In the second quarter of FY25 (August – October 2024), the IMF South Asia Regional Training and Technical Assistance Center (SARTTAC) delivered a wide range of CD activities, including several new training activities hosted for the first time in SARTTAC member countries:

- In October 2024, SARTTAC launched a new dedicated seminar series for the Ministry of Finance of India. A series of lectures were delivered on key economic and financial topics, including macroeconomic stability, debt sustainability and public debt management, fiscal risks assessment and management.

- For the first time, national training course on International Financial Reporting Standards (IFRS9) was conducted in Bhutan and Nepal. The first workshop was conducted in Bhutan (Thimphu) in collaboration with the Royal Monetary Authority (September 23-27, 2024). Following this, a similar workshop was delivered in Nepal (Kathmandu), hosted by the Nepal Rastra Bank (NRB). The workshops focused on asset classification and provisioning, both from the prudential regulatory and accounting perspective.

- New tailored national training courses on macroeconomic foundations were delivered for the first time in Bhutan and Maldives. Following the successful delivery of SARTTAC’s first national Macroeconomics Foundation training course in Sri Lanka in the first quarter of FY25, the course was offered in Bhutan, in partnership with the Royal Monetary Authority of Bhutan (RMA) (August 5-9, 2024), and subsequently in Maldives in collaboration with the Maldives Monetary Authority (MMA) (August 18-22, 2024). Both trainings were customized using data and case studies from the respective countries to make them more relevant for the country officials and to encourage discussions during lectures and workshops.

Macroeconomic Foundation Course in Maldives in partnership with the MMA

(August 18-22, 2024)

- The first regional workshop on Developing a Medium-Term Debt Management Strategy (MDTS) was conducted at SARTTAC (September 23-27, 2024). This was financed under the Japan Administered Account for Selected IMF Activities (JSA). Government officials from SARTTAC member countries and Lao PDR attended the training. Participants were trained on the joint IMF-World Bank MTDS framework to assess cost and risk tradeoffs associated with different debt management strategies and managing the risk exposure embedded in a debt portfolio.

- For the first time, a regional training on National Accounts Statistics for officials of SARTTAC member countries was organized in Nepal. This aimed at enhancing the compilation, dissemination, and interpretation of annual GDP statistics in SARTTAC member countries (September 30 - October 4, 2024).

- SARTTAC’s Public Financial Management (PFM) program with the Indian state of Odisha was successfully concluded. Two missions conducted in August 2024 closed SARTTAC’s project with the Odisha state on selected PFM issues. This supported strengthening cash and debt management, developing strategic budgeting function, enhancing budget execution controls, and developing fiscal risk management and public investment management. Please click here for details.

SARTTAC delivered a series of high-impact training courses that supported enhancing macroeconomic analysis and forecasting, strengthening public financial management and revenue administration in the region:

- A specialized training on Selected Macroeconomic Issues for senior RBI officers was delivered in collaboration with the Reserve Bank of India (RBI) Training Academy (August 27 – 31, 2024). Participants had diverse academic backgrounds from departments such as research, economic policy, financial supervision and regulation, payments systems, and legal and foreign exchange. The course focused on equipping participants with foundational macroeconomic knowledge and tools to analyze the Indian economy and its policies.

- A tailored course on Selected Macroeconomic Issues for the Mid-Career Indian Economics Services officials was delivered (September 30 – October 11, 2024), targeting a wide range of ministries and agencies. The course focused on India’s current macroeconomic trends and policies covering key topics such as Goods and Services Tax (GST), climate finance macroeconomics, and public-private partnerships (PPPs).

Selected Macroeconomic Issues for the Mid-Career Indian Economics Services

Selected Macroeconomic Issues for the Mid-Career Indian Economics Services

(September 30 – October 11, 2024)

- An introductory course on Revenue Forecasting and Analysis for the Central Board of Direct Taxes (September 9–13, 2024) was delivered. It focused on quantitative techniques for revenue forecasting, tax policy analysis, and principles of sound institutional frameworks.

Participants interacting during the training on Revenue Forecasting and Analysis for the Central Board of Direct Taxes (September 9–13, 2024)

- A one-week training program was successfully delivered on Strengthening Public Financial Management Framework (September 23 – 27, 2024). A key collaborative initiative between SARTTAC and the Institute of Public Finance (IPF), Bangladesh to strengthen fiscal capacity and support effective economic management, the course targeted participants of IPF’s Fiscal Economics and Economic Management (FEEM) program to strengthen the understanding of key PFM issues and practices, including the relationship between macroeconomic forecasting and fiscal policy.

Strengthening Public Financial Management Framework (September 23 – 27, 2024)

Strengthening Public Financial Management Framework (September 23 – 27, 2024)

- A regional workshop on Cash Management and Treasury Single Account was successfully delivered (October 14 – 18, 2024), building on SARTTAC’s earlier technical assistance missions and a previous regional workshop conducted in collaboration with the IMF Capacity Development Office in Thailand (CDOT) in August 2023. The workshop fostered sharing knowledge on global advancements and best practices in government cash management. Adopting a multi-pronged approach, it focused on enhancing existing cash management practices and providing guidance on effectively presenting information to support informed decision-making.

During the second quarter of FY25, fourteen TA missions were delivered, across all SARTTAC countries and workstreams. In particular:

- In Bangladesh, a mission (October 21-30, 2024) supported the Planning Commission’s efforts to implement climate change sensitivity in Public Investment Management during project appraisal and project selection. Another mission (October 27-31, 2024) supported the Ministry of Finance in customizing its Macro Framework Foundation Tool for forecasting.

TA mission to support the Planning Commission, Bangladesh (October 21-30)

TA mission to support the Planning Commission, Bangladesh (October 21-30)

- In Bhutan, two missions supported the Royal Monetary Authority in setting up an Interest Rate Corridor Framework (August 20-29, 2024) and in implementing Risk-Based Supervision Framework (September 10-17, 2024). Another mission assisted the National Statistics Bureau in finalizing the experimental constant price quarterly gross domestic product estimates (October 14-18, 2024).

- In the Indian State of Odisha, two TA missions took place in August 2024 which also marked the successful completion of SARTTAC’s subnational level CD support in the PFM stream in another state after Tamil Nadu (SARTTAC CD program with the state of Tamil Nadu concluded in FY24). More details on SARTTAC’s engagement with Odisha can be accessed here.

- In Maldives a mission supported the Inland Revenue Authority (October 6-15, 2024) in aligning their new Strategic Plan to Maldives’ Medium-Term Revenue Strategy. Another mission (October 20-29, 2024) assisted the Maldives Monetary Authority in streamlining and operationalizing instruments, operations, liquidity forecasting, and collateral frameworks. Furthermore, a mission under SARTTAC’s new Public Debt Management program - financed by the JSA - reviewed the public debt bulletin and recommended measures to improve its coverage and content.

- In Nepal, a workshop on Banking Supervision, International Financial Reporting Standards 9 (IFRS9) and Expected Credit Loss (ECL) was delivered in collaboration with the Nepal Rastra Bank (September 23-27, 2024). More details on the training can be accessed here.

- In Sri Lanka a mission (September 3-16. 2024) supported the Ministry of Finance in transition to the Integrated Treasury Management Information System (ITMIS) and to introduce commitment control systems in the budget execution process. Fostering synergies, the mission also delivered a training workshop in these areas. A mission under the JSA- funded Public Debt Management program, assisted the authorities in establishing a Public Debt Management Office and provided TA on auctioning of government securities.

Commencing in 2019, the program covered a range of PFM topics. This included cash and debt management, developing the strategic budgeting function including strengthening macro-fiscal forecasting and medium-term budgeting, enhancing budget execution controls, developing fiscal risk management and public investment management. Most recently, a Public Investment Management Assessment (PIMA) and Climate-PIMA was conducted in May 2024.

Reform-oriented Odisha State is now considered one of the exemplars in modern PFM practices across the Indian States. Key achievements include the introduction of data driven cash forecasting, fiscal strategy and fiscal risk statements, implementation of medium-term budget allocations and utilization of the IMF fiscal risk toolkits to assess and manage a range of macro-economic and fiscal risks that have contributed to the development of sustainable public finances.

During August 2024, two final technical assistance missions covering three topics were conducted. The commitment control activity was the final in a series of missions that supported the Financial Management System design, development and implementation of expenditure commitments to assist with budgetary control and cash management functions. A second mission supported the development of efficient public investment management practices, following the recommendations from the PIMA/C-PIMA. This concentrated on project appraisal and selection and maintenance planning. Furthermore, in a first for SARTTAC, a gap analysis was conducted and helped Odisha develop a medium-term PFM Reform program for the integration of green and environmental considerations into the full PFM cycle.

PIMA/C-PIMA TA Missions to Odisha, August 2024

PIMA/C-PIMA TA Missions to Odisha, August 2024

In August 2004, a regional workshop was delivered for the first time in Bhutan on Banking Supervision -International Financial reporting Standards 9 (IFRS9) and Expected Credit Loss (ECL) Supervision, hosted by the RMA. It was organized as a five-day workshop for banking supervisors of the SARTTAC member countries and few participants from Namibia which is covered by Africa Regional Technical Assistance Center - South. The course used a mix of presentations and group activities to reinforce the supervisor’s capacity to exercise supervisory judgment and was attended by 38 participants, including 16 women, from seven jurisdictions (six SAARTAC member countries and Namibia). This cross-regional workshop provided an expanded opportunity and platform for person to person learning and collaboration.

Workshop on IFRS9 and ECL Supervision in Bhutan (August 26-30, 2024)

Workshop on IFRS9 and ECL Supervision in Bhutan (August 26-30, 2024)

Following this, a similar workshop was delivered in Nepal, hosted by the NRB, at Kathmandu. This was attended by 40 participants including 17 women in September 2024. The goal was to strengthen supervisory capacity in IFRS 9 and ECL implementation which is particularly relevant to Nepal as it has implemented NFRS9 (Nepal Financial Reporting system) from mid-July 2024.

In Nepal (September 23-27, 2024)

In Nepal (September 23-27, 2024)

The courses were especially designed to cover the priority areas that both banks and supervisors should be focusing on. Among the SARTTAC member countries, Sri Lanka, Bhutan, and Maldives, have already implemented IFRS9-ECL frameworks, SARTTAC is already providing assistance to them including guidance on conduct of on-site examination of banks. Nepal has implemented NFRS9 (Nepal Financial Reporting system) from mid-July 2024, while India and Bangladesh have a plan to implement it for their banks in short to medium term.

Both workshops focused on asset classification and provisioning, both from the prudential regulatory perspective and the perspective of accounting. It also explored the role of the supervisor in reconciling differences between the two perspectives. In addition to covering loan loss provisioning principles and the requirements of the Basel Committee on Banking Supervision (BCBS), the course discusses IFRS 9’s ECL recognition principles and related IFRS requirements. The course also tackled IFRS 9 implementation issues, including those related to challenges faced by inspectors during on-site examination.

Senior Management (Governor/Deputy Governor) addressed and interacted with the participants during the opening and closing of both the courses. The course was very well received and connected the issues back to what it means for supervisors, and how to incorporate it into their supervisory approach, processes, tools and techniques.

“I found this course to be very useful in helping our endeavors as supervisors in ECL implementation, challenging our perceptions and focusing on our responsibilities. This course was organized at a very effective time and the facilitations by our mentors in our learning process was highly commendable”. - Participant

For the first time, a regional training course on National Accounts Statistics for officials from SARTTAC countries was organized in Nepal during September 30 - October 4, 2024. This aimed at enhancing staff capacity in compiling, disseminating, and interpreting annual GDP statistics. This was the first regional course on the topic offered by SARTTAC outside of Delhi. Building from the feedback and the requests received from previous TA missions and training courses delivered in the region, this course provided participants an overview of the System of National Accounts 2008 (SNA 2008), Production Account, GDP by Expenditure Component, Supply and Use Tables (SUT), Price and Volume Measures, Rebasing and Backcasting, and Measuring Economic Activities at the Regional Level.

This course was particularly designed for recently hired and experienced staff of national statistical offices (NSOs) and officials from the Ministry of Finance. It addressed skills gaps in the newly hired staff and offered a valuable opportunity for participating countries to strengthen their national accounts capabilities through knowledge sharing and skill development. This regional training workshop was intended to maximize the effectiveness of upcoming technical assistance missions and advancement of sound practices in national accounts compilation among SARTTAC countries.

Regional training on National Accounts Statistics, Kathmandu (September 30 - October 31, 2024)

Regional training on National Accounts Statistics, Kathmandu (September 30 - October 31, 2024)

More articles from the same issue

A Focus on Technical Assistance

- SARTTAC’s engagement with the Indian State of Odisha under the public financial management (PFM) program was successfully concluded in August 2024

- International Financial reporting Standards 9 (IFRS9) and Expected Credit Loss (ECL) Supervision

- National Accounts Statistics

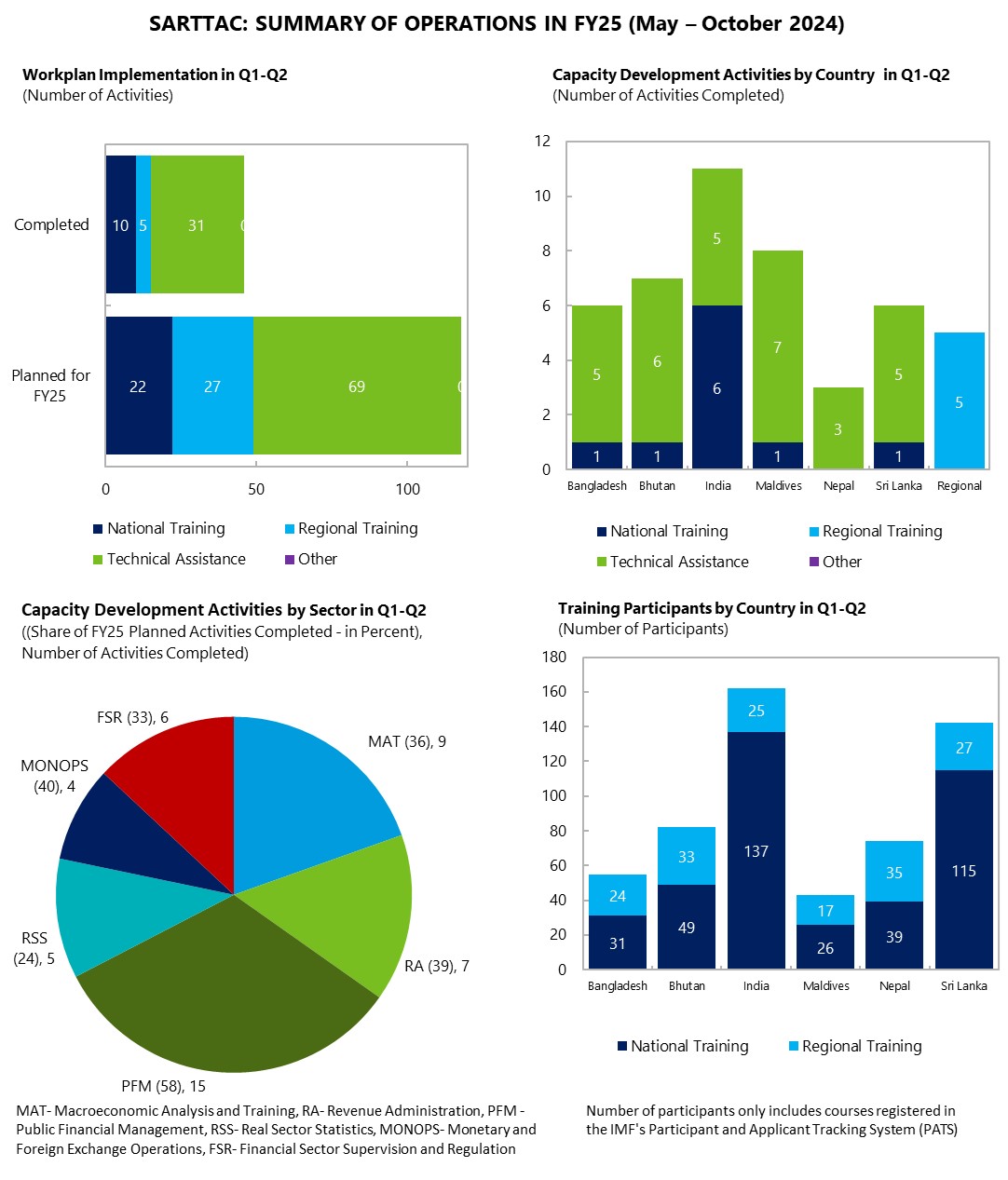

- Summary of Operations in FY25 Q1 & Q2

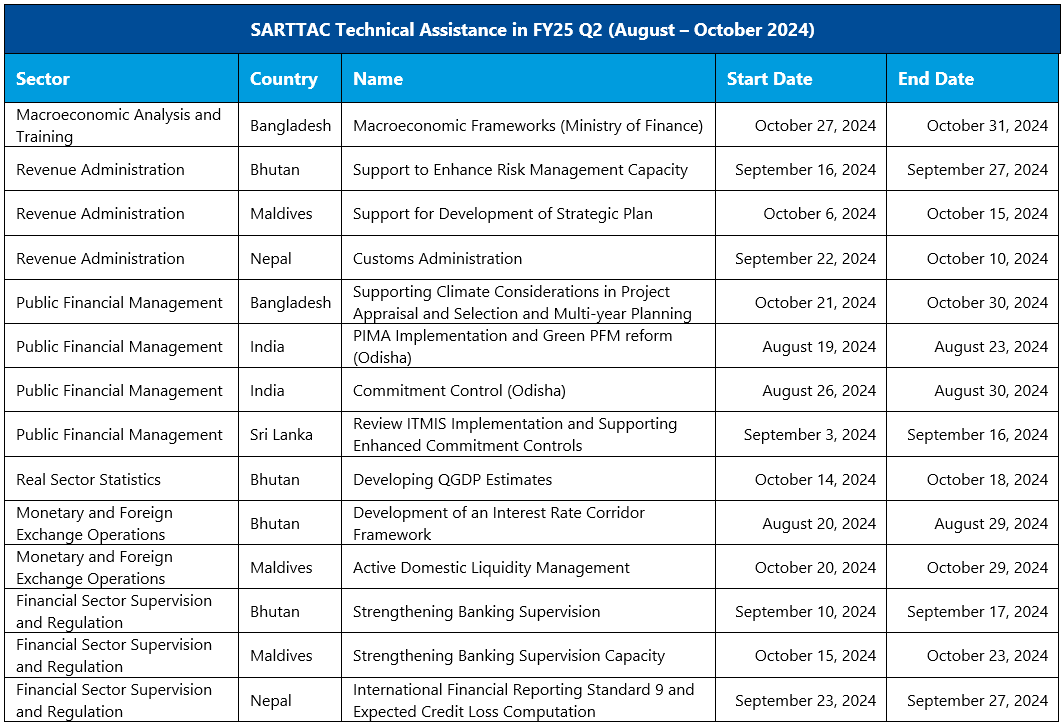

- Technical Assistance

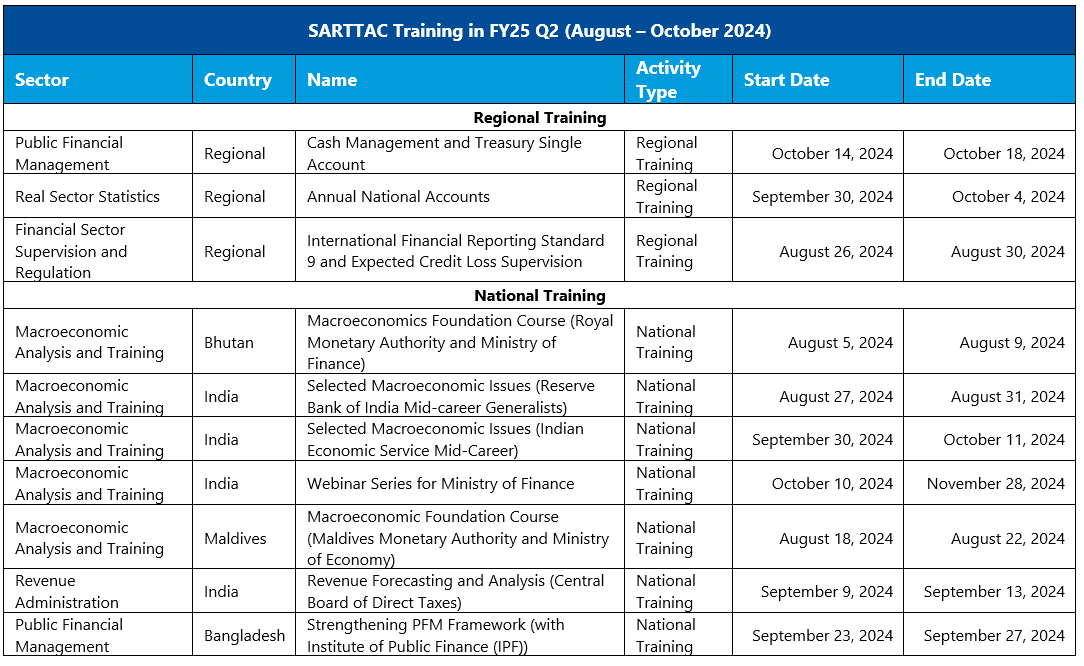

- Training and Webinars

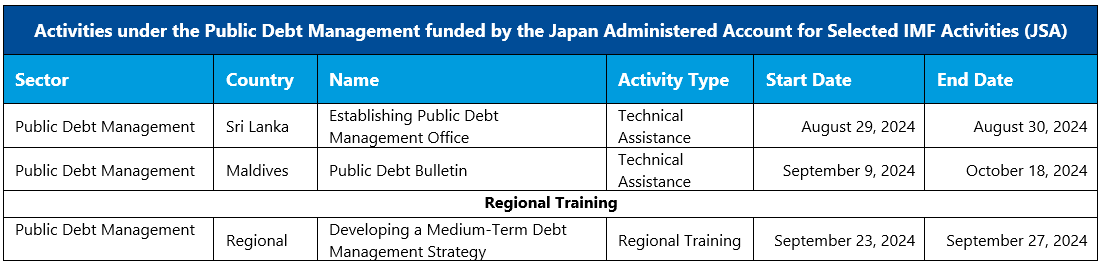

- Activities under the Public Debt Management Program funded by the Japan

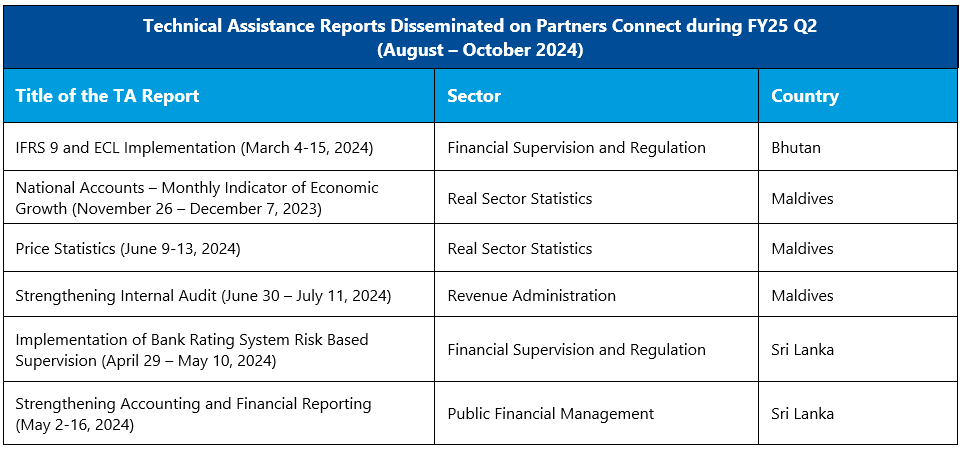

- Technical Assistance Reports Disseminated on Partners Connect during FY25 Q2

Previous Issues <