After a two-year pandemic-induced gap, SARTTAC resumed in-person activities in February 2022, highlighted by a resumption of face-to-face training—a first amongst IMF regional capacity development centers. As a start, training was provided on core macroeconomic principles to civil service officer trainees at India’s Lal Bahadur Shastri National Training Academy (LBSNAA) in Mussoorie in mid-February, led by Bhaswar Mukhopadhyay, Deputy Director of SARTTAC. This engagement was followed up in late April with delivery at LBSNAA of a tailored macroeconomics module for Indian Administrative Service officer trainees during their Phase I course.The SC representatives appreciated SARTTAC’s continued adaptability of virtual training to the needs of member countries, but welcomed planned moves to in-person delivery.

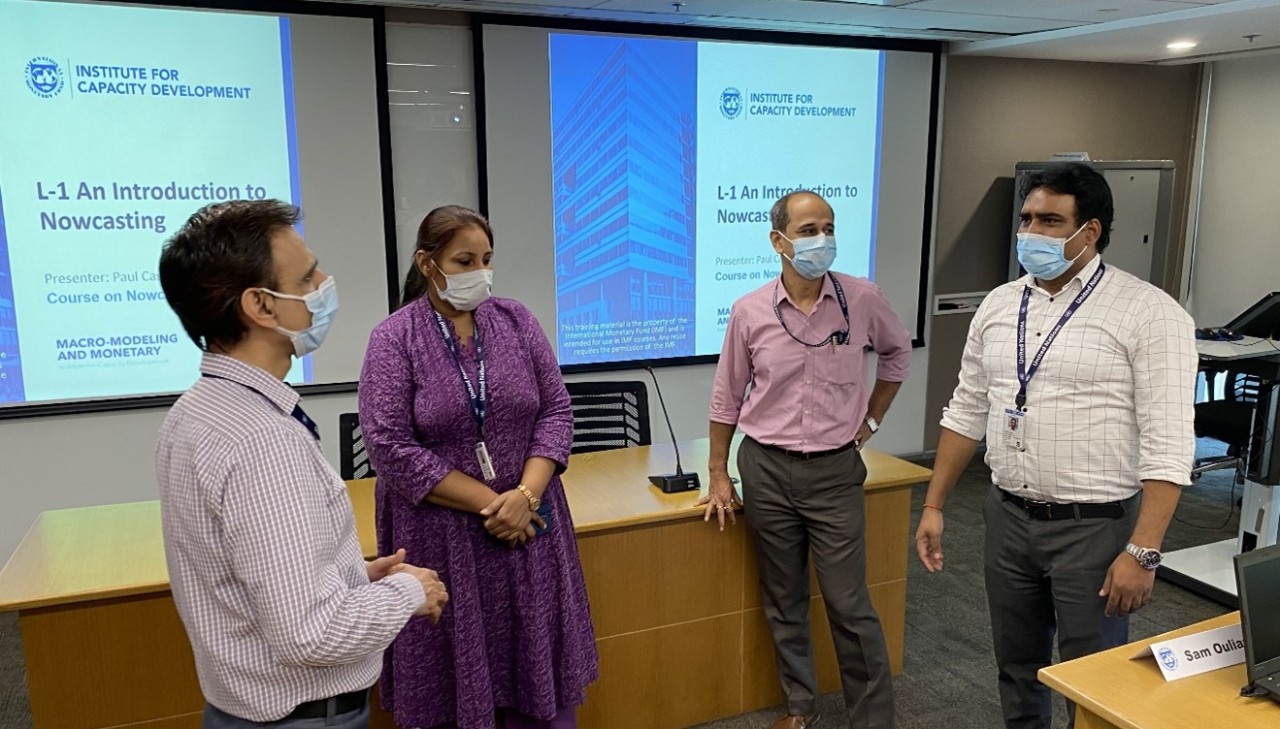

SARTTAC commenced in-person training in its facilities with a regional Nowcasting course at end March in New Delhi delivered by the IMF Institute for Capacity Development (ICD) and joined by around 20 officials from Bangladesh, India, Nepal, and Sri Lanka. Earlier in the month, a short mission visited Nepal to assess capacity development (CD) needs, comprising David Cowen, Director, and Raju Sharan, Public Financial Management (PFM) Advisor. The mission held fruitful discussions at the Ministry of Finance, Central Bureau of Statistics, and Nepal Rastra Bank, highlighted by a meeting with Governor Maha Prasad Adhikari. Finally, in-person technical assistance (TA) delivery commenced in mid-April with a PFM mission to the Indian state of Odisha by Celeste Kubasta, PFM Advisor, and John Grinyer, Macro-Fiscal Advisor.

The fourth quarter of FY22 marked another milestone in SARTTAC—the fifth anniversary of its official opening and first Steering Committee (SC) meeting on February 13, 2017. Since then, SARTTAC has held nearly 300 training events involving nearly 9,000 participants, while technical assistance (TA) has been active in all member countries across a range of CD programs, notwithstanding challenges posed by remote delivery during the pandemic. At the time of its opening, SARTTAC was expected to complete its first phase of operations (i.e. Phase I) by April 2022. However, with some budgetary savings, in part because of restricted travel and the uptake of TA the past two years, Phase I is now expected to extend into 2023, as discussed at SARTTAC’s mid-year SC meeting in January.

Looking at FY22 as a whole, SARTTAC delivered 69 training activities during its fiscal year (May 1 2021 – April 30, 2022), representing around 95 percent of those proposed at mid-year. National and regional courses attracted nearly 1,500 participants—almost double from last year—owing in part to more cohort training for India, while topical webinars attracted another 1,000 participants. Notwithstanding continued remote delivery challenges, TA missions picked up in the second half of FY22, with 35 TA reports [link to TA table below] disseminated in FY22, including 10 in the fourth quarter. All occurred as SARTTAC welcomed two new expert advisors in last quarter of the fiscal year—Rajeswari Thondiyil as the Real Sector Statistics Advisor, replacing Rodger Sceviour (see the FY22 Q3 quarterly bulletin) and Ravinder Saroop as Revenue Administrator Advisor, replacing Elizabeth Goli, as featured below.

Currently, SARTTAC is in the process of finalizing its regional workplan for FY23 for formal endorsement by its SC at its sixth annual meeting, now scheduled on July 7. The meeting is expected to be hybrid and held in SARTTAC in New Delhi. Part will be devoted to discussing a timeline for Phase II of SARTTAC’s operations. Ahead of the meeting, a report on SARTTAC’s operations in FY22 will also be circulated to the SC, setting the stage for July’s meeting. With the adoption of a new mission travel framework by the IMF in early April 2022 and and more favorable conditions in much of South Asia in terms of health risks, prospects look good in FY23 for both in-person TA and training, as will be featured in the workplan.

The resumption came more than two years after SARTTAC and other RTCs ceased in-person delivery owing to the impact of the pandemic. It came at a critical time, given waning interest in virtual delivery, especially for longer courses (i.e., for more than a week). In post-course surveys of participants in SARTTAC training, a constant refrain had been that concentrating for long hours on a computer screen and combining regular work with learning were taxing. Connectivity issues, especially from home, and off-hour courses (to accommodate remote trainers) also proved challenging. Thus, it came as little surprise that when the health situation improved across the region and government officials returned to their offices, interest in virtual training began to drop off.

From the onset, planning for a resumption of in-person training required development and approval of detailed health and safety procedures, on which SARTTAC worked closely with IMF headquarters (HQ).

The procedures adhered to local guidance by the Delhi National Capital Region on COVID-19 protocols and took on board steps being taken at HQ and in field offices to better ensure safety in the face-to-face environment, including in SARTTAC. Other RTCs have now used these procedures to guide their own plans to resume in-person training. They comprised early verification of vaccination status of all course applicants; testing of all participants, faculty, and SARTTAC staff before and during the course; limiting class size to ensure social distancing in the classroom; and masking in all public spaces in the center. All went a long way to ensuring everyone felt as comfortable as possible traveling to India and resuming in-person training. and to observe IMF and national guidelines for travel, which were evolving rapidly as countries reopened borders.

The Nowcasting course was an excellent choice to restart in-person training.

As a brand-new course being offered by the IMF Institute for Capacity Development (ICD), it proved especially relevant at a time when global economic conditions are still volatile and near-term outlooks subject to greater variation and change. A short module on Nowcasting, which was taught at an earlier SARTTAC course on Macroeconomic Forecasting and Analysis, was extremely popular, with participants there voicing interest in a full course on the topic. Notwithstanding a short nomination deadline, the Nowcasting course received many applicants, even with candidates from Bhutan and Maldives not permitted to travel for internal reasons. The strength of the applicant pool and the quality of the course and its faculty, comprising of Paul Cashin, head of ICD’s Macro-Modeling and Monetary Division, Jing Xie, also from ICD, and Sam Ouliaris, short-term expert and a key figure in analytical development and practical application of Nowcasting, were reflected in the impressive learning gains achieved.

In the end, the course proved to be a big success, foremost because of the content and delivery. The faculty and administrators, the latter comprising Jagriti Arya as the lead Course Administrator (CA) and supported by Debraj Chaudhuri as a Senior CA in SARTTAC, received high marks in an end-of-course evaluation, with participants grateful for the opportunity to take the new training and also do it in an environment more conducive to learning. The longer training day was now able to incorporate a full range of hands-on exercises. The interaction during the course—especially important for a technical subject like Nowcasting, and the focus on learning without distractions were also appreciated by both faculty and participants. SARTTAC staff were happy as well to once again be able to engage directly with stakeholders to resume reacquaintances in the region and from HQ and to understand better future CD needs in South Asia.

Looking ahead, SARTTAC plans to deliver a large share of its training in-person in FY23. The Nowcasting course was followed by a full month of in-person macroeconomic training in April 2022 for officer trainees from the Indian Economic Service, and SARTTAC has an exciting program of courses for the current fiscal year , including new courses planned on macroeconomics and climate change and central bank digital currencies. With the support of the region and HQ, SARTTAC looks forward to a return to normalcy and is hopeful that we can manage the lingering effects of the pandemic with the same cooperative spirit as demonstrated by all during the Nowcasting course.

|

In late March 2022, Elizabeth Goli, or Liz, as she preferred, finished a two-year term as SARTTAC’s Revenue Administration (RA) Advisor. Because of the pandemic, all of Liz’s work was done from remote from home in her native Australia and through virtually delivery, apart from a pre-assignment visit to India and participation in a mission (as a short-term expert (STX)) to Bangladesh in January 2020. Despite the obstacles to delivery, her term in SARTTAC was hallmarked by a strong uptick in training opportunities for officials on RA, with good participation across all member countries and especially in India with several newly customized courses. |

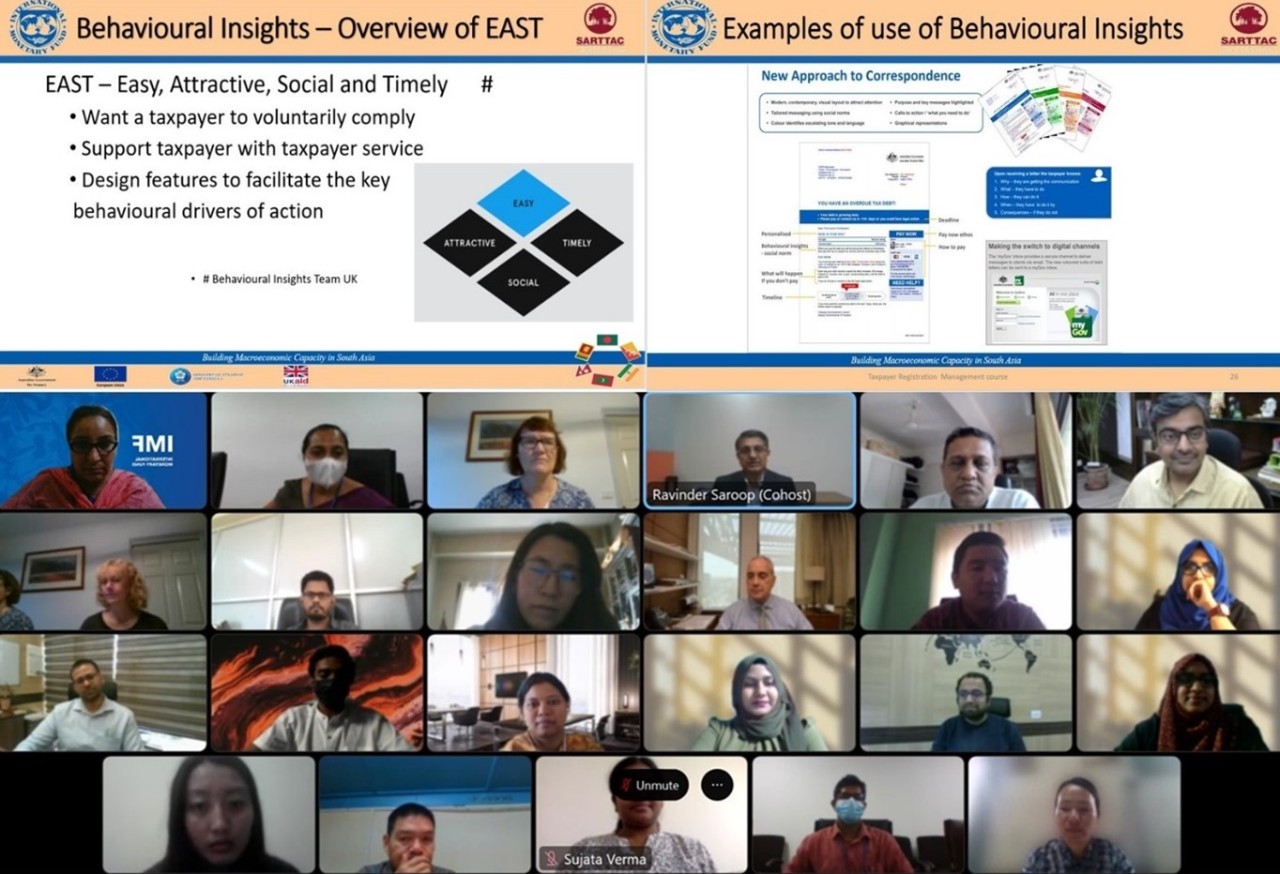

At the regional level and focusing on the past year, FY 22 saw delivery for the first time in SARTTAC of a regional Tax Administration Diagnostic Assessment Tool (TADAT) Accreditation course. It proved very popular with revenue officials, helping strengthen their understanding of international good practices in RA. The year also saw delivery of four other regional courses covering compliance risk management, collection and arrears management, risk-based audit techniques, and taxpayer registration. Each course was well subscribed and actively joined by SARTTAC member country officials, and also favorably evaluated by them, in part owing to a strong group of STXs, namely experienced tax practitioners, cultivated under Liz’s active guidance in project management.

At the country level, and looking at both training and technical assistance (TA), engagement was affected, especially in FY21, by COVID-19 lockdown measures, which constrained delivery in several countries. However, Liz’s tenure witnessed the development of a strong partnership with India’s Central Board of Direct Taxes to provide tailored training on a wide range of topics, including a new course on behavioral insights in FY22. On TA, very good engagement was maintained with Maldives, with support for the introduction of the income tax and on international tax issues, and with Bhutan in support of implementation of the planned goods and services tax (GST), with Liz herself joining a virtual GST TA review mission, led by IMF headquarters, in February-March 2022.

While having finished her advisor’s role, Liz is already supporting the IMF’s capacity development work on revenue administration as an STX, having just completed a two-month virtual handover with her successor Ravinder Saroop (see below). Her work with the Fund in the capacity as an STX is expected to continue on different projects, with hopes that some of her support will include for South Asia when the opportunity arises. In the meantime, all of us in SARTTAC thank Liz for being a great colleague, with hopes of working together with her again, this time in-person, in India or elsewhere in the region.

New Staff Announcement

|

Ms. Rajeswari Thondiyil is the new Real Sector Statistics Advisor (RSS) in SARTTAC. She joined in February 2022, having previously held the post of Additional Secretary in the Government of India (GOI). During her 36-year career in the GOI, Rajeswari worked in several statistical domains, including national accounts (with more than 25 years of experience) and foreign trade, labor market, and government finance statistics. She has published several journal articles on national accounts topics and her current research interests include measuring the digital economy and valuing unpaid household services. Rajeswari has also represented India in several international statistical fora (including Eurostat, OECD, and UN ESCAP) and has also conducted extensive training of national accounts compilers in India at the national and state level. |

Technical Assistance: February – April 2022

BANGLADESH

Macroeconomics: A mission, led by the IMF Institute for Capacity Development and funded by SARTTAC, delivered lectures and workshops on nowcasting and other econometric techniques to officials from Bangladesh Bank (BB) (March 27-31), as part of the commencement of work on a Forecasting and Policy Analysis System (FPAS). The topics covered included, among others, issues of seasonal adjustment, non-stationarity, structural breaks, nowcasting models, and discussion of forecast uncertainty and evaluation. The mission also performed a preliminary assessment of the data, tools, and techniques used for forecasting in BB.

Government Finance Statistics: A mission (February 27-March 3) reviewed preliminary estimates for Bangladesh’s budgetary central government GFS for financial year 2020/21. A comprehensive draft of the Revisions Policy was also reviewed during the mission. During the mission, virtual training on the GFS framework was also provided to officials from the Ministry of Finance and Controller General of Accounts, with the latter expected to take the lead in compiling GFS.

Financial Sector Regulation and Supervision: A mission followed-up on the support provided to BB on strengthening its banking supervision capacity (March 28-April 7). The mission conducted six working sessions with the Risk-Based Supervision (RBS) Working Group at BB to review the progress made on the implementation of the pilot RBS action plan.

BHUTAN

Revenue Administration: A mission reviewed preparations for the introduction of a Goods and Services Tax (GST) in Bhutan (February 18-March 15). It assessed critical work outstanding to support the launch of the GST and identified outstanding risks to GST introduction. Recommendations on measures to address such risks were also provided.

Public Financial Management: SARTTAC is assisting the Royal Government of Bhutan in modernizing its Chart of Accounts. As a part of this project two missions were delivered to the Unified Chart of Accounts (UCoA) Working Group in Bhutan (February 1-15 and March 1-15). The first mission focused on redesigning the Project and the Economic segments of the CoA, while the second one dealt with the Function, Program, and Cross-Cutting segments of the redesigned UCoA.

Real Sector Statistics: A mission assisted Bhutan’s National Statistics Bureau in the ongoing GDP rebasing exercise and development of Supply Use Tables (April 18-29). Assistance on development of Quarterly GDP was also provided by taking stock of source data and preparing a work plan for further support.

Government Finance Statistics: Building on the work done during an earlier mission in July 2021, a mission assisted the Ministry of Finance in Bhutan in compiling fiscal statistics aligned with the Government Finance Statistics Manual 2014 (February 7-11). The mission focused on expanding and refining the coverage of GFS statistics in Bhutan to budgetary central government. A short workshop on the GFS framework was also delivered.

Monetary Policy and Foreign Exchange Market Operations: Support was provided to the Royal Monetary Authority (RMA) in the implementation of its domestic liquidity management framework (March 7-April 29). The mission also identified areas for improvement in the new framework and reached agreement with the RMA on a future workplan to address them.

Financial Sector Regulation and Supervision: Two virtual missions, conducted simultaneously (April 11-15) followed up on earlier missions to strengthen RMA banking supervision capacity. They focused on the current issues facing the banking sector during the pandemic and on the implementation of a risk-based supervision (RBS) approach to on-site examination of banks and on the implementation of RBS in the insurance sector.

INDIA

Public Financial Management: As requested by the Indian state of Tamil Nadu (TN) Finance Department, a remote mission worked with officials to strengthen the analytical underpinning of their financial year (FY) 2023 budget and related documentation (February 8-March 4). The activity focused on analyzing and quantifying fiscal risks for use in budget preparation. This mission also laid the groundwork for further engagement with the state on strategic budgeting, fiscal risk reporting, and public investment management.

Additionally, four missions were delivered to the Finance Department of the state of Odisha, two of which were virtual and two in-person. The first mission (February 17-March 4) reviewed Odisha’s fiscal risk assessment and the documentation for FY 2023 budget. An updated fiscal risk register and a proposed Public Sector Undertaking (PSU) report were reviewed, the latter based on the application of IMF’s State-Owned Enterprise (SOE) health check tool to key PSUs. The second mission (March 31-April 15) focused on the development of a Commitment Control System (CCS) for the state. It reviewed progress on CCS application and implementation based on the functional specification developed during a previous mission.

For Odisha, the third mission (April 18-22), which saw the resumption of in-person TA by SARTTAC, followed up on the implementation of earlier recommendations for improving cash management and assessed progress made on cash forecasting and monitoring of performance. It also worked with state authorities on preparatory activities relating to establishing a Treasury Single Account. The final mission—also in-person—reviewed and evaluated the state’s public financial management reforms (April 25-29), covering areas like budget preparation, budget execution and control, asset and liability management, and identification, monitoring and management of fiscal risks.

MALDIVES

Macroeconomics: A mission (February 27-March 3), led by the IMF Institute for Capacity Development and supported and joined by SARTTAC, was delivered as part of a project that is supporting and guiding officials from Maldives Monetary Authority (MMA) to build an Excel-based macro-framework. The framework will improve the analytical basis of the macroeconomic analysis used to facilitate policy discussions at the MMA. The mission had two focus areas: i) providing customized training on the basics of financial programming and policies and macroeconomic diagnostics; and ii) demonstrating how these principles are applied in a comprehensive adaptive expectations macro-framework.

Revenue Administration: A total of three missions were delivered during the quarter. The first mission assessed the data requirements for conducting a future mission to apply the Value Added Tax Gap Estimation Model (VGEM) to Maldives’s Goods and Services Tax (February 7-21). The assessment showed that the main data requirements were mostly fulfilled. The second mission on Tax Administration Diagnostic Assessment Tool (TADAT) assessment identified the current state of Maldives’s tax system relative to international good practice standards (March 6-27). The assessment looked at the tax system and the wide range of taxpayer service products that it provides. The mission also identified gaps affecting the system’s TADAT scores, which were shared with the authorities to help them work towards better scores in the future. The last mission of the quarter assisted Maldives Inland Revenue Authority with establishing its Advance Pricing Arrangement (APA) program (April 4-18). It provided advice on the management, monitoring, and reporting practices required for the APA program based on international good practice. Assessment on further enhancements to the APA forms and APA Guide, which may be required, was also made.

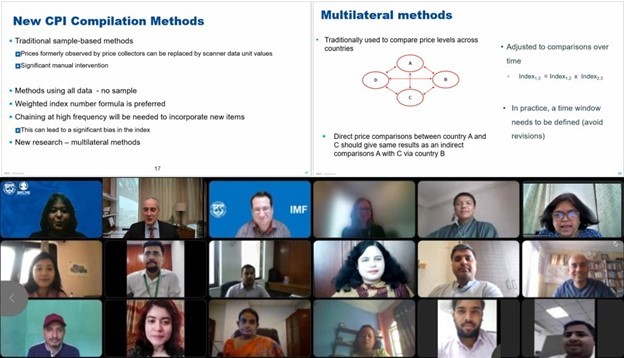

Real Sector Statistics: A mission supported the Maldives Bureau of Statistics in developing a producer price index (PPI) and updating consumer price index (CPI) (April 10-14). It reviewed the data collected for various sectors like construction and utilities, which will be used to develop the PPI. The mission also reviewed and finalized weights for an updated CPI using expenditure data from 2019 household income and expenditure survey.

Financial Sector Regulation and Supervision: Two missions conducted simultaneously (February 21-March 3) followed up on earlier missions to strengthen the Maldives Monetary Authority’s (MMA) banking supervision capacity and on the implementation of risk-based supervision of the insurance sector. The banking supervision mission provided assistance in the implementation of corporate governance regulations and of the risk management guidelines of the MMA (published on March 10, 2022) and on the assessment of the framework and practices of the affected financial institutions. On the insurance side, the mission conducted hands-on working sessions focused on risk-based supervisory techniques, anchoring the work around the revised 2019 International Association of Insurance Supervisors’ (IAIS) Insurance Core Principles.

NEPAL

Public Financial Management: In the context of a comprehensive fiscal structural reform agenda underpinning the reform program accompanying the recently approved IMF Extended Credit Facility arrangement for Nepal, a mission (March 23-25) engaged with the authorities to understand their immediate capacity development requirements and priorities. Discussions helped in creating a workplan with Nepal for FY23 and beyond. Later in April, the first mission in a series on improving fiscal risk management was delivered (April 3-18), led by the IMF Fiscal Affairs Department and supported and joined by SARTTAC. It worked with authorities in identifying the key sources of fiscal risk in Nepal and understanding current reporting and monitoring frameworks to develop an action plan for future engagement.

Monetary Policy and Foreign Exchange Market Operations: A mission (March 14-April 15) supported the Nepal Rastra Bank (NRB) in its transition towards an interest-rate focused domestic monetary policy implementation framework under an exchange rate peg. The proposed monetary policy implementation framework will help Nepal in weathering the exit period from pandemic-related measures, withstand future economic and financial shocks and better prepare the NRB for future policy choices.

SRI LANKA

Revenue Administration: At the request of the Inland Revenue Department in Sri Lanka, a mission, led by the IMF Fiscal Affairs Department and supported by SARTTAC, provided guidance on the structure of the Large Taxpayer Office to strengthen cohesion of the office and establish a single chain of command (February 15-March 8). The mission also included workshops on international good practice in several other areas, including program design, risk assessment, file selection, treatment considerations, and relationship building.

Real Sector Statistics: A mission to the Department of Census and Statistics of Sri Lanka (February 7-8) reviewed the updated supply and use tables for the benchmark year 2015, and the updated rebased GDP estimates for the reference period 2010 to 2020, as well as the updated rebased quarterly GDP from 2015 to 2020. The mission also made recommendations on improving estimates for various components of GDP in accordance with the System of National Accounts 2008.

IMF Departments: FAD (Fiscal Affairs), MCM (Monetary and Capital Markets), STA (Statistics)

SARTTAC Funding Programs: FSR (Financial Sector Supervision and Regulation). GFS (Government Finance Statistics), MONOPS (Monetary and Foreign Exchange Operations), PFM (Public Financial Management), RA (Revenue Administration), and RSS (Real Sector Statistics)

Access SARTTAC TA Reports on secured website (Requires Login Credentials)

Macroeconomics: SARTTAC’s first-ever course on Gender Inequality and Macroeconomics was delivered (February 7-11). It introduced participants to broad dimensions and measures of gender gaps with a focus on South Asia and discussed their macroeconomic implications, with a wide range of agencies joining the course, along with several development partners as observers, all contributing to the richness of discussions. Fiscal and non-fiscal policies to mitigate gender gaps were covered along with evidence of macroeconomic gains from lowering gender inequality. A course on Monetary Policy helped participants understand how monetary policy decisions are made and how these decisions are transmitted to the real economy (March 14-25). It demonstrated ways in which economy and monetary policy respond to shocks under various monetary policy frameworks. As noted earlier, a brand new course on Nowcasting was also delivered (March 28-April 1)—the first training done in-person by SARTTAC in more than two years owing to disruptions from the pandemic.

Revenue Administration: The first of the two courses delivered during the quarter was on Compliance Risk Management (February 7-11). It focused on both the theoretical concepts behind managing compliance risks and the practical application of those concepts. In the exercises conducted during the course, participants identified practical risks they were grappling with in their work and participant groups presented plans that identified key improvement actions to address these risks. The second course dealt with theoretical and practical concepts behind Taxpayer Registration and associated risks (April 4-8). It highlighted the fundamentals of an effective and efficient taxpayer registration management to deliver accurate collections and reduce the likelihood of taxpayers avoiding their obligations.

Public Financial Management: A course on Fiscal Risk Analysis and Management was delivered (April 4-7). The course covered key components of fiscal risk management from the oversight, establishment, and documentation perspectives. Other topics included fiscal risks from state-owned enterprises and use of the IMF Fiscal Affairs Department’s Fiscal Risk Assessment Tool.

Government Finance Statistics: A course introduced participants to the concepts that underpin the identification and correct Sector Classification of Public Sector Entities, with particular focus on extrabudgetary units and state-owned enterprises (March 21-25). Participants also received practical advice on how to apply the sector classification guidance in the Government Finance Statistics Manual 2014.

Real Sector Statistics: A course on External Debt Statistics (EDS) was organized in cooperation with IMF - Singapore Regional Training Institute and IMF Statistics Department (February 7-11). The course provided participants with a thorough understanding of the conceptual framework of EDS and practical guidance for addressing data collection and compilation challenges. The course was conducted in the context of pandemic-related debt challenges, which have highlighted further the value of debt transparency, including for debt relief initiatives such as the G-20 Debt Service Suspension Initiative.

A course on Consumer Price Index was also delivered during the quarter (April 25-29). It provided an overview of the steps for compiling CPI including sampling outlets and areas, establishing index weights, specifying varieties to be priced, calculating indexes, imputing missing prices, adjusting for quality changes, and introducing substitute items. Presentations also highlighted key updates in the 2020 CPI Manual and described new non-survey sources of price data and how they can be incorporated into the CPI.

Monetary Policy and Foreign Exchange Market Operations: The fourth in a series of courses on monetary policy operations organized in co-operation with IMF Capacity Development Office in Thailand and IMF Monetary and Capital Markets Department covered Emergency Liquidity Assistance (ELA) (April 4-6). As financial flows become more volatile and governments withdraw pandemic-related support to the economy, the course noted that central banks as lenders of last resort should be ready provide ELA to solvent banks facing temporary liquidity stress for preserving financial stability. The course improved participant’s understanding of designing and operating an ELA facility and facilitated experience sharing among central banks from South and Southeast Asia.

Financial Sector Regulation and Supervision: A regional course on Banking Supervision Issues was delivered to participants from the region (March 7-11). The topics covered included strengthening on-site and off-site supervision in times of crisis, identification of weak banks, and managing credit and operations risks with a focus on resilience. The course also addressed cyber risks and cyber resilience and climate-related financial risks. A course on Insurance Supervision was delivered to insurance supervisors (April 25-29). Anchored on the Insurance Core Principles, it covered the Insurance Capital Standard proposed by the International Association of Insurance Supervisors, the management of new risks (e.g. climate-related financial risks and cyber risks, but also the risks related to the rising inflation), the management of prudential and market conduct risks, the need to intensify off-site supervision, and best practices in insurance stress testing. The course also raised awareness on the implementation of the IFRS 17 (International Financial Reporting Standard) and the challenges ahead.

NATIONAL TRAINING

Macroeconomics: Two in-person training events were conducted in conjunction with India’s Lal Bahadur Shastri National Academy of Administration, India’s apex civil services training academy—both in-person. The first consisted of a basic macroeconomics module (February 14-18) as part of their Foundation Course delivered to 486 officer trainees (OTs) who will be joining the Indian civil services.

The second event, for about 180 members of the entry cohort into the Indian Administrative Service (who had previously attended the Foundation Course), was a longer macroeconomics module (April 25-29) that built on the earlier training. The course covered key tools of applied macroeconomic analysis and demonstrated how they could be used by applying them to Indian economic data. In doing so, it also introduced the participants to India’s current economic opportunities and challenges. SARTTAC also continued its support of training needs with the Indian Economic Service (IES), conducting in-person courses for the new IES cohort on Financial Programming (April 4-13) and Macroeconomic Diagnostics (April 18-29), with both built around case studies customized with Indian data.

REGIONAL WEBINARS

Non-SARTTAC Webinars: A first webinar titled IMF Online Learning: Shaping the Future of Capacity Development (February 15), organized in co-operation with IMF Institute for Capacity Development, gave officials from the region a glimpse of the online learning opportunities that the IMF Online Training program offers to broader audiences worldwide, and how all the participants can take advantage of this program. The IMF online learning program contains more than 40 online courses, available in multiple languages on edX, as well as nearly 200 microlearning videos available on The IMF Institute Learning Channel on YouTube. A second webinar presented the recently published Triennial Capacity Development Strategy from the IMF Monetary and Capital Markets Department (MCM) to central bank and financial supervisory agency officials from the region (April 6). The strategy is focused on core issues of central banking, monetary and macroprudential policies and frameworks, financial supervision, financial crisis management, debt management, and financial market infrastructures.

NATIONAL WEBINARS

Public Financial Management: A set of webinars was delivered to officers from India’s Comptroller and Auditor General office on fiscal risk management and the IMF’s new Fiscal Risk Assessment Tool (February 16-23). Topics covered a range of fiscal risks, including ones related to Public-Private Partnerships and public sector undertakings, and natural disasters and climate change, with presentations tailored to be more relevant to Indian states.

More articles from the same issue

- A Resumption of In-Person Training in SARTTAC with New Nowcasting Course

- Farewell to Elizabeth Goli, SARTTAC Revenue Administration Advisor

- New Staff Announcement

RECENT and UPCOMING ACTIVITIES

- Technical Assistance

- Training and Webinars

- Upcoming Training Courses

- Upcoming Webinars

- IMF Online Courses

Previous Issues <