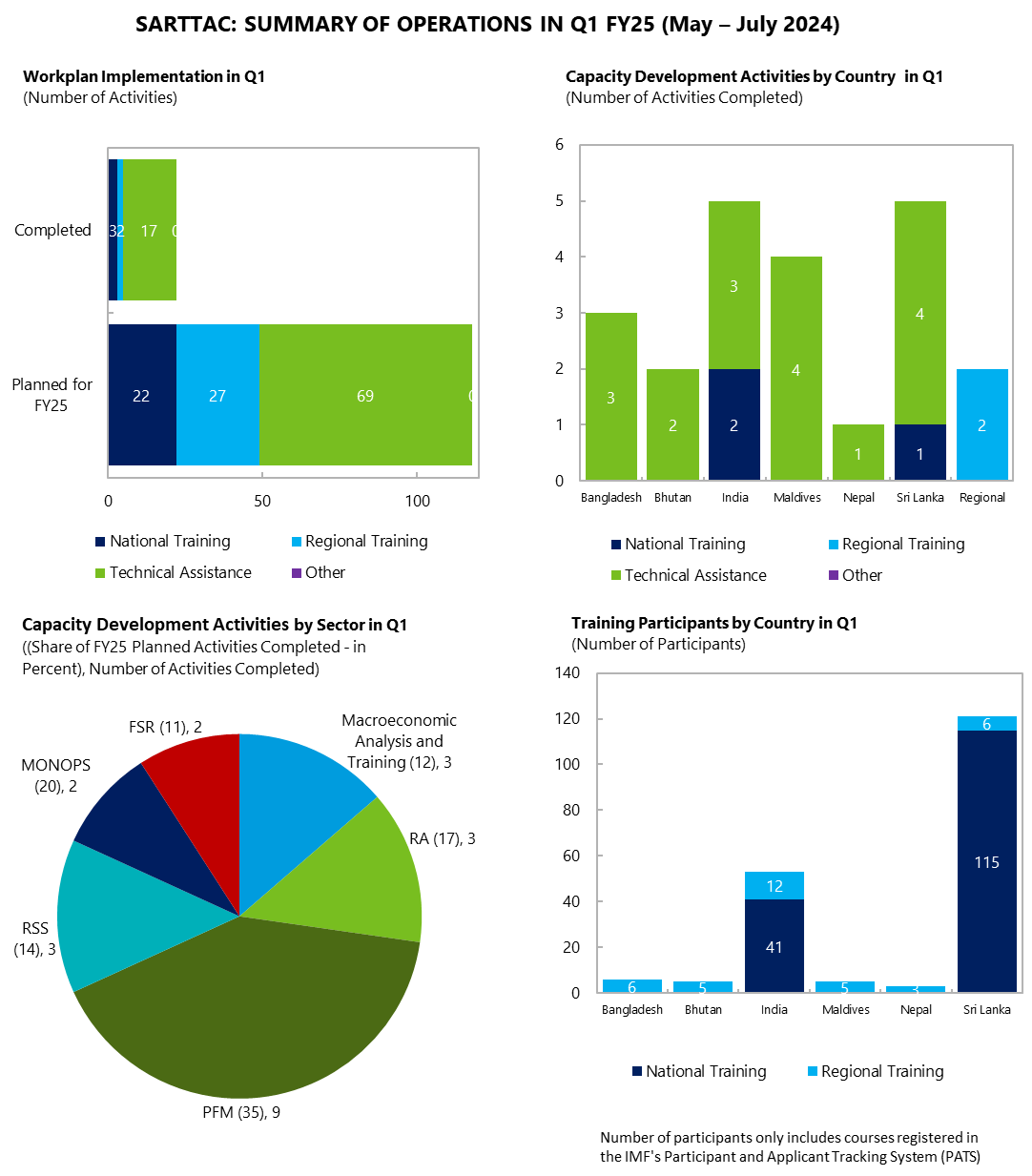

In Q1 of FY25 (May to July 2024), the IMF South Asia Regional Training and Technical Assistance Center (SARTTAC) engaged in several key activities:

A major event was SARTTAC’s eighth annual Steering Committee Meeting, held on July 31, 2024, in New Delhi. Key discussions focused on SARTTAC capacity development (CD) delivery in FY24, the CD workplan for FY25, and the broad strategy for Phase II of SARTTAC’s operations. Furthermore, dedicated sessions focused on: i) members countries’ experience with SARTTAC CD, with featured interventions of the Deputy Governor of Bhutan, Ms Choden, and the Deputy Governor of Bangladesh Bank, Mr. Khurshid Alam; ii) integration of SARTTAC CD with surveillance and program work featuring the interventions of the IMF Resident Representatives in the South-Asia region which included Mr. Jayendu De (Bangladesh), Mr. Ranil Manohara Salgado (India and Bhutan), Ms. Teresa Daban Sanchez (Nepal), and Ms. Sarwat Jahan (Sri Lanka).

IMF SARTTAC’s 8th Annual Steering Committee Meeting (Hybrid), July 31, 2024

The first course of SARTTAC new flagship series on Macroeconomic Foundation in Sri Lanka, developed in close consultation with the Central Bank of Sri Lanka (CBSL), was delivered. This new course targeted the new staff from various departments of the CBSL and Ministry of Finance (MoF). More details about this training can be accessed here.

SARTTAC’s Management conducted missions to Bangladesh and Sri Lanka to strengthen the engagement with the authorities and discuss members’ capacity development needs and priorities. Missions were led by SARTTAC’s Director, Ms. Giorgia Albertin, and included the Deputy Director, Mr. Saji Thomas.

A scoping mission was conducted in Maldives by SARTTAC’s newly appointed Public Debt Management Advisor, Mr. Sanjay Kumar, funded by Japan Administered Account for Selected IMF Activities (JSA). Discussions with officials from the Public Debt Management Department focused on assessing CD needs and formulate a roadmap for technical assistance.

Mission to Bangladesh (May 7-9, 2024)

(From Left to Right Ms. Giorgia Albertin (Director SARTTAC), Ms. Priscilla Toffano (MCM Economist, Bangladesh country team), Mr. Khurshid Alam (Deputy Governor, Bangladesh Bank) and Mr. Saji Thomas (Deputy Director SARTTAC)

A joint regional workshop on Digital Money and Fiscal Operations was held in Tokyo (June 10-13, 2024), in collaboration with the IMF Fiscal Affairs Department (FAD), IMF Regional Office for Asia and the Pacific (OAP), the IMF Information Technology Department, and the IMF Capacity Development Office in Thailand (CDOT). The seminar drew senior officials from ministries of finance across the Asia-Pacific region, focusing on integrating digital money in treasury management, revenue collection, and public service delivery. Participants showcased their country’s practices related to the adoption of digital money in fiscal operations through high-level peer-to-peer learning workshops and panel discussions.

Regional Training on Digital Money and Fiscal Operations jointly organized by SARTTAC, FAD, ITD, OAP and CDOT (June 10-13, 2024)

Regional Training on Digital Money and Fiscal Operations jointly organized by SARTTAC, FAD, ITD, OAP and CDOT (June 10-13, 2024)

SARTTAC kicked off Q1 FY25 by successfully organizing five high-impact training events, listed here, that supported enhancing macroeconomic capacities and financial supervision in the region. Notably:

A course on banking supervision, held in Mumbai (June 24-28, 2024), offered a comprehensive overview of the current regulatory and supervisory challenges in the banking sector. Building from the feedback and the request received from a similar training delivered in FY24, the course looked at regional perspectives on emerging issues in banking supervision such as climate-related financial risks, implementing International Financial Reporting Standard (IFRS) 9 and technology-related issues such as fintech and cybersecurity.

India and Sri Lanka benefited from national-level customized training. A Financial Programming and Policies (FPP) was delivered to 17 probationers from the Indian Economic Service (IES), using an Indian case study to deepen their understanding of macroeconomic sectors and policy analysis. Additionally, 23 officials from regional offices of the Ministry of Statistics and Programme Implementation (MoSPI) of India participated in the National Accounts Statistics course, which focused on developing essential skills for compiling annual and quarterly GDP with emphasis on regional aggregates.

During the first quarter of FY25, seventeen TA missions were delivered spread across all SARTTAC countries and sectors as listed here. In particular:

In Bangladesh, a TA mission supported National Board of Revenue (NBR) (June 9-20, 2024) in strengthening its compliance risk management including developing Compliance Improvement Plans. A training on Compliance Improvement Plans was also delivered to NBR officials during the mission.

In Bhutan, SARTTAC delivered two missions to support the authorities. A TA mission (May 20-28, 2024) assisted the Royal Monetary Authority in improving its foreign exchange reserves management framework. Another mission (July 23-Aug 5, 2024) provided further support in designing Bhutan’s unified chart of accounts.

As part of SARTTAC’s ongoing CD support at the subnational level in India, three missions were conducted to selected states. A mission to Odisha (May 13-25, 2024) evaluated the public investment management practices. This was second such assessment (after Tamil Nadu in November 2022) and included a climate module. A mission to Assam (May 27-31, 2024) imparted training to the State Finance Department officials in areas such as Gross State Domestic Product forecasting, debt stock, interest and fiscal space forecasting. Another mission (July 29-Aug 2, 2024) to Assam focused on State-Owned Enterprise – Health Check Tool.

Medium-Term Fiscal Framework mission to the state of Assam, India

(May 27-31, 2024)

In Maldives, CD support was provided to Maldives Monetary Authority (May 26-June 6) in strengthening its regulatory and supervisory capacity for implementation of the regulatory framework for IFRS 9 and expected credit loss. Another mission to Maldives Ministry of Finance (June 30-July 4, 2024) reviewed the budget formulation, reallocation and virement processes and how these aligned with a proposed law on fiscal responsibility.

In support of Nepal’s efforts for advancing its cash management systems, a SARTTAC mission (June 24-28) provided comprehensive training on using cashflow forecasting and analytical tool (CFAT) including making annual and in-year adjustments to accommodate policy changes.

TA Mission to Nepal on Cash Management (June 24-28, 2024)

A mission visited Sri Lanka to support the authorities in improving the functioning of the foreign exchange (FX) market functioning and foster deep and liquid FX market. The mission (June 24-28, 2024) capitalized on the findings of the first mission conducted earlier in the year and focused on trading platform and rules, market conduct, communications, and FX operations.

TA Mission to Sri Lanka focused on Improving Foreign Exchange Market Functioning (June 24-28, 2024)

A customized macroeconomics in-person training for the new staff of the Central Bank of Sri Lanka (CBSL) and Ministry of Finance (MoF) was organized in Colombo, Sri Lanka from May 27-31, 2024. 115 participants from various departments of CBSL such as financial supervision and regulation, payments systems, and legal and foreign exchange operations enthusiastically attended the training.

CBSL requested this training as part of their capacity development program, spearheaded by the Center for Banking studies (CBS), the training academy of the CBSL. This flagship course was offered for the first time in Sri Lanka and was curated in close consultation with the CBS. It was designed for the new CBSL staff with diverse academic backgrounds, to broaden their knowledge of macroeconomics and equip them with macroeconomic tools to assess the macroeconomic challenges that Sri Lanka currently faces. The program covered the current state of the economy; the stance of fiscal and monetary policy; financial stability; exchange rate misalignments; vulnerabilities in the different sectors; and the medium-term outlook, especially the sustainability of public debt. Throughout the course, these concepts were applied to Sri Lanka to illustrate its current macroeconomic opportunities and challenges, and to demonstrate practical tools for use in day-to-day macroeconomic analysis and policy making.

More articles from the same issue

A Focus on Technical Assistance

- Macroeconomic Foundation Course for Central Bank of Sri Lanka (CBSL)

- Summary of Operations in Q1 FY25

- Technical Assistance

- Training and Webinars

- Technical Assistance Reports Disseminated on Partners Connect during FY25 Q1

Previous Issues <