervisory practices. Presentations made by senior executives from the European Central Bank, representatives of the Network for Greening the Financial System, Reserve Bank of India, Bangladesh Bank, and Bank Negara Malaysia provided information about the latest developments in the regulation of climate-related financial risks, which allowed contextualized understanding of these risks and of sustainability concepts.

Other areas: The IMF Statistics Department, in collaboration with SARTTAC, did a webinar (January 20) on the main methodological updates brought about by IMF’s 2019 Financial Soundness Indicators Compilation Guide (2019 FSIs Guide). The new FSIs data and metadata templates to report the sectoral financial statements and new template on Concentration and Distribution Measures were also presented.

NATIONAL WEBINARS

Public Financial Management: A series of three webinars were delivered to the Indian state of Tamil Nadu. The first session (December 14) touched upon Strategic Planning and Cash Management. The second session (December 16) focused on preparing a Medium-Term Fiscal Framework and institutional considerations for macro-fiscal forecasting. The final session (January 11) comprised of presentations on Public Investment Management and Fiscal Transparency.

Financial Sector Regulation and Supervision: A series of webinars on Credit Risk were delivered to officials from Nepal Rastra Bank (December 21-23). The topics covered included the assessment of credit risk, the Basel simplified standardized approach for credit risk, the development of guidelines for the Internal Ratings Based approach and the calculation of expected credit loss under the International Financial Reporting Standard.

More articles from the same issue

- A Chat with Rodger Sceviour

- SARTTAC Training for India’s Comptroller and Auditor General Office

- New Staff Announcement

RECENT and UPCOMING ACTIVITIES

- Technical Assistance

- Training and Webinars

- Upcoming Training Courses

- Upcoming Webinars

- IMF Online Courses

Previous Issues <