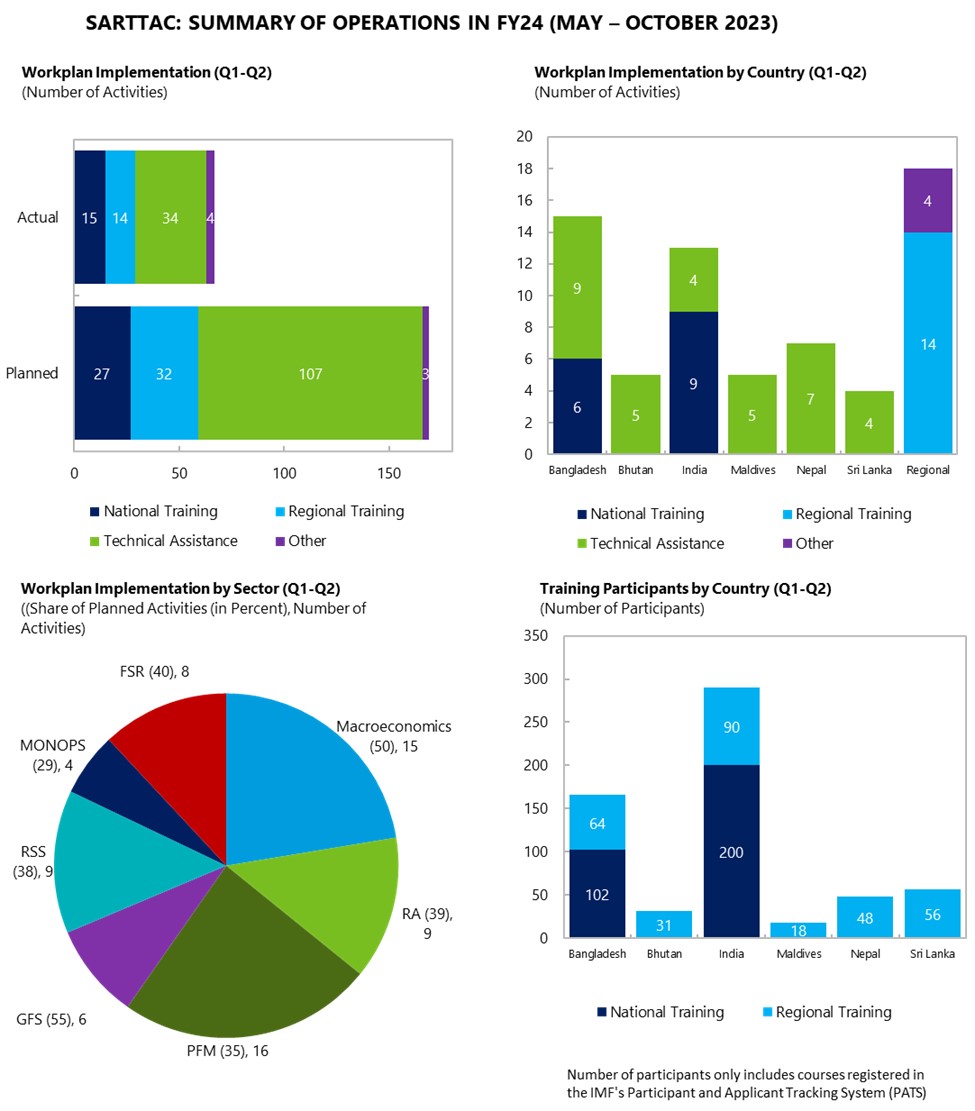

In the second quarter (Q2) of FY24 (August – October 2023), the IMF South Asia Regional Training and Technical Assistance Center (SARTTAC) built on earlier momentum in implementing a range of activities. Through October, the Center commenced or completed around 70 activities, or more than 40 percent of those in its annual workplan, inclusive of a few new activities since SARTTAC’s Steering Committee gave its final endorsement of the original FY24 workplan in July. Implementation of the plan differed across capacity development (CD) programs but was largely in keeping with expectations. Delivery lags were mainly due to a transitioning to new advisors in SARTTAC, selected requests by recipient agencies to delay technical assistance (TA) missions, or an intentional backloading of TA in FY24 given time needed by the authorities to act on previous recommendations. As discussed below, a first-time regional course was held in Mumbai (on banking supervision), administrative support and outreach was provided for an international seminar showcasing India’s digital public infrastructure, and new engagement in CD commenced for the Indian state of Assam in strengthening public financial management (PFM).

Focusing on training, most took place as planned in FY24 Q2, with the 19 courses and webinars in total, as listed here including several new ones. In early August, SARTTAC held a first-time course for mid-career general inductees from the Reserve Bank of India (RBI) (including financial supervisors, reserve managers, and regional officers). The course looked at how macroeconomic policy analysis and decision-making affected different aspects of central banking and addressed macroeconomic challenges facing India and the region. In late August, a new regional course was delivered on the International Survey on Revenue Administration (ISORA), which is a survey used to collect data on tax administrations from around the world using a set of questions and definitions agreed by five international organizations, including the IMF, with the aim of strengthening tax administrations’ focus on data management, performance measurement, and reporting. A new two-week regional Nowcasting course was delivered in the second half of September by the IMF Institute for Capacity Development (ICD)—one that was heavily oversubscribed given the growing popularity of the use of high-frequency and big data sets to forecasts near-term trends in support of better macroeconomic decision-making. Finally, a series of five regional webinars, done jointly with the IMF Capacity Development Office in Thailand (CDOT) commenced on using government finance statistics (GFS) to assess fiscal risks, with the first three sessions in October covering data requirements to capture these risks, the recording of contingent liabilities, and coverage of state-owned enterprises.

In addition, 17 technical assistance missions commenced in FY24 Q2 in line with SARTTAC’s annual workplan, with a complete list here. Highlights included a resumption of TA with Nepal Rastra Bank (NRB) in monetary and foreign exchange operations, with a mission covering FX management, and with Bangladesh Bank (BB), focused on developing an interest rate corridor for conducting monetary policy—as a follow-through to an attachment on this topic by BB at the RBI in July. In Bangladesh, under SARTTAC’s revenue administration program, TA was provided to the National Board of Revenue on compliance risk management, which also included a training workshop, all complementary to mobilizing domestic resources—a key component of the IMF Extended Credit Facility arrangement. For Bhutan, work commenced on updating the consumer prices index and development quarterly GDP estimates. Finally, scoping missions were conducted under SARTTAC’s financial sector supervision and regulation program for Bhutan, Maldives, and Sri Lanka to develop workplans to strengthen supervisory capacity in banking and insurance, addressing with the fall-out of the pandemic and strains on the financial system in each.

SARTTAC also provided selected advisory support to India on GFS in the context of the G20 Data Gaps Initiative (DGI). Launched in 2009 by G20 Finance Ministers and Central Bank Governors, the DGI looks to close the policy-relevant data gaps identified following the global financial crisis. SARTTAC’s GFS Advisor (Mr. Andrew Evans) worked with different offices and departments in India’s Ministry of Finance (MoF) to address gaps identified in the DGI Phase II progress report issued in 2022 by the IMF and Financial Stability Board Secretariat. Specifically, focus was placed on Recommendations 15 and 16 in the report on GFS and public sector debt statistics (PSDS), respectively. Working with the MoF’s Department of Economic Affairs and Office of the Controller General of Accounts, India was able to provide an update to the progress report in October on its compliance with these recommendations, which will also support more systemic reporting of standardized GFS and PSDS data to the IMF.

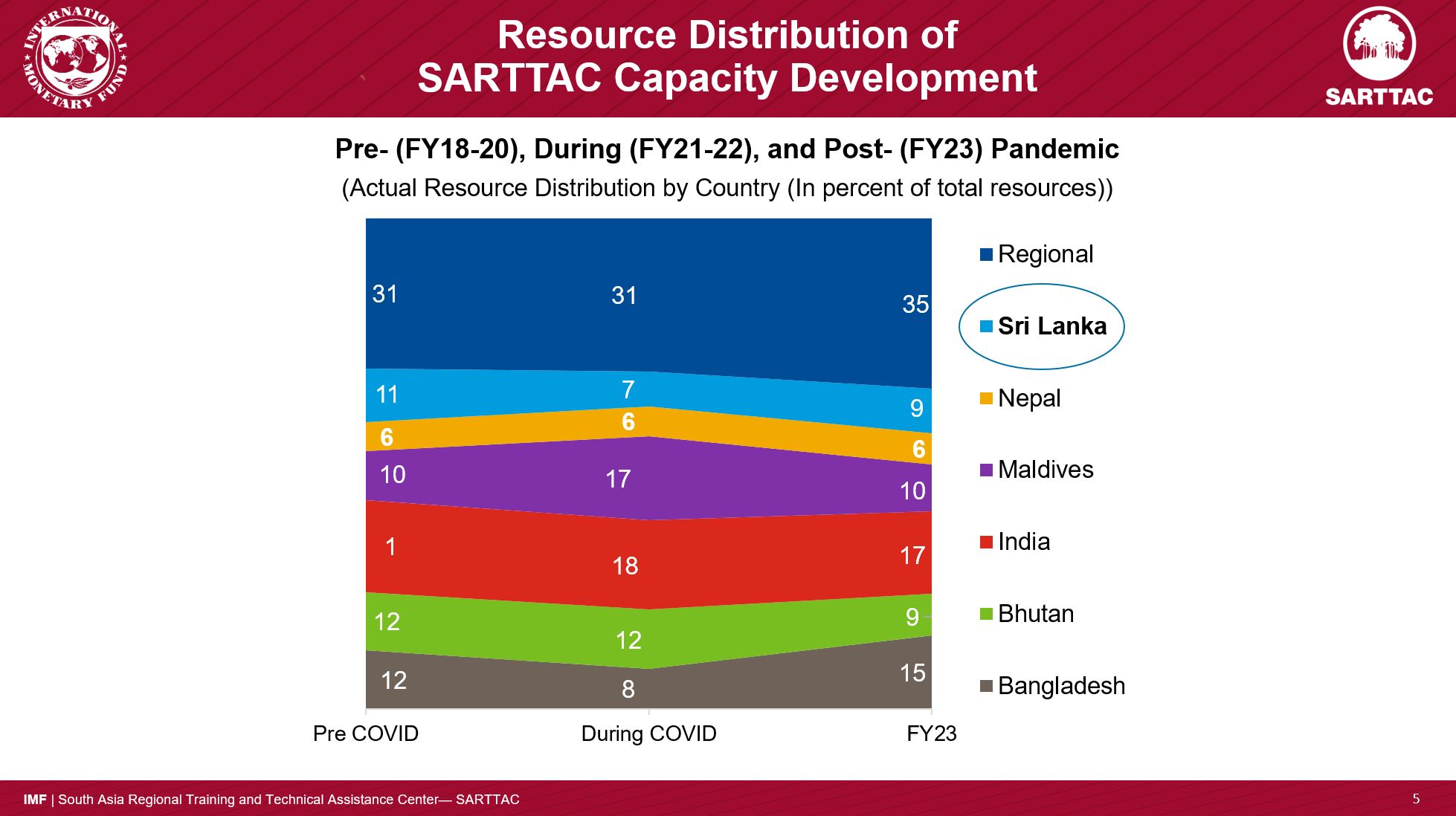

Looking ahead, SARTTAC is working with member countries and development partners to firm up commitments for Phase II of its funding and operations. The next phase, which is expected to start in January 2024, will be anchored by a new Program Document for the Center. In this context, SARTTAC’s Director (Mr. David Cowen) and Deputy Director (Mr. Saji Thomas) visited Nepal in early August and Sri Lanka in early September to discuss near-term workplans in FY24 and CD priorities in Phase II. SARTTAC has also been reaching out to all member countries on firming up their support for this new phase, given they provided nearly two-thirds of all financial support for Phase I, anchored by India’s sizable contribution.

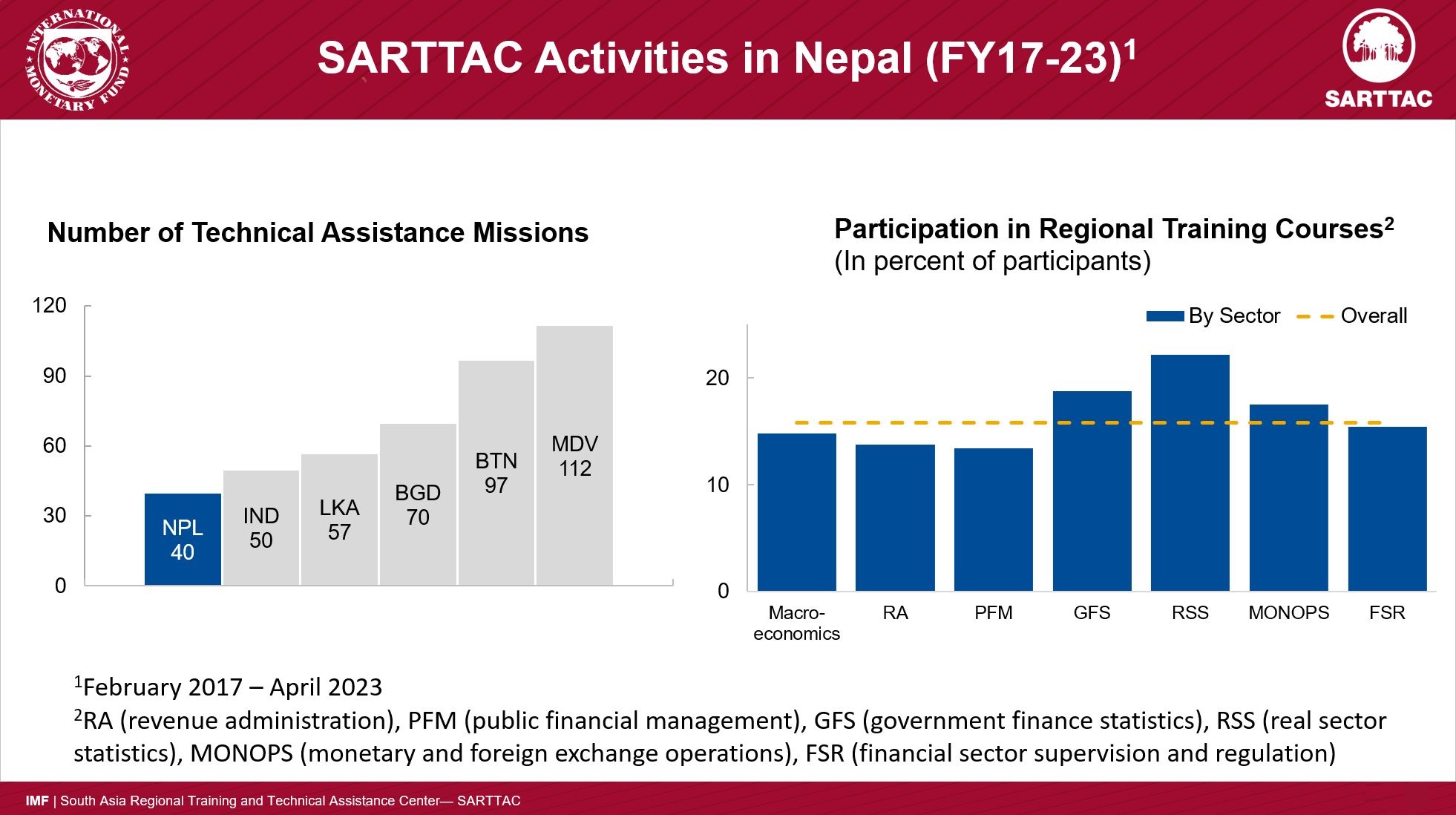

In Nepal, SARTTAC met with the NRB, MoF, and National Statistics Office, delivering a few presentations on the intensity of resource use in Phase I and expected focus in Phase II with these agencies. During the visit, highlighted by a meeting with NRB Governor Maha Prasad Adhikari, officials voiced support for more structured engagement with SARTTAC, including possible cohort training, as done currently with India and Bangladesh, enabling the authorities to build more durable capacity in areas such as macroeconomic analysis and forecasting and PFM. The visit coincided with a SARTTAC GFS TA mission, which provided an opportunity to emphasize the importance of building on progress in compiling GFS for budgetary central government to general government, also complementary ongoing SARTTAC TA in strengthening fiscal risk management and cash flow forecasting under its PFM program.

For Sri Lanka, close attention was given to CD needs tied to program implementation under its Extended Fund Facility Arrangement with the IMF, with the CBSL and MoF requesting support through CD ultimately aimed at mobilizing more domestic resources, improving public service delivery, ensuring price stability, and strengthening the financial sector. Joining this visit was SARTTAC’s Financial Sector Supervision and Regulation Advisor (Mr. Nitin Jain), who focused on essential support for building supervisory capacity (as noted earlier). Both CBSL Governor Nandalal Weerasinghe and Secretary of the Treasury K M Mahinda Siriwardana expressed their appreciation for SARTTAC’s role in Sri Lanka and looked to intensify engagement as the country moved into the post-crisis period and could more systematically address longstanding CD challenges, including with the support of IMF HQ staff, new IMF resident revenue administration and PFM advisors (funded by Japan), and other CD providers.

Finally, a few staff changes took place in FY24 Q2. Mr. Raju Sharan ended his nearly 4 ½ year term in SARTTAC in mid-October as a regional PFM advisor. He immediately took up a new post as resident PFM advisor in Sri Lanka (mentioned above) under the management of the IMF Fiscal Affair Department (FAD). In the wake of his departure, a new regional PFM advisor, Mr. Stephen Turnbull, joined SARTTAC in early October, with more on his background here.

In October 2023, SARTTAC and FAD conducted a one-week diagnostic mission with the Finance Department (FD) of the Indian state of Assam. The mission reached common understandings with the FD on the best way to proceed with a CD program focused on three areas: (i) reforming the budget process to allow for a more strategic budget formulation, (ii) improving policy and analytical focus of budget documentation and (iii) improving performance budgeting by strengthening indicators in the outcome budget. These areas of engagement were encompassed in a request made by the Government of Assam (GoA) to the India MoF’s DEA in 2022 for technical support from the IMF aimed at strengthening and modernizing their PFM processes. Subsequent discussions led to an agreement between the GoA and SARTTAC, with final approval by the DEA earlier this year of a CD program covering the period June 2023 to June 2025.

The diagnostic mission in October was preceded by the three-day workshop by SARTTAC in July for Assam FD officials highlighting good practices in the agreed reform areas. During both visits, it was evident that Assam was in a strong position to address its PFM challenges. In part, the FD had demonstrated its commitment to reforms through a World Bank-financed PFM project—Assam State Public Finance Institutional Reforms (ASPIRe), which provided a solid base, notably a state-of-the-art financial management information system. SARTTAC itself was not new to Assam, with the GOA hosting a PFM workshop on Strengthening of Budget Institutions for North-Eastern [Indian] States dating back to 2019.

Officials from Assam’s Finance Department gather for training in Guwahati on key reform aspects of SARTTAC’s engagement with the Government of Assam, with the workshop led by Ms. Celeste Kubasta, PFM Advisor, SARTTAC, and Mr. John Grinyer, short-term export for FAD (bottom row, right side).

Looking ahead, the success of the FD’s engagement with SARTTAC is expected to be anchored in strong leadership from the Assamese authorities, with the October mission meeting the Additional Chief Secretary and benefiting from senior guidance elsewhere in the FD. To supplement direct support from SARTTAC, selected FD officials have also been taking advantage of training delivered by SARTTAC, both regional and state-level workshops (e.g., on budget transparency and documentation with selected Indian states in Tamil Nadu in June). In the near term, TA will focus on budget documentation and performance indicators, aiding the budget preparation process, and on the medium-term fiscal framework, to enhance the credibility of future budgets.

A SARTTAC Regional Course on Core Elements of Banking Supervision in Mumbai in September was a great success, drawing enthusiastic supervisors who appreciated its well-balanced agenda. This in-person training, jointly organized with the IMF Monetary and Capital Markets Department and hosted by the RBI’s College of Supervisors, had 42 participants, including several senior representatives from nine different agencies in the six SARTTAC member countries, including from each country’s central banks. The course skillfully covered core supervisory topics and emerging issues such as climate risk, drawing facilitators from IMF HQ, with experience from the Bank of International Settlements, and from SARTTAC.

A distinctive feature of this course was its hands-on approach, using practical examples and interactive tools to foster a better understanding of regulation and supervision. The course was designed to encourage group discussions, which were vivid, and networking among participants, which created valuable connections among professionals. For example, participants liked the role plays and Excel exercises and the fact that they were able to present their own results and solutions. To sum up, the course not only provided a platform for knowledge-sharing and collaboration, but also enriched the understanding of banking supervision, leaving participants with valuable connections and insights. SARTTAC eagerly anticipates future engagements that promise to be equally insightful and enriching, with a follow-on regional course titled Navigating Banking Supervision: Unpacking the Latest Issues with a Regional Perspective to be held in New Delhi at SARTTAC during January 22-25, 2024.

Building on the course’s success, nine officials of Bangladesh Bank’s (BB) Risk-Based Supervision (RBS) Working Group visited the RBI for three days in late September, with support from SARTTAC. It turned out to be a highly successful peer learning event. As an extension of technical assistance on risk-based supervision (RBS) of banks provided to Bangladesh Bank (BB) by SARTTAC, a It provided a platform for sharing of knowledge-based developments and experiences in the financial regulation and supervisory processes thereof. The study visit, designed by the RBI in consultation with SARTTAC Financial Sector Supervision and Regulation Advisor, allowed first-hand experience sharing for switching from a traditional supervisory approach to a forward-looking risk-based framework.

Participants in the study visit were actively involved and forthcoming in sharing their perspectives and appreciated the similarities and differences in the risk-focused supervisory frameworks and practices between BB and RBI. The visit will be followed by further TA for BB from SARTTAC to facilitate this transition. The collective knowledge shared will undoubtedly be invaluable as BB embarks on their journey to implement RBS in their banking sector. Extremely positive feedback from both the jurisdictions is strong motivation for SARTTAC to offer similarly effective programs in future in our pursuit of nurturing the spirit of collaboration, adaptability, and shared learning in the region.

SARTTAC worked closely with India Ministry of Finance’s (MoF) Department of Economic Affairs (DEA) and the IMF Asia and Pacific Department (APD) on a hybrid international seminar on leveraging India’s Digital Public Infrastructure (DPI) on September 22. This peer learning event, which was hosted by the Ministry of External Affairs (MEA) (Sushma Swaraj Bhawan) in New Delhi, highlighted the use of DPI as a means of engendering more inclusive growth by being harnessed to foster innovation and competition, expand markets, close gaps in financial inclusion, and help make financial transfers to the vulnerable.

The main role for SARTTAC was to leverage its regional and global contacts to bring in a remote audience to learn from India’s experience. Officials in South Asia working with SARTTAC were invited to join, as were others engaged with IMF regional capacity development centers in Africa, the Middle East, and Central Asia. The MoF also worked with the MEA to extend an invitation to various Indian diplomatic missions, which resulted in a broad-ranging audience—both in-person and from remote. In total, the seminar attracted more than 900 registrants from around 100 countries, with most joining virtually. In all, the event had more than 500 unique connections, including shared ones from viewing audience in Indian embassies and consulates.

Scenes from the Digital Public Infrastructure Seminar (hybrid) in New Delhi on September 22, 2023.

The seminar featured two presentations on DPI, with presenters also joined by original architects and service providers of the DPI. Following an opening of the seminar by Mr. Krishna Srinivasan, Director of APD, Shri Ajay Seth, Secretary of the DEA, delivered opening remarks, noting the efficiencies India’s DPI (commonly known as India stack) had introduced to government service delivery, but with this public good also having broader positive implications on economic growth, a point that was elaborated on by Dr. V. Anantha Nageswaran, Chief Economic Adviser at the MoF in the seminar’s closing.

The first presentation drew from a recent IMF working paper on India’s journey in developing a world-class DPI, comprising unique identifications, payments systems, and data exchange (see Stacking up the Benefits: Lessons from India’s Digital Journey). The session, under the lead of Ms. Nada Choueiri, APD India Mission Chief and Assistant Director, highlighted powerful lessons for other countries embarking on their own digital transformation.

The second presentation was on the G20 Policy Recommendations for Advancing Financial Inclusion and Productivity Gains through DPI (see G20 Policy Recommendations). It was led by Mr. Laurent Gonnet, a Lead Financial Sector Specialist at the World Bank and one of authors of the report containing the recommendations, which were endorsed by G20 Central Bank Governors and Finance Ministers in July 2023. These action-oriented and customizable recommendations intend to help countries optimize the potential of DPI and provide use cases from emerging market and advanced economies.

SARTTAC itself later hosted a complementary training workshop on India’s Digital Payments System in late October, co-organized with and co-funded by the IMF Capacity Development Office in Thailand. In attendance were around 25 officials from Cambodia’s Ministry of Economy and Finance, who want to study lessons on design and use in India. Also joining them, with SARTTAC funding, were several officials from Bhutan’s MoF. A highlight of the workshop was a visit to Government e Marketplace (GeM) India (see GeM India)—the Government of India’s national public procurement portal.

![]() Stephen Turnbull joined SARTTAC as a Public Financial Management (PFM) Advisor in October 2023. During his professional career spanning 30 years, he has held senior financial management and consultancy positions in the public and private sectors, including with the United Kingdom Government and IMF. He has worked internationally across Europe, the Caribbean region, and Asia delivering and leading PFM and economic reform programs. His work areas have included the development of audit and assurance functions, enterprise and fiscal risk management, financial accounting, medium-term fiscal planning, legislative and institutional reform, and policy development, as well as improving the oversight of state-owned enterprises. He is a Chartered Accountant and member of the Chartered Institute of Public Finance and Accountancy.

Stephen Turnbull joined SARTTAC as a Public Financial Management (PFM) Advisor in October 2023. During his professional career spanning 30 years, he has held senior financial management and consultancy positions in the public and private sectors, including with the United Kingdom Government and IMF. He has worked internationally across Europe, the Caribbean region, and Asia delivering and leading PFM and economic reform programs. His work areas have included the development of audit and assurance functions, enterprise and fiscal risk management, financial accounting, medium-term fiscal planning, legislative and institutional reform, and policy development, as well as improving the oversight of state-owned enterprises. He is a Chartered Accountant and member of the Chartered Institute of Public Finance and Accountancy.

More articles from the same issue

- New engagement on strengthening public financial management reforms in the Indian state of Assam

- Working with the Reserve Bank of India on regional capacity development

- Sharing India’s experience with developing a digital public infrastructure

- Staff Announcements

- Technical Assistance

- Training and Webinars

- Other Activites

- Technical Assistance Reports Disseminated on Partners Connect during FY24 Q1

Previous Issues <